For the newbie forex traders out there who are just tuning in, the Purchasing Managers’ Index or PMI is a survey conducted among the purchasing managers of various companies in the manufacturing sector. It is very important because it acts as a leading indicator for the manufacturing sector and because many central banks make use of PMI readings when considering their respective monetary policies.

The main problem with PMI is that there are many survey providers and their methodologies sometimes vary to such a degree that comparing the PMI levels of various economies is like comparing apples and oranges. Fortunately, Markit collects the PMI data of most of the major economies, with the exception of Switzerland, Australia, and New Zealand, which is why we’re relying primarily on Markit’s PMI readings. Okay,enough of that! Let’s get this show on the road!

Global Manufacturing PMI

As advertised, the current trend among most of the major economies seems to be one of stability – still above the 50.0 neutral level and no major deviations in the last three months. The only ones buckling this trend are China and Canada since the former saw further declines while the latter was climbing steadily, although it finally saw a slight drop in July.

Canada’s manufacturing PMI reading dropped to 50.8 in July after climbing to 51.3 in June. According to Markit’s Canadian report, the main reason for the drop was a drop in employment levels despite rising levels of production and new order volumes brought about by “exchange rate depreciation and stronger U.S. consumer spending.”

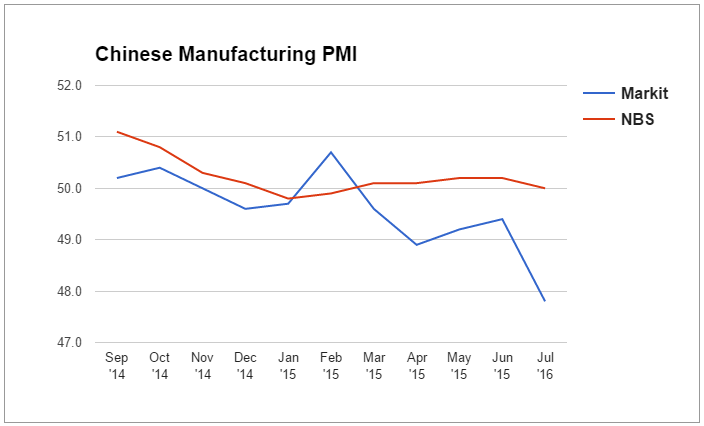

As for China, Markit’s Chinese report shows that China is in deep trouble since employment levels declined for the 21st consecutive month and production levels contracted for the third consecutive month. Apparently, the weakness in China’s manufacturing sector was due to a one-two punch of declining domestic and overseas demand for Chinese goods.

Interestingly enough, Markit’s reading and the official PMI data issued by the National Bureau of Statistic of China (NBS) are beginning to diverge greatly since the official reading is stubbornly refusing to go below the 50.0 neutral mark, which is rather strange given China’s economic slowdown and all the other troubles that China has been experiencing lately.

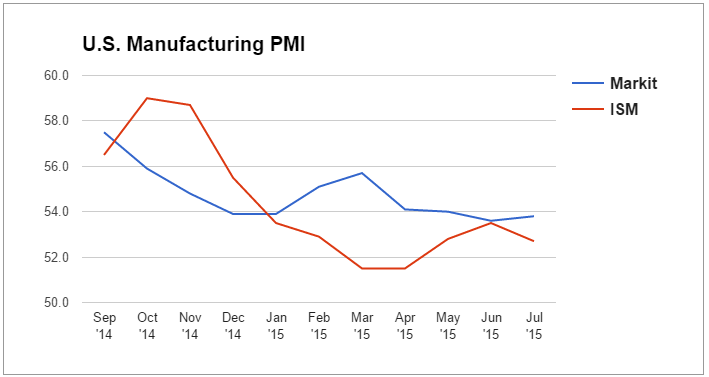

Speaking of diverging PMI readings, Markit’s report for Uncle Sam and the report released by the Institute of Supply Management (ISM) are at odds too since Markit is saying that the expansion accelerated in July (53.8 latest v.s. 53.6 previous) while the ISM is saying the opposite (52.7 latest v.s. 53.5 previous).

One particular point worth highlighting is that Markit’s respondents viewed lower oil and raw material prices as good since they help to “reduce manufacturers’ costs and protect margins.” ISM’s respondents, on the other hand, aren’t as upbeat since they viewed lower oil and raw material prices with “a combination of optimism mixed with uncertainties.”

Moving along, the manufacturing sector in the U.K. remains subdued, but it finally climbed higher to 51.9 in July after dipping to a 26-month low in June. According to Markit’s U.K. report, the main driver for the increase was continued strength in domestic demand, which managed to offset the weakness from poor overseas demand brought about by the “sterling-euro exchange rate hitting competitiveness in eurozone markets,” which is a fancy way of saying that the pound is just too darn strong.

Incidentally, the Bank of England also complained about the strong pound in the latest MPC meeting minutes and inflation report, which is probably one of the reasons why forex traders dumped the pound. Did you catch that move, by the way?

Getting back on topic, Japan’s manufacturing sector expanded for the second month (51.2 latest v.s. 50.1 previous) due to production increasing at the quickest rate since February of this year and employment rising at the fastest rate since December 2014. In addition, Markit’s Japanese report states that overseas demand saw a pickup due to “new product launches and success in gaining new international clients.” I guess you can add this to my monthly economic review as another positive sign of a recovery in Japan.

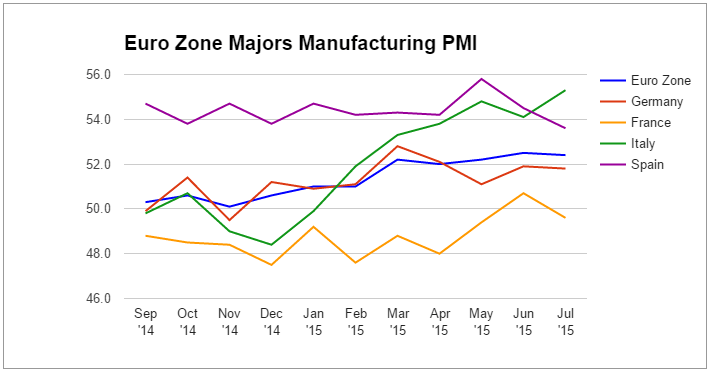

Last but not least is the euro zone. According to Markit euro zone report, the manufacturing sector in the euro zone was little changed (52.4 latest v.s. 52.5 previous) despite all that drama with Greece, thanks to continued domestic and overseas demand. Breaking down the euro zone’s PMI reading, Italy was the top dog (55.3) among the major euro zone economies, followed by Spain (53.6) and Germany (51.8). France, meanwhile, was actually a drag since it posted a 49.6. And if you’re wondering, Greece was last in line at a ridiculously low 30.2.

Overall, most of the world’s major economies seem to be seeing some stability and continued yet subdued expansion, including the euro zone, which had to deal with all that drama from Greece. China is a bit worrying, though, since Markit’s PMI reading is indicating deteriorating conditions. And given the interconnectedness of the world’s economies and China’s status as an economic superpower, that is almost certainly a bad thing, especially if the trend continues.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0900, eyes on tariffs

EUR/USD keeps the bid bias well in place so far on Tuesday, hovering above the 1.0900 barrier on the back of fresh downside pressure in the Greenback amid investors' hope of trade negotiations.

GBP/USD looks bid and approaches 1.2800

GBP/USD maintains its fresh bullish bias in the upper-1.2700s, printing marked gains in response to some loss of impulse in the US Dollar, which in turn lent fresh legs to the risk-associated universe on Tuesday.

Gold trims gains and breaches $3,000

Gold prices now lose some upside momentum and slip back below the critical $3,000 mark per troy ounce. Tuesday's recovery in the yellow metal comes on the back of the weaker US Dollar as well as steady trade tensions, while higher US yields continue to cap gains.

Who is Satoshi? Crypto lawyer sues DHS to reveal Satoshi Nakamoto's identity

James Murphy, a cryptocurrency lawyer popularly known to his followers on X as "MetalLawMan," has filed a lawsuit in a D.C. District Court against the Department of Homeland Security (DHS). He intends to uncover the real face or faces behind Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.