Analysis for December 26th, 2013

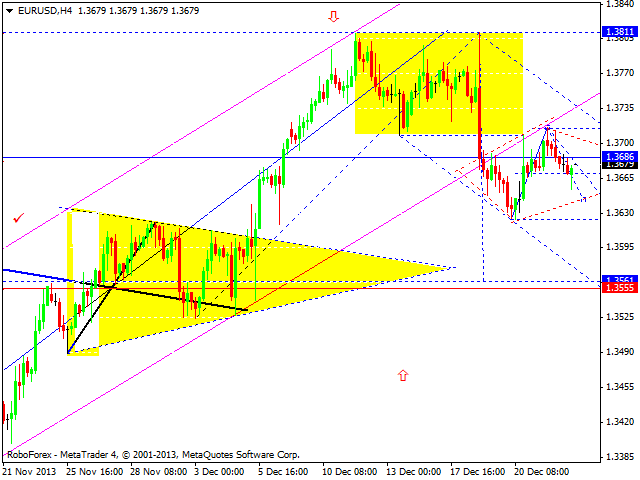

EUR/USD

Euro is still forming consolidation channel, which may be considered as triangle pattern. After the market opening, price may fall down to reach level of 1.3644, return to triangle’s upper border, and then complete this correction by moving downwards and reaching level of 1.3560. Later, in our opinion, instrument may continue growing up with target at 1.4100.

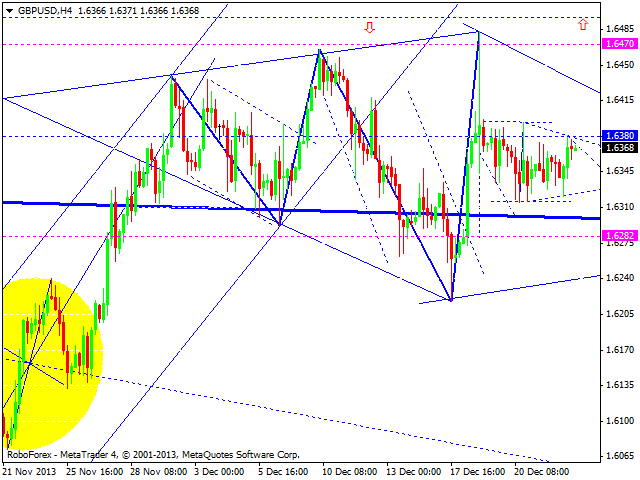

GBP/USD

Pound is still consolidating below 1.6380. After the market opening, price may continue its correction and reach level of 1.6300 (at least). Later, in our opinion, instrument may continue moving upwards to reach predicted target at 1.7150.

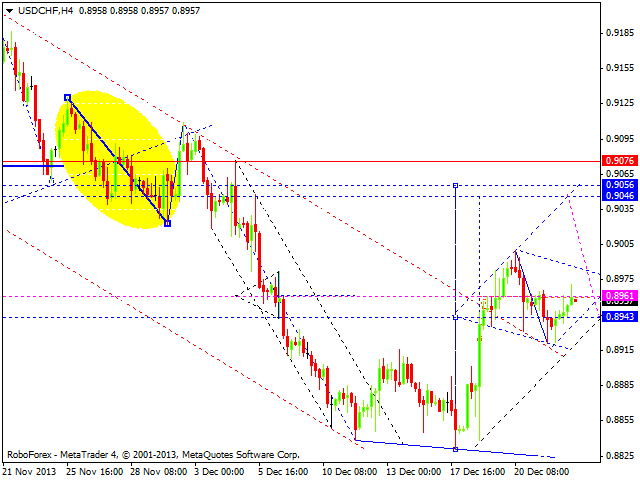

USD/CHF

Franc started forming another ascending structure; right now market is moving inside consolidation pattern. After the market opening, price may reach level of 0.9000 and then fall down towards 0.8960. Later, in our opinion, instrument may complete this correction by reaching level of 0.9060 (at least) and then continue falling down towards 0.8300.

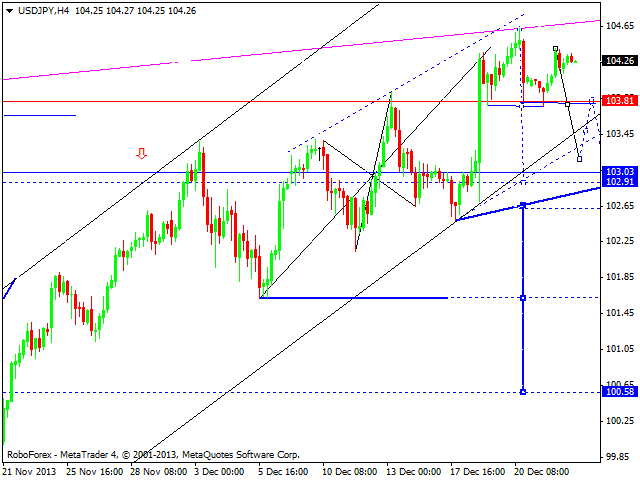

USD/JPY

Yet is still consolidating near its maximums. After the market opening, price may start descending structure towards level of 103.58, return to 104.00, and then continue falling down towards next target at 102.70. Alternative scenario implies that pair may continue growing up to reach new maximums.

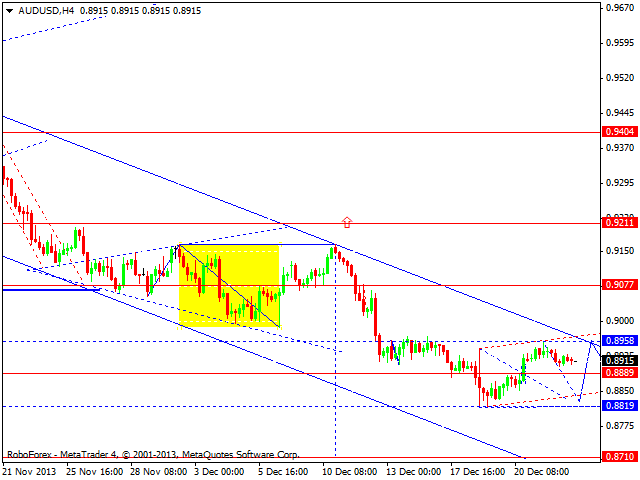

AUD/USD

Australian Dollar is still being corrected towards previous descending movement; structure of this correction implies that price may fall down to reach 0.8840. Later, in our opinion, instrument may complete this correction by forming ascending structure to reach level of 0.8958 and then start moving inside down trend towards 0.8720.

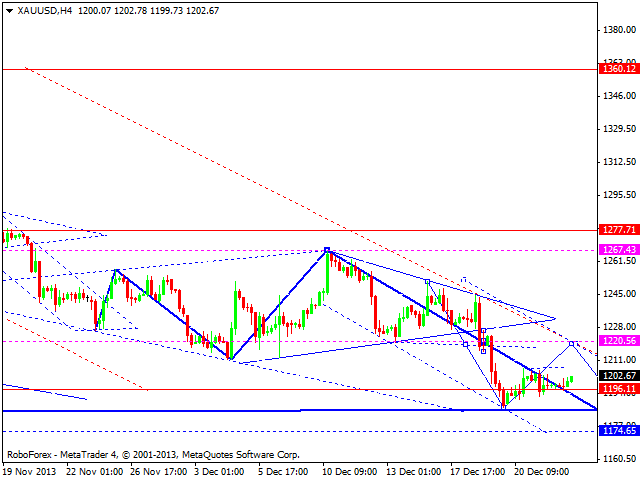

GOLD

Gold is still moving towards level of 1220; after the market opening, price may reach it. This movement may be considered as the fourth wave of another descending structure. Later, in our opinion, instrument may start the fifth wave inside this final structure with target at 1175 and then form reversal pattern for new ascending movement to return to 1360.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.