Is the part-time hiring binge that has inflated job numbers for at least two years about to come to an end?

I think so. More importantly, so do CEOs of large corporations.

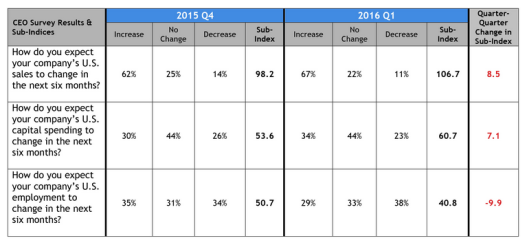

In December, a quarterly survey of large corporation CEOs showed a minuscule net of 1% (35% to 34%) of corporations expected an increase in hiring. 31% expected no change.

The latest quarterly survey shows nearly 10% (29% to 38%) of large corporation CEOs expect to reduce headcount. The remaining 33% expect no change.

CEO Economic Survey Details

Let’s dive into the Business Roundtable First Quarter 2016 CEO Economic Outlook Survey for more details.

Key Survey Results

Mixed Bag?

For the fourth quarter in a row, CEO expectations on the economy remain mixed.

CEO expectations for sales over the next six months increased by 8.5 points, and their plans for capital expenditures increased by 7.1 points, relative to last quarter. Hiring plans declined by nearly 10 points from last quarter.

Mixed Bag Not

Is that an ominous report or a mixed bag?

On the surface one can make a claim either way. The business outlook is up huge as are capital spending expectations.

However, CEOs are clueless about where the economy is headed.

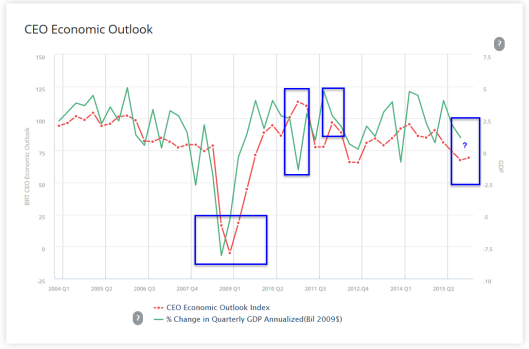

CEO Outlook

Notice the perpetually lagging nature of the CEO Economic Outlook.

GDP is a lagging indicator. The aggregate CEOs’ economic outlook is even more lagging. That’s quite a pathetic under-performance.

Jobs are also a lagging indicator.

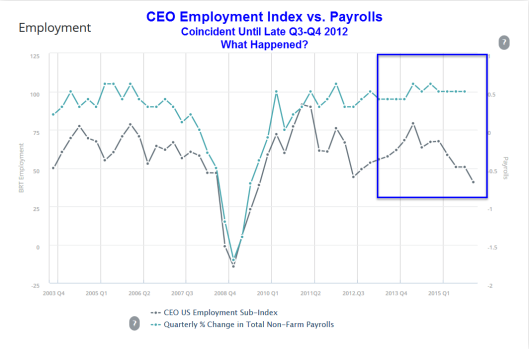

Battle of Lagging Indicators

In the battle of lagging indicators, results show the CEO hiring index was amazingly coincident with nonfarm payrolls from 2003 until late 2012.

What happened?

Obamacare!

The newly created Obamacare health insurance marketplaces opened for enrollment on October 1, 2013.

Starting 2014, citizens were required to have insurance.

Businesses with 50 or more full-time employees had to offer insurance benefits to their employees.

Obamacare reduced the number of hours to 30 that it took to be considered a full-time employee.

Employers cut hours and hired more part-time workers.

Five Consequences

The hiring binge associated with Obamacare is finally over.

US job growth will “unexpectedly” slow dramatically now that CEO hiring plans have weakened to the point of contraction.

Talk of rate hikes will morph into talk of easing.

The US dollar will sink further.

Gold, not the stock market, will be the big beneficiary of this “unforeseen” jobs weakness.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.