Gold prices remained stuck in the range of USD 1180-1125 ahead of the Non-farm payrolls report as anticipated in the report titled “Gold Forecast: Seen in the range of USD 1180-1225 ahead of Nonfam Payrolls†(Gold Price Analysis 3rd April, 2015) published on March 27th. Prices did clock an intra day low of USD 1178.5, although the daily closing throughout the week remained well above the USD 1180.00 mark.

Apart from the Fed’s comments on the negative effects of strong USD, the NFP is the only piece of data that could significantly alter the rate hike expectations.

Delay in rate hike until September already priced-in

The downward revision of the interest rate forecasts in the March policy statement by the Federal Reserve, coupled with weak growth and inflation forecasts and concerns regarding the strong USD pushed the rate hike expectations to September 2015 from June 2015.

Gold prices jumped from the low of USD 1142.6/Oz levels to hit a high of USD 1219.4/Oz post the March Fed meet. From the move, it appears the delay in the rate hike until September has been priced-in by the markets.

Rate hike expectations could be pushed far out in 2015 or early 2016 since

NFP prints came in surprisingly weak at 126K, missing the consensus estimate of 244K. Gold could rally significantly, over and above USD 1250/Oz over the next week.

Meanwhile, the major centralbankers across the world have run out of ammo for the short-term. Thus, we are unlikely to see a major central bank announcing fresh monetary stimulus in theshort-run.

Furthermore, the prospects of rise in Iranian crude supplies is high after reaching a deal over its nuclear program. Thus, Crude prices could start falling rapidly. In such case, we could see the USD strengthen across major currencies - a move witnessed in Oct-Nov 2014 crude fall. This could further cap gains in Gold.

Greek issue is the only factor apart from the speculation of a delay in the rate hike in the US that could push Gold prices higher. It remains to be seen how the Greece situation unfolds.

Weak equities could trigger a rise in safe haven demand

As mentioned earlier, a significantly weak NFP print could push the rate hike bets further out in late 2015 or early 2016.

Moreover, the Fed policymakers, US Treasury secretary and other major central bankers across the globe in the past six months or so have repeatedly sold an interest rate hike as appositive development for the US and the global economy. Consequently, the equity markets in the US have rallied even on talks of a rate hike.

Thus, with the increased possibility of a delay in the interest rate hike beyond September 2015, the equity markets in the US and Europe could fall, leading to strength in Gold and other safe haven assets like Yen.

Markets are likely to turn their attention now to Q1 US GDP initial estimate. It is widely expected that Q1 GDP is likely to significantly weak or even negative.

Gold Technicals

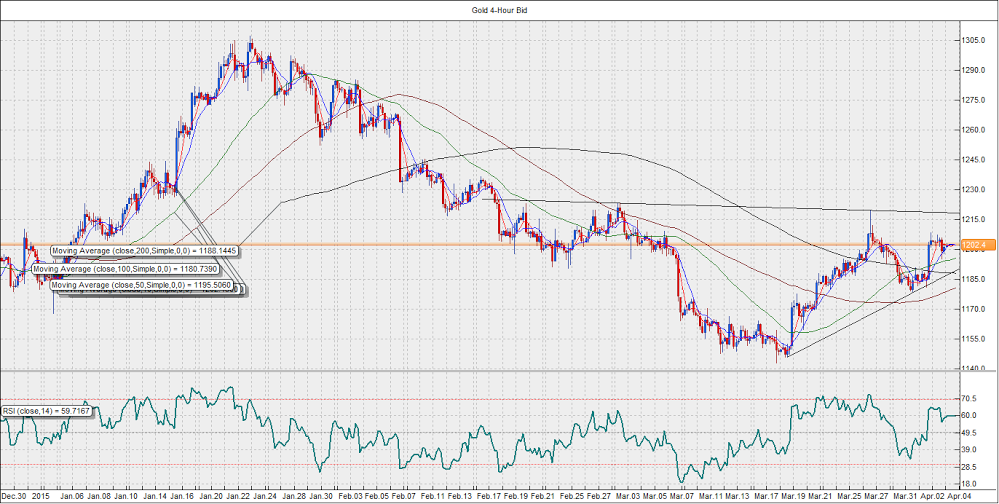

On the 4-hour chart, we see an inverted head and shoulder pattern with a neckline resistance at USD 1220.

Prices have a support of the rising trend line currently around USD 1190 level.

The RSI is bullish on the daily as well as the 4-hour time frame.

Gold Fib Levels

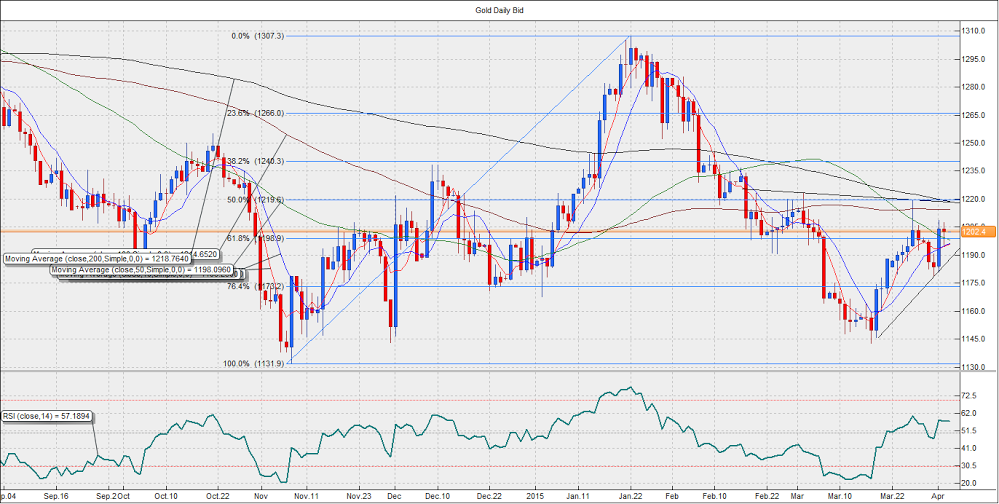

Currently trades above 1198.9, which is 61.8% Fib retracement of 1131.9 (Nov. 7 low) to 1307.3 (Jan. 22 high).

The inverted head and shoulder neckline at 1220, almost coincides with 50% Fib retracement at USD 1219.6. We also see USD 1225.1 (505 Fib retracement of 1307.3-1142.6). Thus, USD 1220-1225 is likely to act as strong resistance.**

On the other hand, 76.4% Fib at 1173.2 is likely to act as strong support.

To conclude–

- Immediate Upside appears capped at USD 1225/Oz,above which USD 1250/Oz is possible

- Metal likely to be bought on dips

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

Recommended Content

Editors’ Picks

Gold price keeps the red below multi-week high; lacks follow-through selling

Gold price retains its negative bias through the Asian session on Tuesday though it does lacks bearish conviction. A modest US Dollar bounce, along with a generally positive risk tone, triggers the intraday pullback from a three-week high. However, a combination of factors is holding back traders from placing aggressive bearish bets.

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

AUD/USD turns lower toward 0.6450 after RBA Minues, poor China's PMI

AUD/USD is meeting fresh supply toward 0.6450 in the Asian session on Tuesday as traders digest the RBA Minutes and the unexpected contraction in China's May Caixin Manufacturing PMI. Additionally, a modest US Dollar rebound keeps the pair undermined.