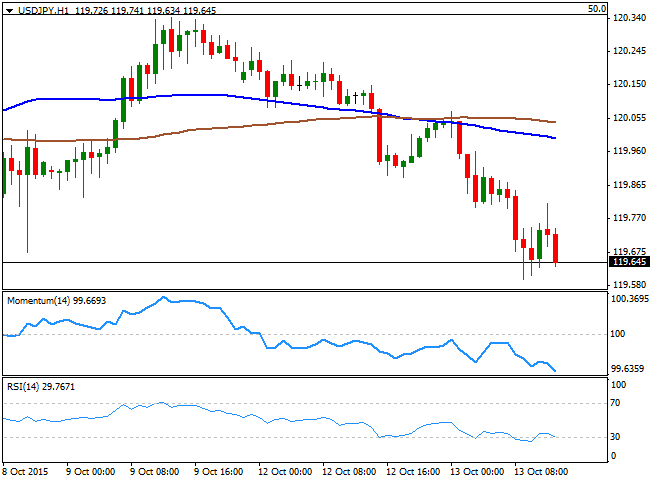

USD/JPY Current price: 119.65

View Live Chart for the USD/JPY

More slides below 119.35. The USD/JPY pair trades slightly lower daily basis, holing near its daily low of 119.59 ahead of the US opening. The pair come under pressure on the back of stocks' slide in Asia, albeit the movement lacks momentum, with the price still confined within its latest range. Technically, the 1 hour chart shows that the 100 SMA is slowly detaching from the 200 SMA well above the current level, whilst the technical indicators head sharply lower in negative territory, maintaining the risk towards the downside. In the 4 hours chart, the technical indicators also head south below their mid-lines, supporting a downward continuation, with the next support at 119.35, the 38.2% retracement of its latest bearish run. Below this level, the pair can extend down to 118.90, followed later by 118.55, the base of its latest range.

Support levels: 119.35 118.90 118.55

Resistance levels: 120.05 120.35 120.70

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0400 amid Europe's Ukraine peace push

EUR/USD holds the rebound above 1.0400 in European trading on Monday. The Euro firms up on Europe's efforts in a renewed push for peace in Ukraine. Upbeat Chinese PMI data underpins risk sentiment, adding to the weight on the US Dollar, keeping the pair afloat ahead of EU inflation data.

Bitcoin, Ethereum and Ripple rallies as Trump announces ‘Crypto Strategic Reserve’

Bitcoin price hovers around $93,000 on Monday after rallying 9.53% the previous day. Ethereum and Ripple prices followed BTC’s footsteps and rallied nearly 14% and 35% on Sunday.

GBP/USD hovers around 1.2600 amid US Dollar weakness

GBP/USD defends minor bids near 1.2600 in the European session on Monday, helped by the sustained US Dollar retreat amid risk appetite and a potential truce in the Ukraine conflict. The further upside remains capped by looming US tariffs and geopolitical updates.

Gold price sticks to positive bias on weaker USD, concerns over Trump's tariff plans

Gold price attracts some buyers on the first day of a new week and moves away from over a three-week low, near the $2,833-2,832 region touched on Friday. Traders continue to price in the possibility that the Fed will cut interest rates by a quarter of a percentage point twice by the end of this year

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.