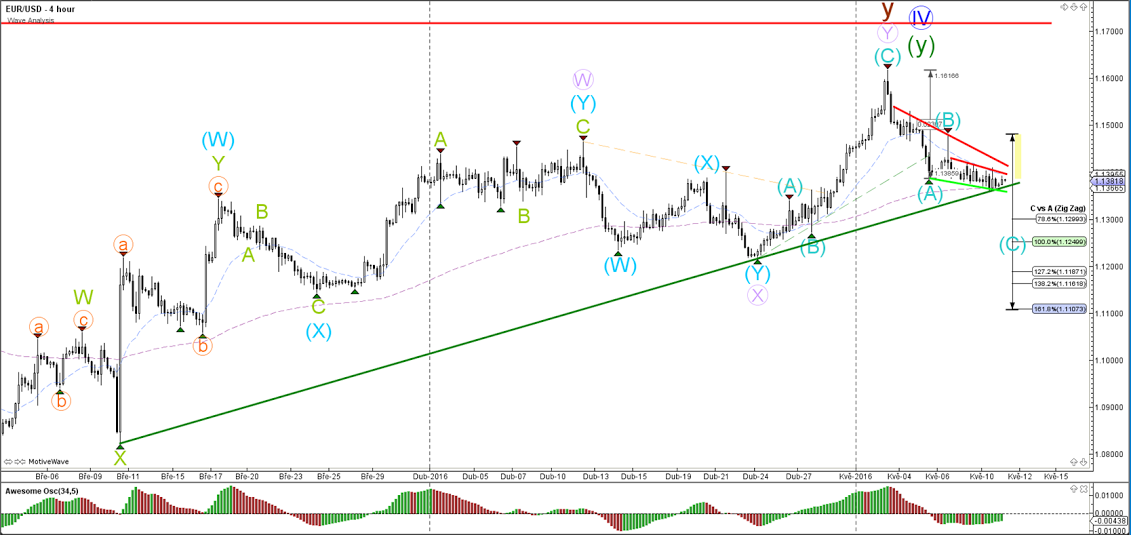

EUR/USD

4 hour

The EUR/USD is entrapped between support trend lines (green) and resistance (red). Price has reached a long-term support trend line (dark green), which is a bounce or break spot. A bullish breakout could indicate a completion of the ABC (blue), whereas a bearish breakout could indicate a continuation of the C wave (blue).

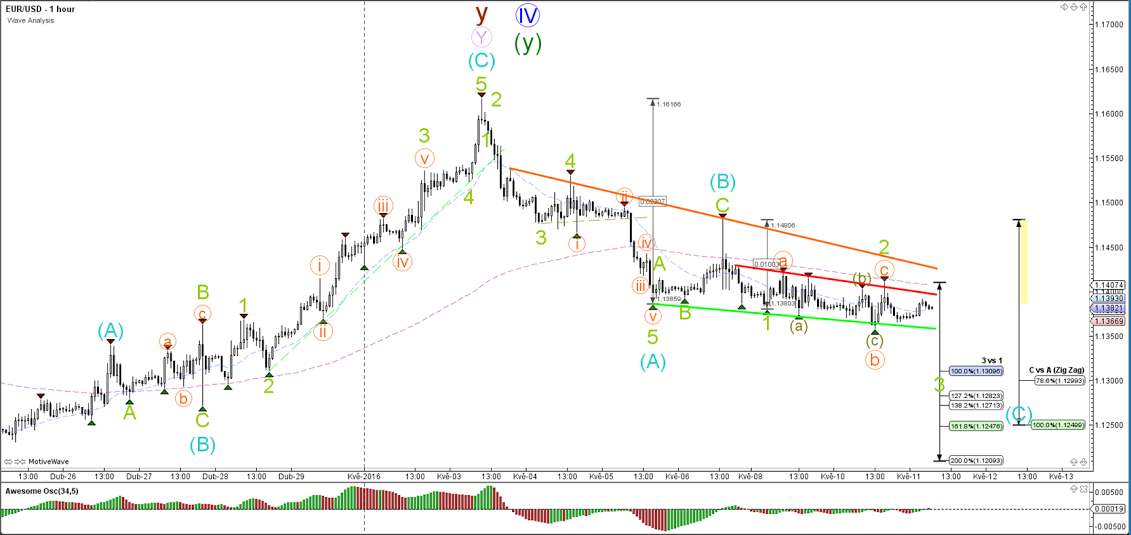

1 hour

The EUR/USD remains in a choppy trend channel. Price keeps respecting the support (green) and resistance (red) levels. A bearish breakout would most likely see price move towards the Fibonacci targets of wave 3 (green) and wave C (blue).

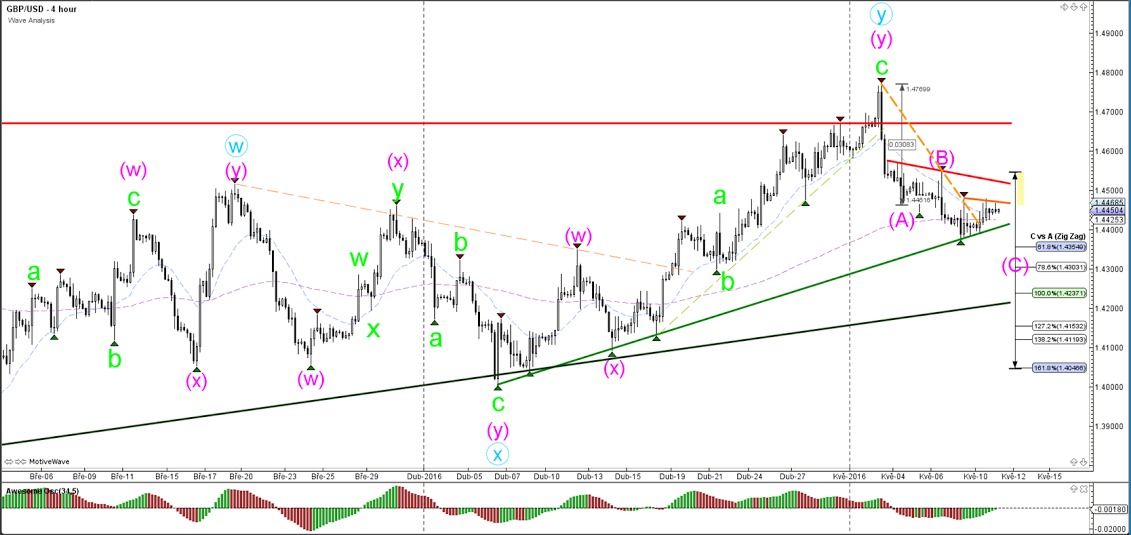

GBP/USD

4 hour

The GBP/USD has also reached a long-term key support trend line (green). A break of the support trend line would confirm the downtrend on the GBP/USD whereas a break of the 2 resistance trend lines (orange-red) could indicate the completion of the ABC (pink) and an expansion of the uptrend.

1 hour

The GBP/USD is still respecting the 61.8% Fibonacci level of wave 2 vs 1. A bearish break below the support trend lines (green) could see price expand wave A (pink) lower via a potential wave 3 (green). A bullish break above resistance (red) invalidates 123 (green) and indicates a bullish breakout.

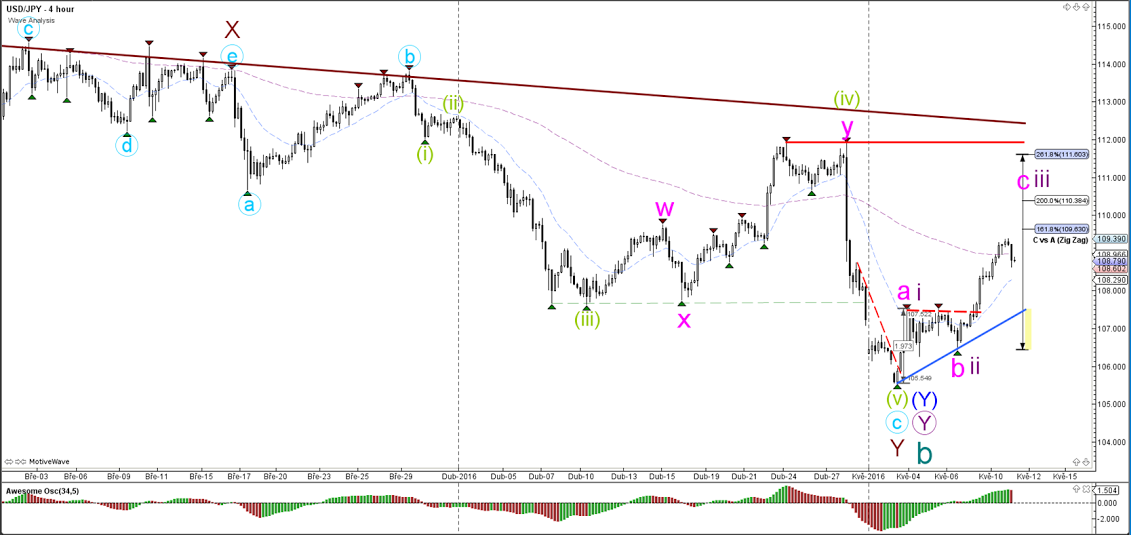

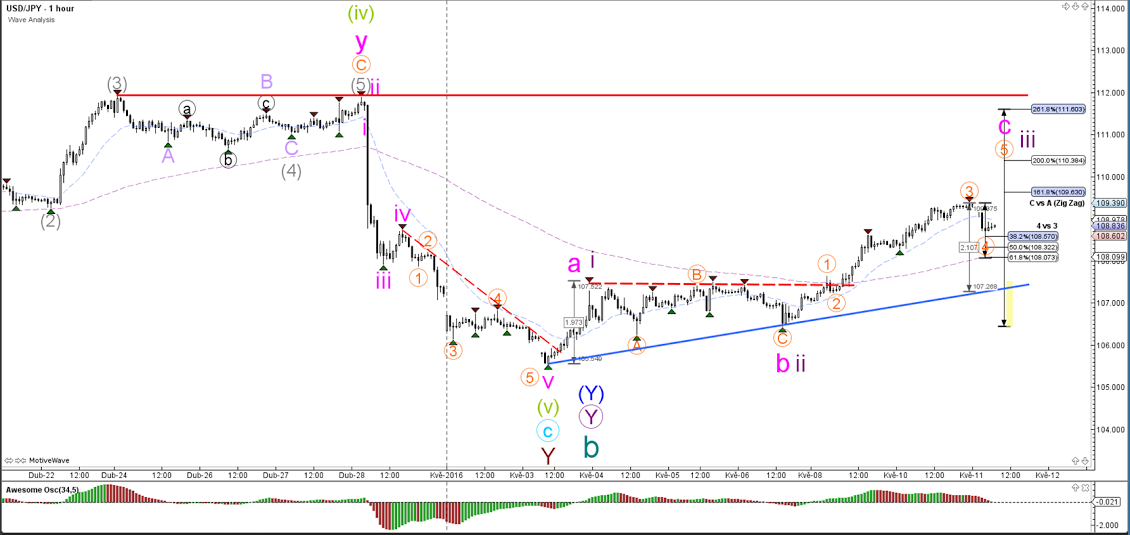

USD/JPY

4 hour

The USD/JPY has reached the 161.8% Fibonacci target. A break above this target favors a wave 3 (purple) whereas a bearish turn makes a wave C (pink) more likely.

1 hour

Whether the USD/JPY will build a wave C (pink) or wave 3 (purple) depends on its price reaction at the Fibonacci levels of wave 4 (orange). Price should typically stop at the 38.2% Fibonacci level and not break below the support trend line (blue) if a wave 4 indeed unfolds.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.