ROB COLVILLE

ROB COLVILLE

PROFILE

• Current Job: Analyst and Traderat The Lazy Trader

• Career: Has trained thousands of private investors around the globe and has created a globally renowned currency training brand, The Lazy Trader. Member of the Society of Technical Analysts (STA). View profile at FXStreet

View profile at FXStreet

Rob Colville has trained thousands of private investors around the globe and has created a globally renowned currency training brand, The Lazy Trader. Famed for his simple and honest approach to trading and investing, he has presented and traded live in front of his students in London, Singapore, Johannesburg and Cape Town.

Member of the Society of Technical Analysts (STA), Rob is renowned for his ability to bring the subject of financial markets trading to life in his humorous and direct style of teaching.1. What will 2015 be remembered for?

Well, 2015 saw a real return to volatility across world equity and currency markets, and I think that, in addition to the tragic terror attacks in Paris, and geopolitical conflict around the world is, unfortunately, what many will now remember the most.

That’s certainly what’s at the forefront of our minds heading into year end, anyway, but I think what’s going to be largely forgotten about 2015 is a crucial item, too, and I’ll tell you why I think that:

Amidst such a volatile and news-driven second half of 2015, largely forgotten will be the first six months or so, when volatility was practically non-existent and trading conditions, quite frankly, weren’t all that friendly. Ignited once again by (surprise, surprise) another China meltdown, fear spiked around the world starting in June, with aftershocks happening again in both July and August. That really changed the entire complexion of 2015, and ultimately gave rise to the “memorable” trading conditions that could well come to define the year in the minds of many traders.

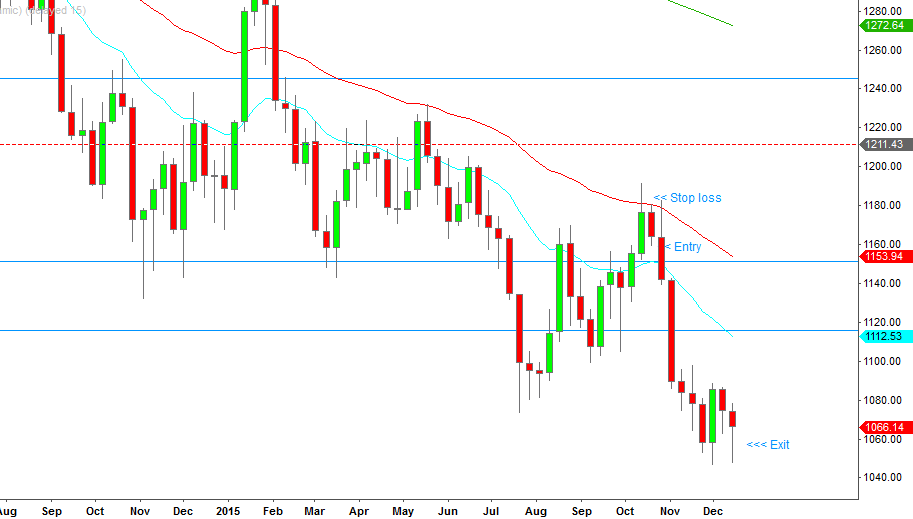

Technically speaking, 2015 became a great year for hopping onto well-established trend moves. Especially once the pace quickened throughout the second half, we were able to capitalise on a number of classic price-action set-ups, most notably in gold, USDCAD, and EURGBP, where simply buying dips in uptrends and selling rallies in downtrends produced some fantastic and long-running gains.

Recent Gold Trade (October 2015 – Weekly; sell)

Those results aside, though, 2015 was a lot like a tale of two years for traders, many of whom likely feel like our year didn’t really begin, or at least gain any positive momentum, until volatility did about mid-way through. That’s why I think I’ll remember 2015 as a year that definitively proved, once again, that volatility is indeed a trader’s close ally!2. Which were your most important achievements this year?

I’ll be rejoicing quite a bit about having weathered some tough trading conditions early on, and finding the patience and resiliency to stay the course and trade well into year-end. I think any trader who lived to trade on in 2016 should do the same, but for me personally, my most prized achievement was my ability to consistently blend trading with an active and leisurely lifestyle, which embodied my commitment to “lifestyle trading.”3. What emerging issues or trends should traders prepare for in 2016?

I a trip to Malaysia and Bali this past year, and while traveling (and trading), I met and mentored developing traders, and brought The Lazy Trader brand to a part of the world I had long hoped to see and experience for myself. My life and trading took me all over Europe and Asia this year, and I’m supremely proud of how my own trading set an example for Lazy Traders, those who were with us already, and those that are now found in those far-reaching locales I recently had the honour of visiting. .

Let’s start with the most obvious one first: Interest rate increases from the US Federal Reserve. The first rate hike was announced recently, and was widely expected, but with rates now on an upward trajectory, and further increases expected in 2016, this right now is one of the more prominent trends impacting the US dollar (USD) and the broader forex markets. For traders, the easiest and most obvious trades would be to play steady and continuous trend moves in pairs with diverging monetary policies, where one central bank is tightening while the other is still easing. Of course, USDCAD, EURUSD, and USDJPY first come to mind there.4. Which will be the best and worst performing currencies in 2016 and why?

Elsewhere, other trends to watch in 2016 may include:

Potential crash in equities: World equity markets have been seemingly under fire for some time now, and some, like China, have already cratered. Weakness and vulnerability has also been well-publicized for European and Latin American markets, and the US market was a lot like Teflon throughout 2015, with all sorts of problems being thrown at it, but nothing sticking just yet. Not that we want to—or should—live in constant fear that the other shoe is about to drop, but it’s happened before, and it could well happen again. That’s just the nature of these modern-day financial markets, and the way of the world that we all now live and trade in.

Continuation of weak oil prices: There’s been so much speculation, and no doubt traders who are anxious to try and pick a bottom in oil, but for right now, all signs point to a slow drip lower, or a sideways dredge for oil prices in the coming year, and maybe even longer. With correlations widely felt across the forex market, it’s another key trend to watch, and one that’s not welcome news for commodity currencies.

US Presidential election: Division, infighting and contentious party politics are already running rampant in the US, and it’s going to take almost all of 2016 to get it all sorted out! The markets don’t really like all that uncertainty, and this stage of the election cycle is yet another potential catalyst for declining US equities, and a trend that dollar traders will monitor closely.

Geopolitics, terror attacks, and even cyberterrorism: I know, I know, more doom and gloom to worry about! I’m sorry for being so negative here, but just think for a moment about the things that keep you up at night? Many will quickly gravitate here, and few could blame them. We’ve got the Syrian refugee crisis, Russian military conflict, violence across the Middle East, and fears about ISIS, just to name some of the current worries…but I’ll tell you a sort of “wild card” that I’m perhaps most worried about when it comes to the markets and trading: Cyber attacks. Any or all of these things—but especially a cyber attack—could wreak havoc on the markets. And while I hope I’m flat-out wrong about this one, when I think about possible issues to contend with in 2016, this is one that most concerns me.

I think that policy tightening and rising interest rates in the US have created a foundation for continued US dollar strength throughout 2016, and while the long-dollar camp is already pretty crowded, you can’t fight the fundamentals, as they say. It’s not a surprise nor a very provocative pick, but the US dollar looks like the big winner to me for the year ahead.5. Which under-the-radar currency pair do you expect to make a big move in 2016?

To find the worst performer, I think you just have to look at the US’ neighbour to the north, where the Canadian dollar (CAD) just doesn’t have much going for it right now. Even with USDCAD making fresh yearly highs and looking technically overbought, Canada’s sluggish economy remains hard-hit by large-scale and persistent weakness in the oil and energy markets, and until that reverses to the upside, the Loonie isn’t likely to, either.

That’s tough to say, and being a pure technical trader, I don’t have a strong opinion at this point. I will say this, though: I love the concept of going “off the radar” to find promising forex opportunities. I believe that entirely too much attention is traditionally given to the major currency pairs, and to a certain degree, even the minors. Exotic pairs always get a bad rep for being illiquid and having low volume, but I’m always watching and am willing to trade more exotic pairs just as long as the quality of the set-up is there. USDNOK and USDSEK are two that fly under the radar, but tend to behave well and are quite well-suited for longer-term trend trading.6. Which macroeconomic events will have the biggest impact on the FX markets in 2016?

There seems to be a sort of “Big 3” in play as far as macro themes for the forex market are concerned, and I’d put them in the following order: 1) Changing central bank policies and interest rates; 2) Weakness in oil and commodity prices; and 3) Further economic problems in China, Greece, or elsewhere. Also keep in mind, however, continued stimulus in the Eurozone, and the subsequent impact in the UK, where some analysts see the potential makings for the next serious equity market problems. Meanwhile, the Summer Olympics will be held in Brazil (Rio de Janeiro) in 2016, and the collective eyes of the world will shift there, to a country and region whose economy has been particularly hard-hit. Brazil’s near-term economic hopes are riding, in large part, on the success of those Games.7. Which asset class will cause the next financial crisis?

The highest likelihood is that stocks will give rise to the “next” financial crisis. We already saw in 2015 the immense and very global impact of China’s stock collapse, and whether it’s a repeat of that, or a severe downturn in the US, Eurozone, or the UK, sentiment among traders and investors alike is very fragile. Persistent weakness in commodities, geopolitics, and a tenuous global recovery are all among the obstacles world equity markets have been weathering throughout the last year or more, but if there is indeed some other shoe that drops, stocks could fall hard as a result, and investors and traders might be quick to hit the panic button if that were to materialize. It’s still surprising to think that this is the nature of modern-day financial markets, but we’ve seen it before, and are likely to see again that “financial crisis” can occur very suddenly and without advance warning. All it takes is one serious catalyst.8. What will you be focused on next year?

Living life to the fullest, first of all, but also continuing to use currencies as a vehicle to make money. Of all the outside factors, the worries, and the countless things that we, as traders, can’t control, I want to focus most intently on what I can. That includes things like trade selection, risk and money management, and my own entry/exit strategy. I can’t make the markets move in my favour, but I can adhere closely to my strategy, act decisively when opportunities appear—even for just short, quick moves—and then preserve and protect any hard-earned profits once they’re made. I want to be aware about the markets and the factors that drive them, but I want to focus more closely on me, my own, individual trading process, and doing all that’s actually in my power to get results. I think “focus” is a great word in this sense, because it implies that there are factors beyond our periphery that are always there, but that we’ll choose not to fixate upon. That’s a solid metaphor for blocking out the “noise” and just trading mechanically and methodically for the long run.9. Who are the people to watch in 2016 in terms of impact on the industry?

I think you have to look first and foremost to the central banks and their key decision makers. In 2016, just like this past year, the forex world will revolve around interest rates and monetary policies, and with widespread manipulation and governments taking a “hands-on” approach, it’s easy to see that the major players are those who “hold the keys” and make those decisions. US Fed Chair Janet Yellen, ECB Chief Mario Draghi, BOE Governor Mark Carney, and Bank of Canada head Stephen Poloz are all leading persons of interest for traders…but they’re not the only ones! Remember way back in January, when the Swiss National Bank removed the long-standing peg between the euro and Swiss franc? That sudden and shocking announcement, which many believe was irresponsible, wiped out countless trading accounts in one fell swoop. It now lives in infamy, and goes to show that the biggest impact on the forex markets and the industry as a whole is had by central bank policymakers, not rogue traders, big banks, algorithm or black box developers, or really any single trader. I’d also look to liberal Prime Ministers like Japan’s Shinzo Abe and the newly-elected Justin Trudeau of Canada, as their policy decisions could also make a big splash on the JPY and CAD, respectively, as well as the equity and currency markets as a whole.10. What are your New Year's resolutions?

Mine sound simple, but they’re really all about the perspective by which I view my life and trading. I want to be humble, be gracious, and always strive to see the bigger picture. The truth is I’m fortunate to do what I love each day, and to make my living at it. But like so many of us, my love and appreciation for it is sometimes lost in the day-to-day rush of things, the stresses of life and trading, and the unfavourable outcomes we encounter along the way. Somehow when you flip on the news, or look out into the world, though, one or a couple losing trades don’t seem so bad anymore, and that’s especially true for any of us who can live well and travel, or share our lives with family, friends, and loved ones. Seeing things in that light helps me remember that I’m rich already in the sense that there are many people and blessings for which I’m eternally grateful, and while I care and strive every day to trade well and be successful, the quality of our life should never defined by trading results. That’s the perspective that I want to cultivate more in my life and trading so I cherish each day, the good ones and the inevitable bad ones.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.