Daily Forecast - 01 October 2014

USDCHF Spot

USDCHF in a strong bull trend & as expected beat 9530/32 shooting to our target of 9595/9600 & topped exactly here!! We are so overbought at this stage that profit taking is likely but not a big sell off & offers buying opportunities. A drift lower to support at 9530/25 with a bounce from here expected but longs need stops below 9505. A break lower could then target 9485/80 for the next buying opportunity. Unlikely the pair will fall any further but if 9450/45 is seen this should be an excellent opportunity to enter longs with stops below 9430.

Immediate resistance at 9595/9600 again of course & we should struggle here today. Selling to shorts in a bull trend is never wise but it may be worth trying small shorts here today in the hope of a quick turn, with stops above 9625. Be ready to jump back in to longs on a break higher & look for 9650/60.

AUDJPY Spot

AUDJPY in a strong 3 week bear trend but did reach as far as strong resistance at 9590/95 as predicted for a perfect selling opportunity with stops above 9615. This trade worked perfectly keeping the outlook negative for a return to last week's low at 9540/35 & a quick 50 pip profit. A break below the 2 day low at 9510/08 is likely & should trigger stops in the market to target important key weekly support at 9470/60. It is possible we see a low for the week here, despite the strong bear trend. Exit shorts & try longs with stops below 9430.

Immediate resistance at 9555/65 is likely hold a move higher but above here look for a selling opportunity at 9580/90 with stops above 9610.

EURGBP Spot

EURGBP in a 12 month bear trend & broke 7781 which as stated yesterday was always likely in a bear trend. The pair went for our next target & a test of important 2012 lows at 7753. This is also 7 year Fibonacci support & we advised to exit shorts & try longs with wide stops below 7725. The pair bottomed just 5 pips early. IT IS TOO RISKY NOW TO RUN SHORTS ANY FURTHER AFTER YESTERDAY'S BOUNCE FROM THE IMPORTANT SUPPORT. Again today the 7765/55 area is a medium term buying opportunity with stops below 7725.

Immediate resistance at 7795/7800 but above here is more positive & targets 7825/30. A good chance of a high for the day but shorts need stops above 7850.

EURJPY Spot

EURJPY held resistance at 139.05/15 & the break of 138.70/65 triggered losses as expected to our target & good support at 138.15/10. We advised to exit shorts & try longs AND be prepared to add to longs at 137.95/85 with a good chance of a bounce from here. We stated this area could mark the low for the 2 week correction. The pair magically bottomed at 137.90!!! So far so good & an excellent bounce to 138.80 has already provided a potential 70 pip profit. We need to hold above 138.70 to continue higher & target strong resistance at 139.15/20. Exit longs & try shorts expecting a high for the day,with stops above 139.40.

Failure to hold above 138.70 however sees a drift lower to 138.35/30. If we continue lower look for a second buying opportunity at 138.00/90, with stops below 137.65.

GBPJPY Spot

GBPJPY in a longer & short term bull trend. We have been pausing for breath over the past week to relieve the overbought conditions before the next leg higher. Watch the 4 day high at 178.09/16. Above we can target last week's high at 178.60/70. A break above here is then required to re-start the bull trend & target trend line resistance at 179.20/25. Above here we look for a retest of September highs at 180.60/66.

The 4 day low of 177.25/10 is key for today. A break lower does look possible & should target support at 176.45/35 for a buying opportunity with stops below 176.00. Go with a break lower however as we could then target 175.25/00. Exit shorts & try longs with stops below 174.50.

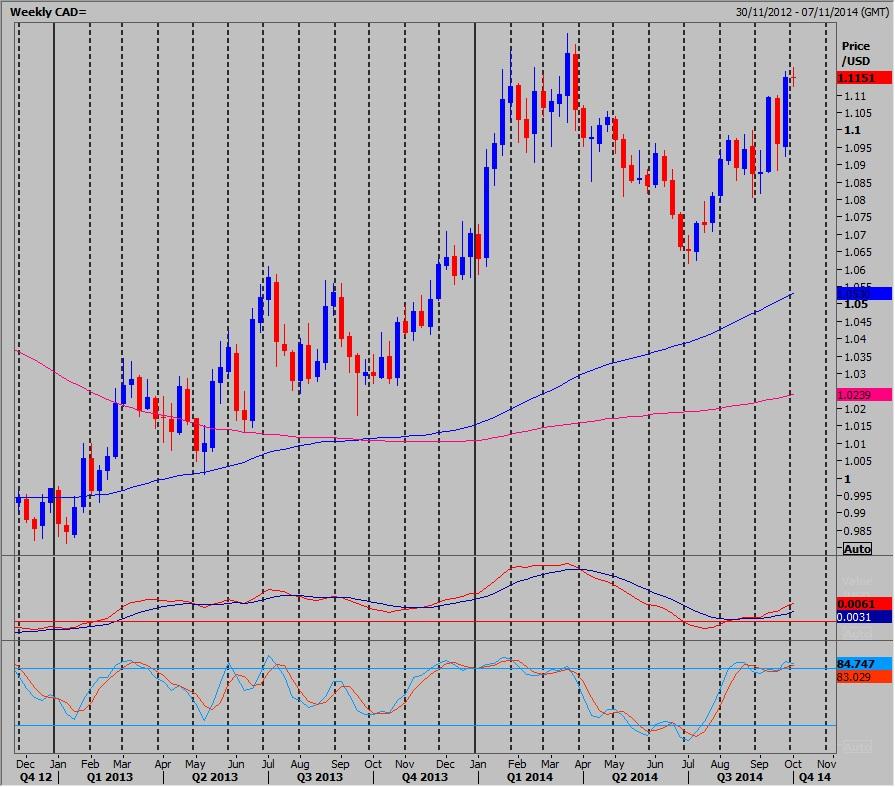

USDCAD Spot

USDCAD in a 3 month bull run & had no trouble breaking resistance at 1.1155/60 as expected to hit our target of 1.1220/25. As I write we have topped exactly here over night but stick with the bulls & look for 1.1245/50 to exit any longs. Above we meet this year's high at 1.1278 & can try shorts within the 1.1255/75 band, with stops above 1.1295.

Immediate support is 1.1185/80 & could hold the downside but below here a buying opportunity at 1.1155/1145, with stops below 1.1125.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.