![]()

A major shift has happened in the last couple of days, Greece, who everyone thought was on the mend, saw its bond yield cross an important line. If you cast your mind back 3 years you may remember that in the heat of the sovereign debt crisis, when Europe’s struggling periphery saw their bond yields cross above 7%, it was considered the point of no return. Well, late on Tuesday, Greek 10-year yields did just that, they crossed this important line, and have continued to push higher on Wednesday.

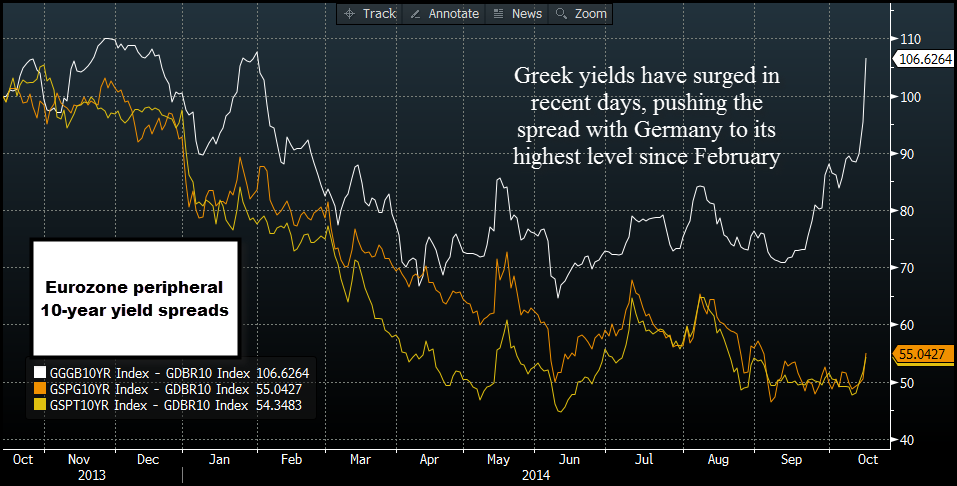

I did not expect to be watching Europe’s peripheral yield spreads with Germany. However, this old chestnut is back and the chart below shows Greek (white), Spain (orange) and Portugal (yellow) 10-year bond yields with Germany. As you can see in figure 1, Greek yield spreads have risen sharply, Portuguese yields have turned higher, and the Spanish spread has also started to widen. At this stage, the contagion effects are minimal, as Spanish and Portuguese yield spreads with Germany are still at relatively low levels. However, as you can see in figure 2, Greek, Spanish and Portuguese yield spreads have tended to move in the same direction for most of the last 5 years, although Greek yields have tended to overshoot more. This does not bode well for the other “at risk†countries in the Eurozone.

So why are peripheral risks rising right now?

Growth fears: Europe’s growth forecast was revised down by the IMF for this year and next year, disinflation has taken a firm hold and even Germany is showing signs of stress. This is not good when you have a giant pile of debt. In fairness, Europe could do with a little inflation to eat away at its debt pile, which is why it is imperative that the ECB takes more action to get rid of the threat of deflation. Read my colleague Matt’s piece from Tuesday HERE. http://www.forex.com/uk/post?SDN=ea33f244-4a84-48c4-9d23-a2b5d508886a&Pa=20db1fa6-e674-420c-9a87-2ee29261d638

Germany: As we mention above, even Germany is struggling. The ZEW survey for October suggests that there is a good chance that the US will fall into technical recession this year. If Germany’s economy starts to suffer, who is going to pay for all the bailouts? This essentially leaves Europe without a true lender of last resort, which could make some of Europe’s most troubled nations less credit-worthy.

Political risks: Some of Europe’s member states have fragile governments right now. The French government nearly collapsed earlier this year, Italy’s Five Star Movement is gaining popularity once again and trying to get Italy to leave the currency bloc; in Greece the radical leftist anti-EUR party SYRIZA hold a strong lead in the opinion polls. The Greek political issues could continue to grow if the current government do not win a majority at next year’s Presidential election then SYRIZA could call a snap election putting them in a good position to run the country.

Rising bond yields are merely a reflection of the troubles that have resurfaced in the currency bloc. We tend to think that the economy is the biggest threat, and if growth does not pick up sometime soon then we could see rising bond yields spread beyond Greece into Portugal, Spain and even Italy.

Right now, there is no sovereign crisis, but the fact that Greek yields have crossed the 7% threshold is a warning sign that all is not well. Investors are ditching the highest risk peripheral debt and ploughing their money into German yields, 10-year German yields have fallen to another record low on Wednesday, which suggests that stress levels could be starting to rise.

What now for the EUR?

EURUSD is shrugging off the Greek news, for now, however if yields continue to rise and we see 8 or 9% in 10-year Greek bond yields, or if we see contagion start to spread and other peripheral yield spreads start to rise, then it could trigger some selling pressure in the single currency. We continue to think that the risks to the EURUSD are to the downside, and the market could fade any rallies towards 1.2680 and then 1.2710. In the short term, the first level of support is 1.2625 then 1.2600; however the main target is still 1.2500, the low from 3rd October.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.