Analysis for May 8th, 2014

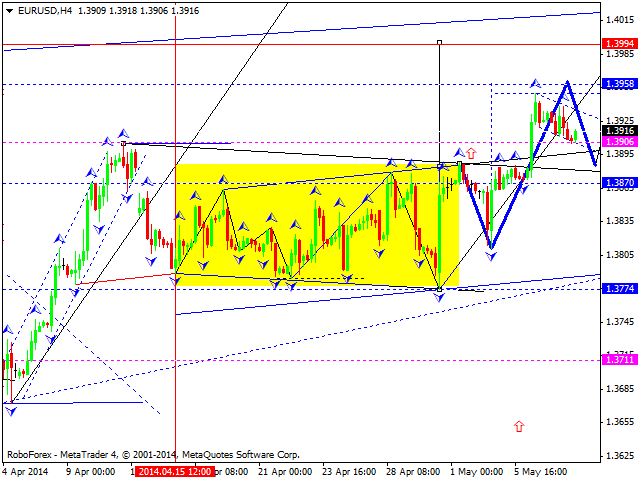

EUR USD, “Euro vs US Dollar”

Euro is being corrected towards previous ascending impulse. We think, today price may continue moving upwards to reach target at level of 1.3990. Later, in our opinion, instrument may return to level of 1.3880 and then continue growing up towards level of 1.4100.

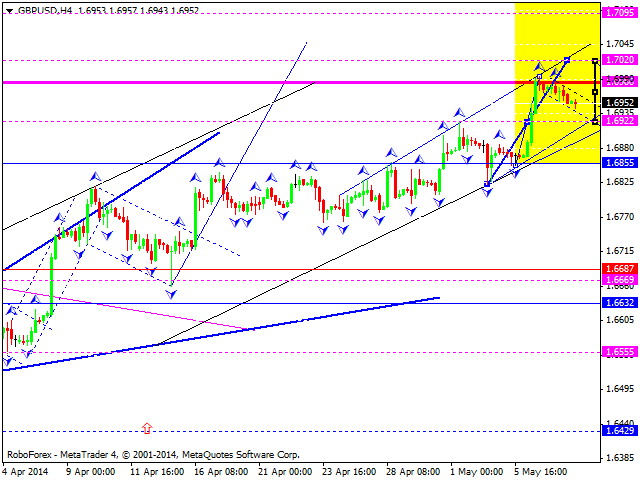

GBP USD, “Great Britain Pound vs US Dollar”

Pound is forming descending structure, which may be considered as correction. Later, in our opinion, instrument may continue growing up towards level of 1.7020 and then form another descending structure. After that, pair may consolidate and form continuation pattern. Main target is at level of 1.7730.

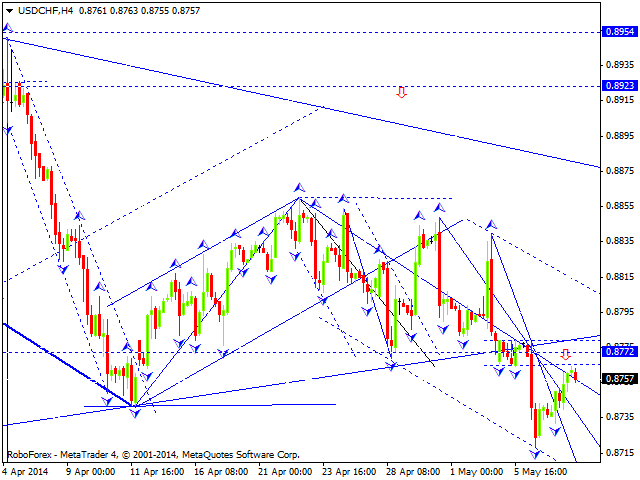

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving upwards slowly. We think, today price may continue moving downwards to reach level of 0.8700. Later, in our opinion, instrument may return to level of 0.8770 and then continue moving inside descending trend to reach level of 0.8630.

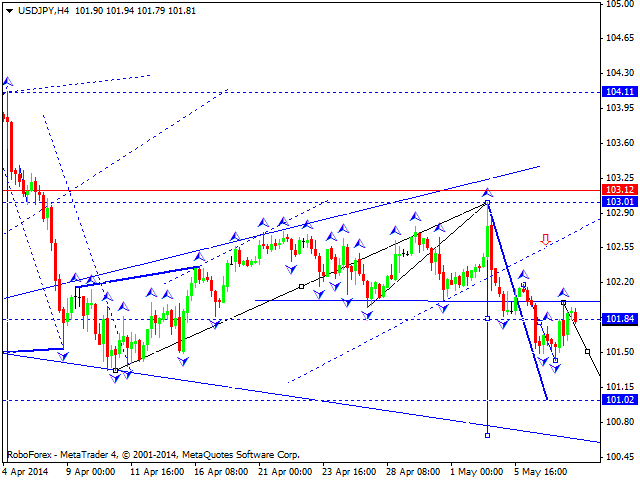

USD JPY, “US Dollar vs Japanese Yen”

Yen formed consolidation channel. We think, today price may continue falling down to reach level of 101.00, start new correction towards level of 102.10 and then form another descending structure towards main target at level of 100.00.

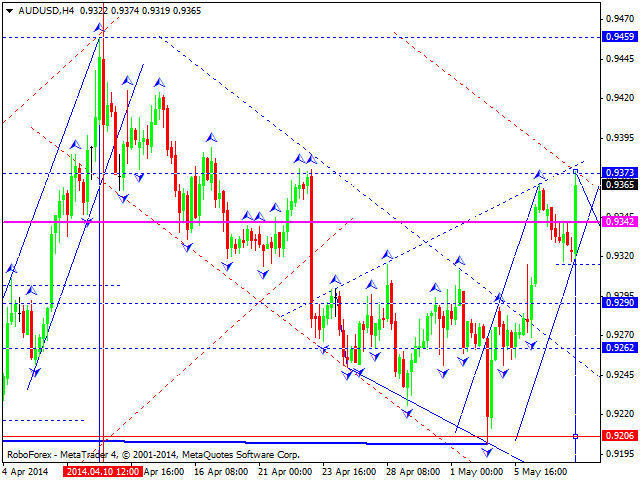

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar completed another ascending structure and broke maximum of current wave. We think, today price may consolidate for a while, form reversal pattern, and then continue moving downwards. Next target is at level of 0.9200.

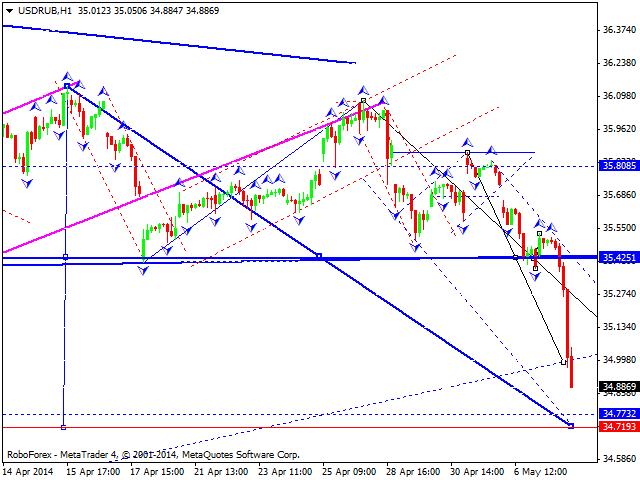

USD RUB, “US Dollar vs Russian Ruble”

Ruble continues falling down. We think, today price may continue falling down towards target at level of 34.80, test level of 35.22 from below, and then complete this descending wave by forming another descending structure to reach level of 34.70. Later, in our opinion, instrument may form new ascending wave towards level of 37.50.

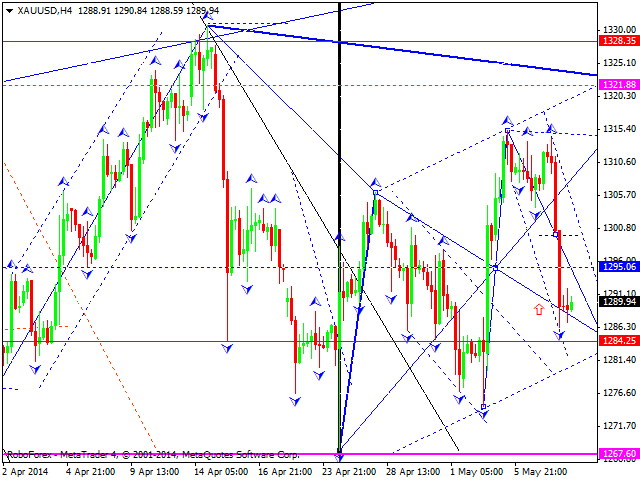

XAU USD, “Gold vs US Dollar”

Gold is being corrected towards level of 1280. We think, today price may complete this correction and then form ascending wave towards level of 1321. Later, in our opinion, instrument may complete this ascending wave and start forming correctional bullish flag pattern with target at level of 1290. After that price may continue growing up towards main target at level of 1435.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.