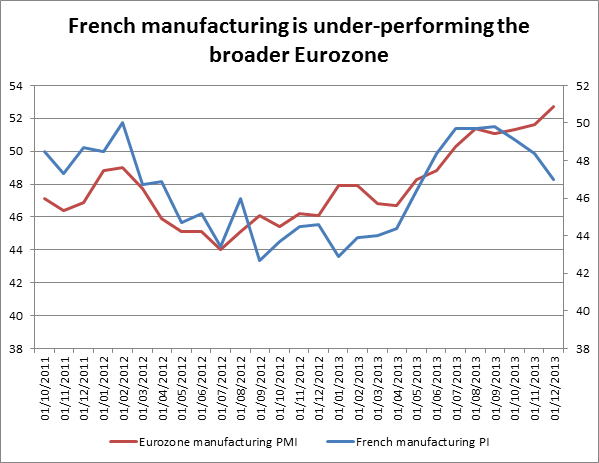

The final reading of European December PMI’s released earlier today made for grim reading for Paris. French manufacturing PMI was revised down to 47 from 47.1, the lowest level since May. The second largest country in the currency bloc saw its reading fall below Greece, where the manufacturing PMI actually picked up last month to 49.6 from 49.2 in November. It also underperformed Italy and Spain, with both nations managing to eke out positive growth with readings above 50 at the end of the year.

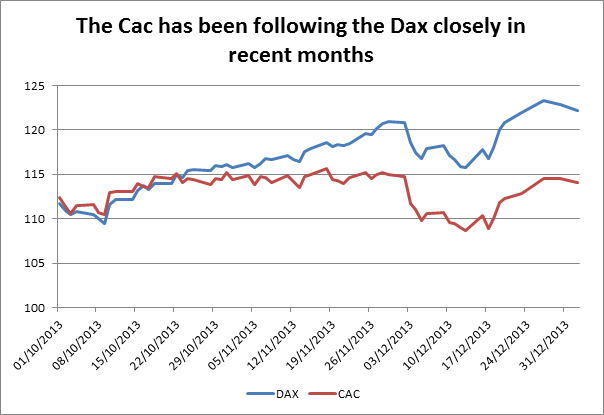

As you can see in figure 1, France is now lagging the currency bloc’s overall PMI reading by quite some margin as it becomes the weakest link in the Eurozone. Interestingly, for now this fundamental underperformance in France has not hurt the performance of the Cac 40 stock index, which has followed its German counterpart the Dax quite closely in recent months, as you can see in figure 2, which has been normalised and shows how the two indices move together. This suggests that French equities have not yet been singled out because of weak domestic economic performance.

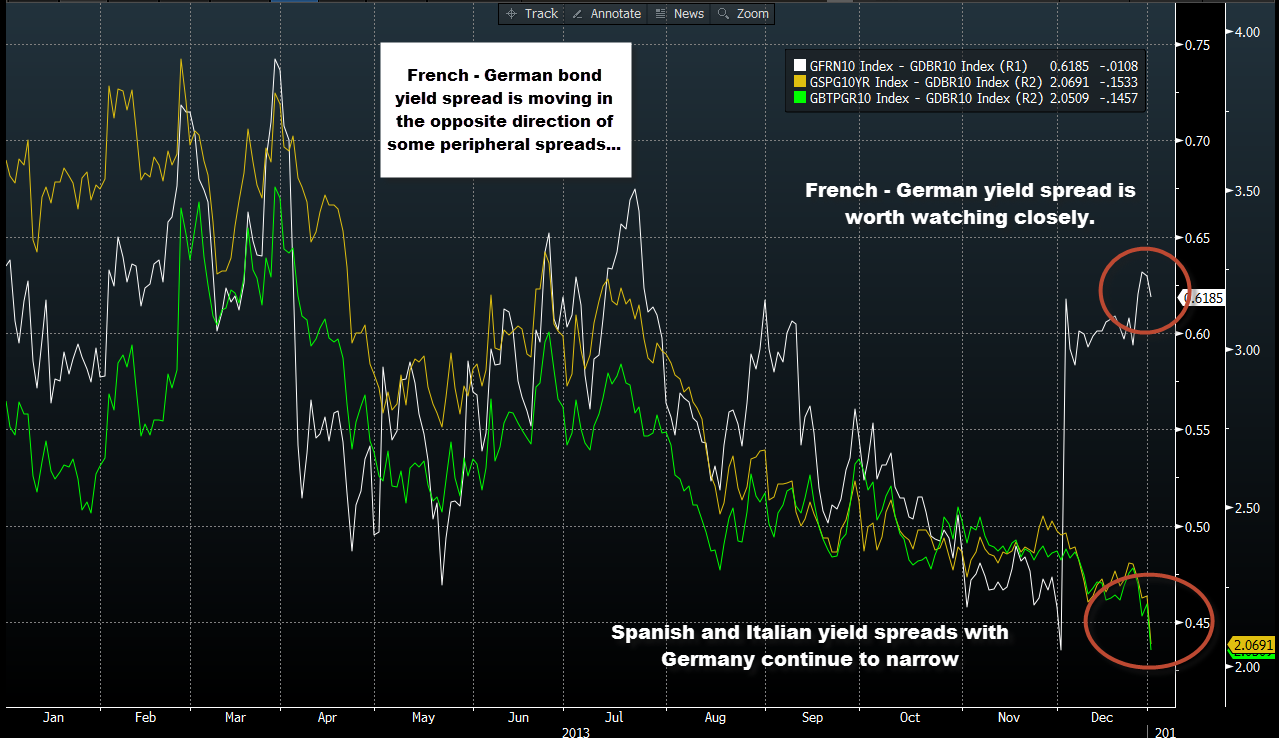

French – German bond yield spread worth watching

However, French bond yields are worth watching. The spread between French and German yields has widened in recent weeks and is now at its highest level since August. This contrasts sharply with the spread between Spanish and German and Italian and German yields, which have continued to narrow and are at their lowest levels since 2011.

Although the French – German spread is only 0.61 basis points compared with 200 + basis points for Spain and Italy, it is the pace of the increase in the spread that is worrying and the fact that the French – German spread is widening while the peripheral- German spreads are narrowing.

This does not suggest that danger is imminent, but it does urge caution. Sometimes the bond market is considered more astute than other financial markets, and if bond investors are starting to re-price French credit risk this could be the start of something more serious. If this is correct, then no doubt the FX and equity market will catch on at some stage, especially as we don’t see any signs that the French economy is ready to turn the corner yet.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0900, eyes on tariffs

EUR/USD keeps the bid bias well in place so far on Tuesday, hovering above the 1.0900 barrier on the back of fresh downside pressure in the Greenback amid investors' hope of trade negotiations.

GBP/USD looks bid and approaches 1.2800

GBP/USD maintains its fresh bullish bias in the upper-1.2700s, printing marked gains in response to some loss of impulse in the US Dollar, which in turn lent fresh legs to the risk-associated universe on Tuesday.

Gold trims gains and breaches $3,000

Gold prices now lose some upside momentum and slip back below the critical $3,000 mark per troy ounce. Tuesday's recovery in the yellow metal comes on the back of the weaker US Dollar as well as steady trade tensions, while higher US yields continue to cap gains.

Who is Satoshi? Crypto lawyer sues DHS to reveal Satoshi Nakamoto's identity

James Murphy, a cryptocurrency lawyer popularly known to his followers on X as "MetalLawMan," has filed a lawsuit in a D.C. District Court against the Department of Homeland Security (DHS). He intends to uncover the real face or faces behind Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.