The Australian dollar did well to finish out last week in moving through the resistance level at 0.93 and maintaining the break. Prior to the break through, over the last couple of weeks or so the Australian dollar had fallen back down below the 0.93 level and settled within a very narrow range just below the level before surging back up. This break has provided some hope that it may resume its up trend that it has experienced over the last few months. Since the recent surge higher it has slowly and steadily eased lower and looks poised to retest the 0.93 level again. It was placing ongoing upwards pressure on the resistance at 0.93 before breaking higher. This level had been providing reasonable resistance over the last week or so denying any movement higher and is likely to play a role again should the AUD/USD retreat lower.

The last month or so has seen the Australian dollar drift lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

Australia's unemployment rate held steady at 5.8 per cent last week, with the estimated addition of 14,200 jobs. The result defied economist expectations of a small tick up in unemployment to 5.9 per cent, with most having expected a payback after a large decline in the jobless rate last month. However, the Bureau of Statistics figures estimate that 14,200 full-time jobs were created last month, with no part-time jobs lost, leaving unemployment steady at 5.8 per cent, seasonally adjusted. The more stable trend figures, which smooth out volatility, also had unemployment steady but at 5.9 per cent. The participation rate - which measures the proportion of over 15-year-olds in work or looking for it - eased slightly from 64.8 to 64.7 per cent, seasonally adjusted.

(Daily chart / 4 hourly chart below)

AUD/USD May 11 at 23:30 GMT 0.9364 H: 0.9376 L: 0.9363

AUD/USD Technical

During the early hours of the Asian trading session on Monday, the AUD/USD is continuing to settle around the 0.9360 level. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.90 again. Current range: trading around 0.9360.

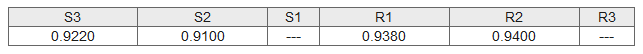

Further levels in both directions:

- Below: 0.9220 and 0.9100.

- Above: 0.9380 and 0.9400.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.