The XAU/USD pair (gold prices in terms of the US dollar) did manage to take out the Fib golden ratio at 161.80% retracement (Set 24-Oct 2 decline) located at 1190.18 on Thursday. However, the spike was short-lived and the bullion retreated sharply after the USD bulls jumped back into the bids following the release of unexpectedly positive US CPI data. The US CPI dropped 0.2% m/m in Sept, matching forecasts while the core CPI accelerated to 1.9% in September, outpacing the 1.8% gain expected. While further adding to the bullish sentiment around the greenback, the US weekly jobless claims reached the lowest levels since 1973, dragging the gold prices lower. Markets started re-pricing in Dec Fed rate lift-off bets, with the Reuter Polls showing a 56% probability of a Dec rate hike. The prices breached the 200-DMA support then located at 1176.73, falling as low as 1174.32, although recovered to 1181.80 at close.

As for today’s trade in running, XAU/USD extends weakness and corrects further, having failed once again at higher levels. The prices edged lower mainly on the back of profit-taking after the recent strength and ahead of the weekly closing. Moreover, the renewed optimism on the US economy after the recent datasets has triggered a fresh wave of risk-on rally in the global equities, thereby dulling gold’s appeal as a safe-haven. While markets now look forward to a set of key US data flow in the New York to confirm the recent signs of strength seen in the US. Later today, the crucial US prelim consumer sentiment and the industrial production figures will be closely watched. Markets are expecting consumer morale to have improved to 88.88 in Sept versus an 87.2 reading seen in Aug. While the industrial output is expected to show a 0.2% drop in Sept, easing slightly from a 0.4% decline seen previously.

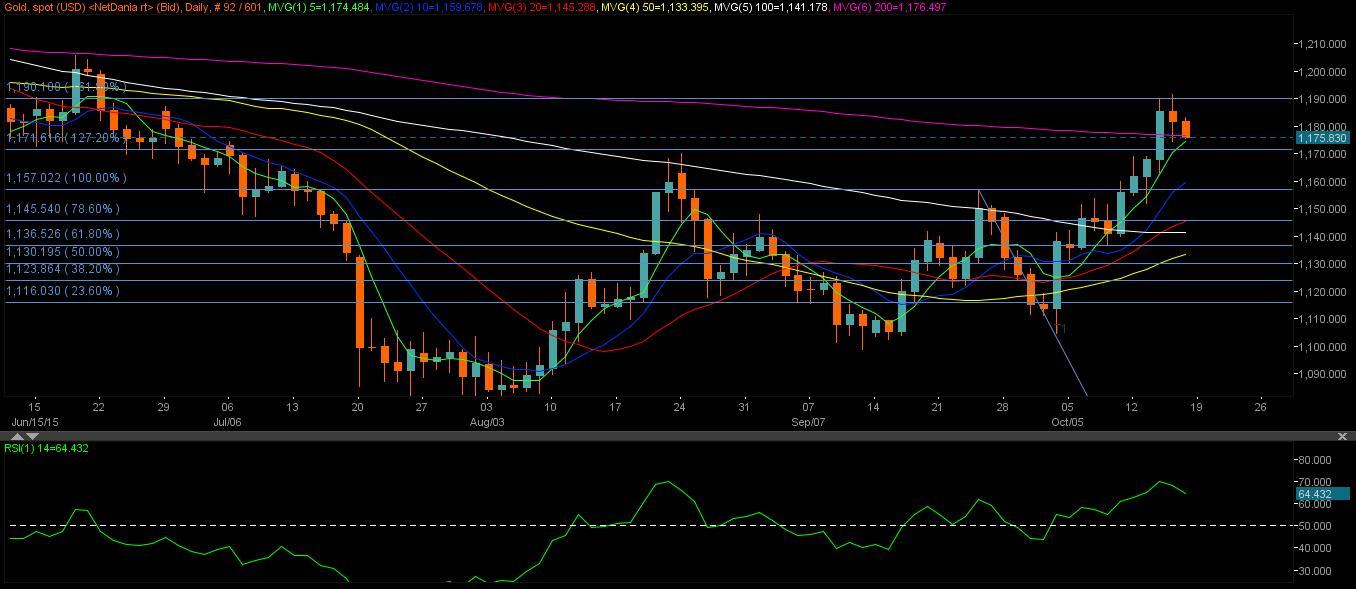

Technicals – Bearish on US data, could drop to Fib 127.20% level

On daily charts, the prices have dropped below the 200-DMA now located at 1176.49 and looks to drop further in the day ahead with the daily RSI aiming sharply lower at 64, suggesting further room for declines. Hence, the next immediate support in sight is placed at Fib 127.20% (of the same fall) level at 1171.61, below which floors would open for a test of 1163.05 - Oct 14 Lows.

Should the US consumer sentiment miss estimates, USD bulls will take a backseat and resume its broader downtrend, driving the bullion back towards the key Fib golden ratio 161.80% levels. A sustained break above the last, the pair could storm its way through 1200 barrier. Only a weekly closing above 1200 levels, could open further upside towards 1215-1230 levels in the next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.