Risk Sentiment Rising Amid Mixed Trade Signals

Risk sentiment is rising as investors decipher the mixed signals on the US-China trade war. The US dollar index fell for the first time in six days while equity markets were poised for a decline after four consecutive sessions.

The trade war has become the major narrative behind the markets.

Euro Catches a Bid as Dollar Weakens

The declines in the US dollar index saw the euro rising modestly on Monday, as economic data from the eurozone was sparse.

Germany’s wholesale prices fell 0.1% on the month missing estimates of a 0.2% increase. This marks a decline from 0.4% previously. Italy’s industrial production also fell by 0.4%, in line with expectations.

EUR/USD Could be Testing for Resistance

The current reversal in the currency pair comes following the declines. However, prices turned around, just shy of the lower support area at the 1.1000 region.

If the current bullish momentum holds, then the EURUSD should be testing the price level of 1.1075 – 1.1062. If this level holds as resistance then the declines could resume.

Sterling Jumps as Odds of Johnson Staying Rise

The pound sterling got a boost after UK bookmakers raised the odds that PM Johnson will continue on post-election.

This comes after the Brexit Party said that it will not contest the seats that are currently held by the Conservative party. The move is aimed to give Johnson’s party a majority in the parliament.

The UK will be heading to the polls on December 12th.

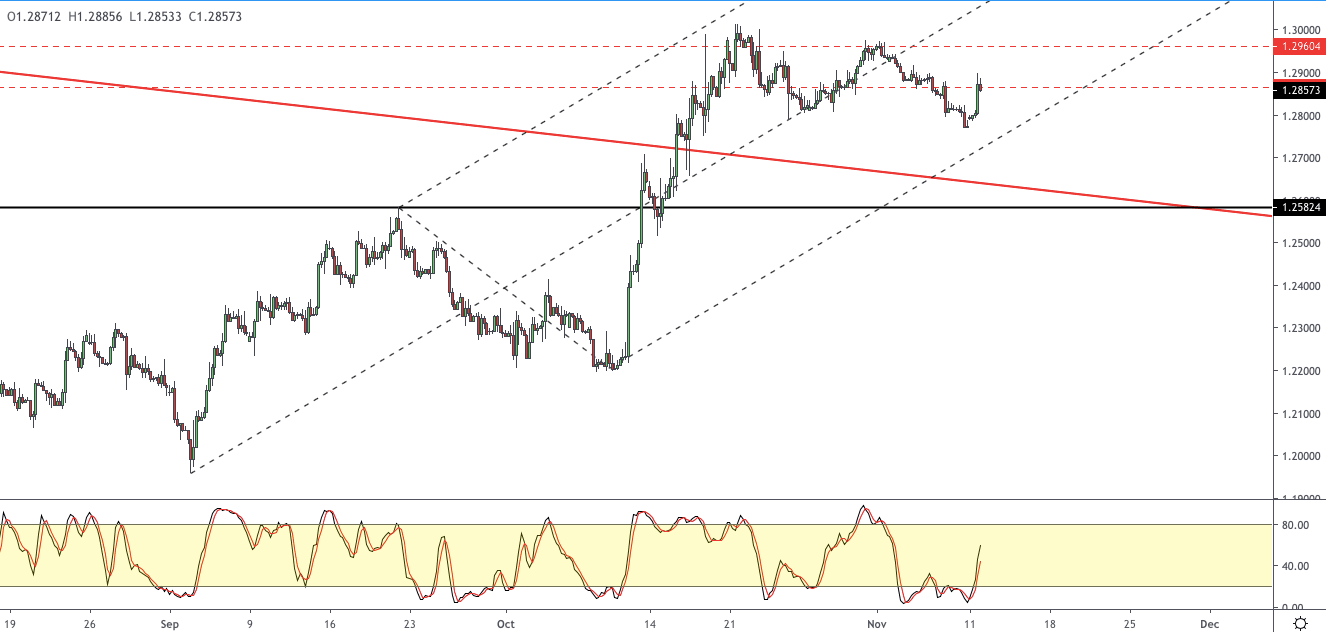

GBP/USD Back at Resistance

Cable managed to rally, but the gains stalled near the price level of 1.2856. If this level holds, then it would mark a retest of the previously held support area.

A decline off this level will see the bearish trend resuming. The lower support at 1.2582 remains key to the downside.

Oil Markets on the Backfoot as Trade Euphoria Clears

Crude oil prices were on the backfoot following the weekend comments from President Trump. The President dismissed reports of an early rollback of tariffs as reported last week.

However, Trump said that the trade talks were progressing smoothly. The initial euphoria of progress on the trade talks looks to be putting pressure on oil prices as well.

WTI Crude Oil Consolidating Near Current Highs

Oil prices are pulling back from the intraday lows. However, the gains look to be stuck near the resistance area of 57.87 – 57.64.

A reversal off the resistance level could trigger short term declines. The minor support at 56.28 will be key in the near term. A close below this level will, however, see oil prices retreating again.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.