Market Wrap - The novel coronavirus in China has lead to global risk aversion

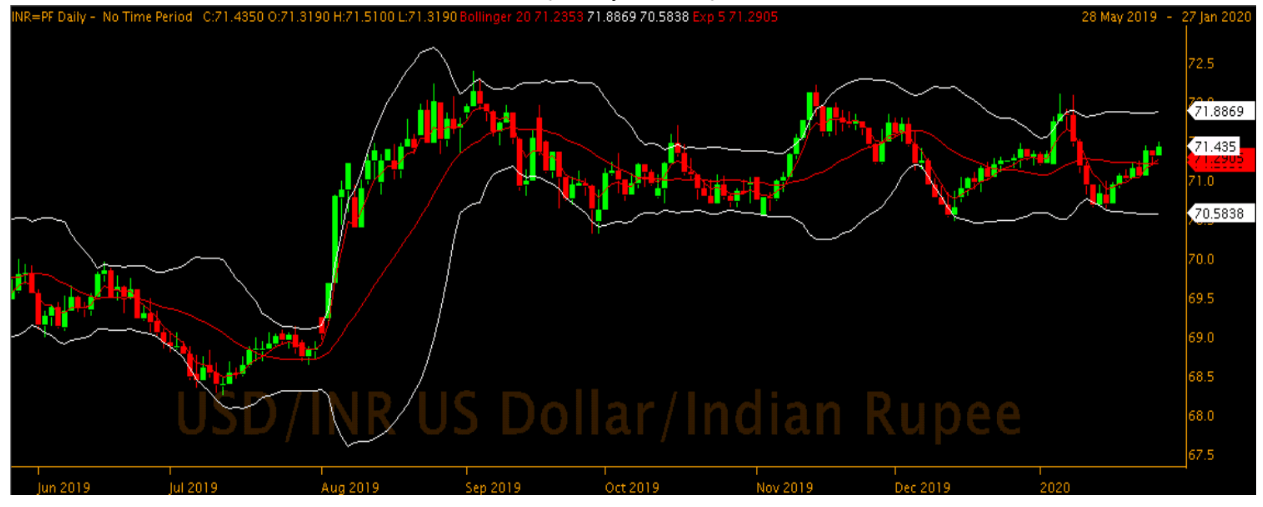

The USDINR pair ended the session higher by 11 paise at 71.44 due to broad-based US dollar strength across the global market and buying from some state-owned banks for importers. However, foreign and domestic private banks sold the greenback at higher levels, likely for exporters, cushioned the fall in the rupee. The novel coronavirus in China, the world's second largest economy, has lead to global risk aversion. So far, it has claimed 81 people's lives and affected more than 2,860 people. While Equity indices witnessed heavy selling pressure amid global risk-off sentiment, declining by 1.10%. The benchmark bond yield ended up marginally lower by 2bps to 6.55%. The dollar index was trading around 1-month high around 97.90 levels. On the data front, Eurozone Ifo Business climate index numbers came disappointing as German business morale deteriorated unexpectedly in January as the outlook darkened suggesting that Europe's largest economy got off to a slow start in 2020 after narrowly avoiding a recession in the previous year.

Indian indices registered their steepest fall in three weeks, amid global risk aversion due to the rising cases and deaths related to the coronavirus, even as corporate earnings are to be in focus. Going ahead, market is likely to remain highly volatile, as it would be dictated by key events such as US Fed meeting, Brexit, FNO expiry and the Union Budget, which are lined-up for this week. At close, the Sensex was down 458 points at 41,155.12, and the Nifty was down by 129 points at 12,119.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.