Market Brief

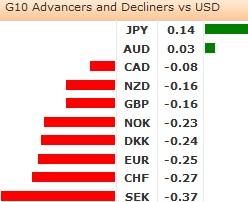

In FX markets the USD continued to gain as the Fed let the possibility of December tapering on the table. Post-FOMC EURUSD fell to 1.3689 from 1.3740 while USDJPY rallied aggressively to 98.68 before dropping to 98.27(muted ration to the BoJ’s unchanged policy). USDNZD fell to 0.8233 despite the fact that the RBNZ maintain their tightening bias. Although the New Zealand central bank highlighted two points, exchange rate and the possible impact of recent macro environment alterations, which would allow them some flexibility in the timing of hikes. Regional equities indices were weaker following a 0.5% fall in S&P. The Shanghai Composite dropped -0.87%, Hang Seng -0.52% while the Nikkei fell -1.52%. JGB yields are slightly higher, while in China, the PBoC did reverse repos, to further push down rates.

The FOMC October statement was slightly less dovish than the market had anticipated, but in line with our expectations. There were no changes in the policy rate or adjustment to $85bn asset purchases. The committee made few changes to the statement and keep the key phase “decided to await more evidence that progress would be sustained before adjusting the pace of purchases.” To us this means the Fed is inching toward tapering but is not there yet. The most interesting aspect of the statement was the clear nonexistence of any mention of the US government shutdown and possible spillover effect into growth. From our perspective, the October statement indicates that tapering at the December meeting remains as a real possibility, although we believe the decelerating pace of data (slowing in the pace of the housing & labor market recovery) will push any reduction in asset purchases to March.

Overnight, the RBNZ maintained its tightening bias as was widely expected. The statement includes a new sentence directly related to NZD, “Sustained strength in the exchange rate that leads to lower inflationary pressure would provide the bank with greater flexibility as to the timing and magnitude of future increases in the OCR.” From Australia, building approvals surged 18.6% in September, while August was revised higher to 11.1% from 7.7% prior read. In Japan , the BoJ held policy untouched as was universally anticipated. Traders will now focus on Governor Kuroda’s speech on policy and economy later today.

Today is data rich. In the European session traders will be focused on euro area flash HICP for October and Germany, retail sales for September could increase by 0.4% mom. While in Italy, market expect a rise in September unemployment from 12.2% to 12.3%. In the US session, initial claims are expected to fall 12K to 338K while October Chicago PMI is expected to moderate from 55.7 to 55. In Canada August GDP data to print 0.1% mom, yet after last week’s downward GDP forecast revision by the BoC this number will have little relevance.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.