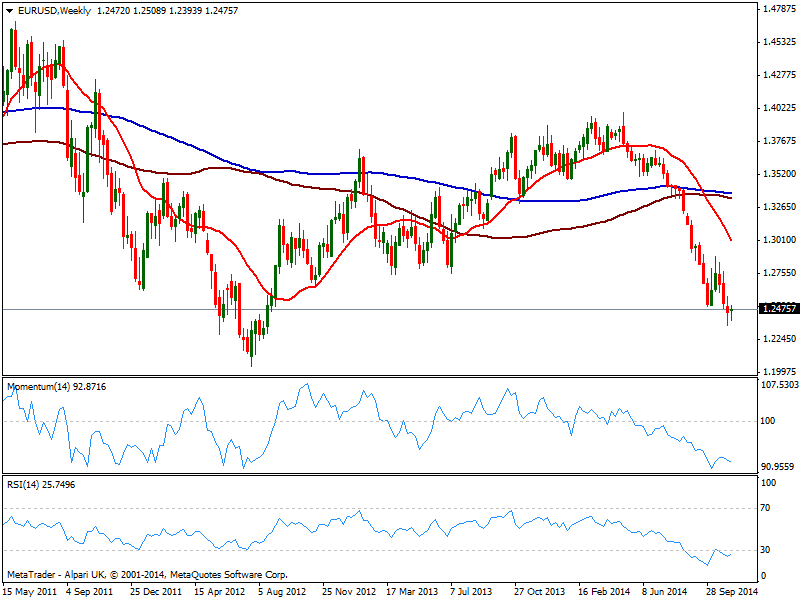

Technically, the weekly chart shows 20 SMA has extended its decline through larger ones, momentum maintaining its bearish slope and RSI still below 30, with sellers surging on advances towards the 1.2500 price zone.

Daily basis, 20 SMA offers dynamic resistance well above current price in the 1.2550 price zone, whilst indicators had erased oversold conditions but remain well into negative territory, and showing no aims to advance further. For the upcoming days, the year low of 1.2357 will be the critical support to follow, as it will take a break below to see the pair resuming the side, down to 1.2280/90 price zone, where the pair presents several weekly historical lows. If this last gives up, an approach to 1.2100 seems likely, opening also doors for a test of the long term key psychological level of 1.2000 in a longer term view.

Above afore mentioned 1.2550 the pair may correct higher, but the line in the sand remains at 1.2660, next resistance and probable top in case of a weekly recovery. In the unlikely case the pair manages to break above it, next target comes at 1.2750/70 price zone, albeit chances of such advance seem extremely poor at this point.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.