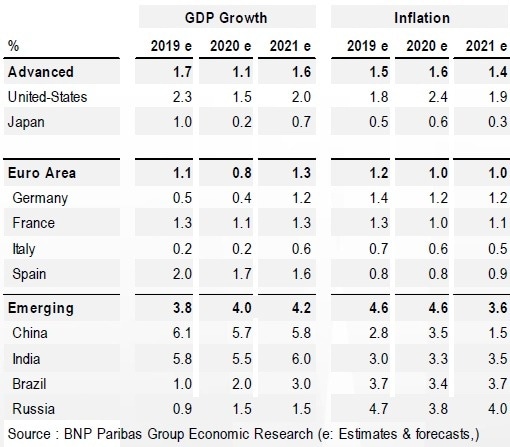

Summary of macroeconomic forecasts

In the US, economy, especially in the manufacturing sector, has shown some signs of weakness recently, prompting the US Federal Reserve to cut rates "preventively".

The materialization of US "trade war" through tariffs increases on worth $300bn of imports is likely to weigh on firms profitability, then activity.

The inverted yields curve is a bearish signal. It could be followed by sizeable downward adjustments in highly leveraged sectors such as energy and IT

As a consequence, the monetary policy would continue to ease.

The Euro area, growth is sharply decelerating, with some countries like Italy and Germany now close to recession.

Extra EU trade is less dynamic, in line with fading external demand, in particular coming from EMEs.

Inflation is expected to come-back near the 1pct level, as a consequence of falling oil prices.

The ECB has consequently restarted it Asset Purchases Program (APP) and plan to buy EUR20bn per month (net) over an indefinite period of time. The depo rate was cut to -0.5% and will stay there for long.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.