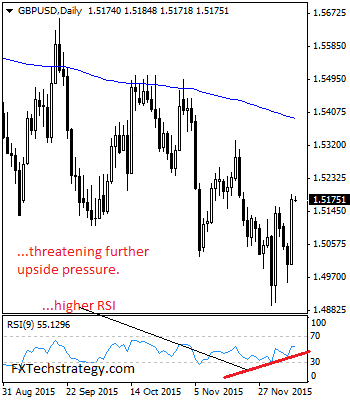

GBPUSD: Having rallied strongly to reverse its three-day weakness to close higher on Wednesday, GBPUSD faces further bullish offensive on rally. This development leaves more upside threats likely towards the 1.5200 level. Support lies at the 1.5100 level where a break will turn attention to the 1.5050 level. Further down, support lies at the 1.5000 level. Below here will set the stage for more weakness towards the 1.4950 level. Conversely, resistance stands at the 1.5200 levels with a turn above here allowing more strength to build up towards the 1.5250 level. Further out, resistance resides at the 1.5300 level followed by the 1.5350 level. On the whole, GBPUSD faces further bullish offensive on bull pressure on rally.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD eases from multi-week top; bulls retain control ahead of Fed

AUD/USD trades with a mild negative bias below a three-week high, around the 0.6400 neighborhood touched on Monday, as traders turn cautious ahead of the FOMC meeting. However, the optimism over China's stimulus measures, the risk-on mood, and the overnight breakout through the key 100-day barrier favor the Aussie bulls amid the recent USD slump.

USD/JPY climbs to two-week high ahead of BoJ-Fed rate decisions

USD/JPY touched a nearly two-week high during the Asian session on Tuesday as the risk-on mood undermined the safe-haven JPY ahead of this week's key central bank event risks. However, divergent BoJ-Fed expectations and rising trade tensions should limit deeper JPY losses.

Gold price sits near all-time peak, just above the $3,000 mark

Gold price trades above the $3,000 mark, near the record high touched last Friday, as the economic uncertainty sparked by Trump's tariff war continues to underpin safe-haven assets. Moreover, the recent USD slump to a five-month low, triggered by rising Fed rate cut bets, lends support to the XAU/USD.

Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

Crypto exchange-traded funds extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Fed.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.