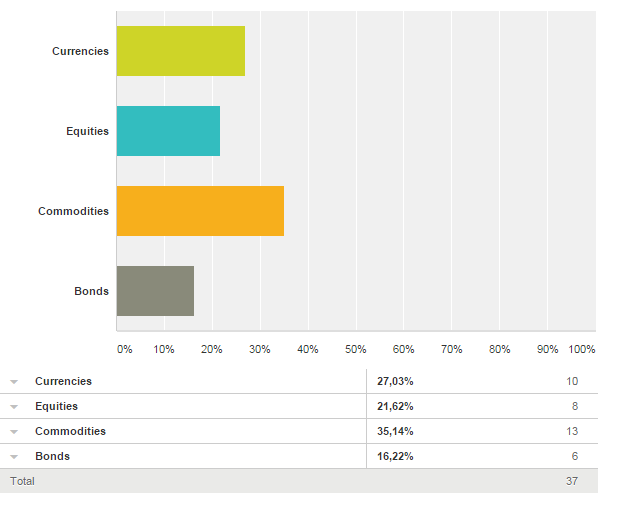

Which of these asset classes do you expect to be the most volatile in 2016?

Commodities get the nod here and no wonder why, looking at the wild ride the oil prices and other hard commodities are experiencing these days. As we saw in the first part of the survey, gold will also be an interesting asset to follow, with its traditional safe-haven nature being tested. Interestingly, bonds are the asset class with less answers, even though they were the most repeated answer by the ten experts we interviewed when asked about the asset class to bring the next financial crisis.

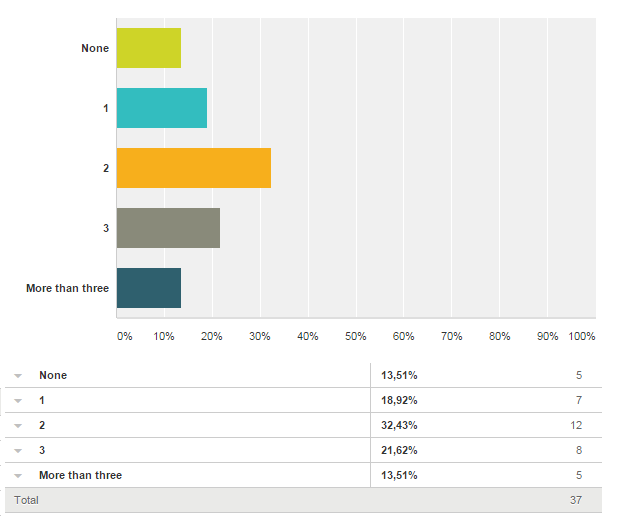

How many interest rate hikes will the Fed deliver in 2016?

This is close-to-perfect symmetry. Our contributors expect on average two rate hikes this year, which is the answer picked by the 32% of them. But there's nothing sure, as the 0 and the >3 rate hike extreme options combine for the significant 26% of the answers and there's no bias favoring neither the doves nor the hawks. Brace yourself for another year of crucial and controversial FOMC decisions on whether to tighten or not.

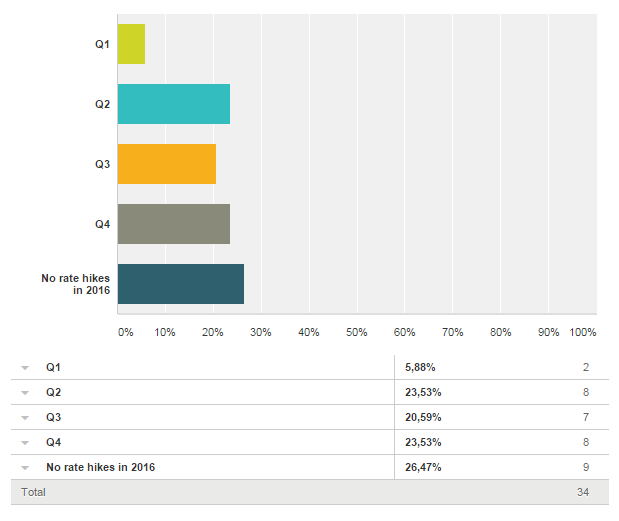

Timing of the first BoE Rate Hike?

Well, here we have a more dovish result. Only two contributors expect a Rate Hike in the first quarter and then the answers are pretty even between the rest of the year and the possibility of not seeing any tightening at all in 2016. This is probably correlated to the moderate bearish bias seen in the GBPUSD average forecast, even if there is another subject that could affect british outlook this year: a potential Brexit referendum.

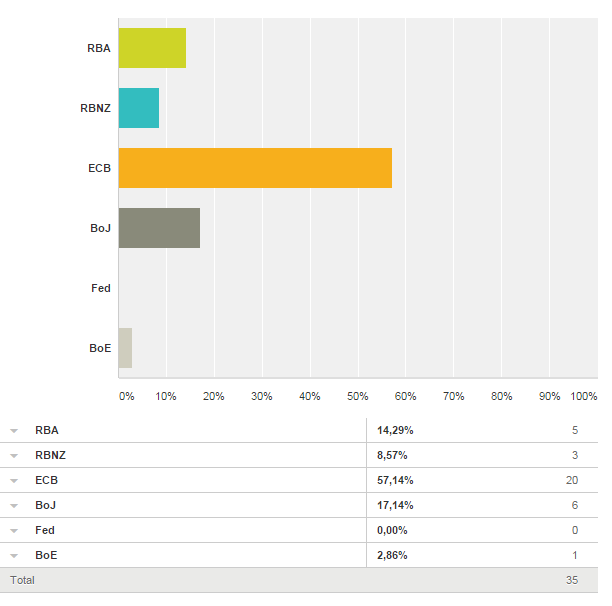

Which central bank is more likely to continue easing?

The results speak by themselves here. The majority of the market expects the ECB to continue leading the quantitative easing battle, so we could infer this is an event the market has (at least partly) priced in and the surprise could arrive is Draghi doesn't deliver. There's also people voting for more BoJ and RBA easing, which are events less priced in and could set interesting trends in several crosses.

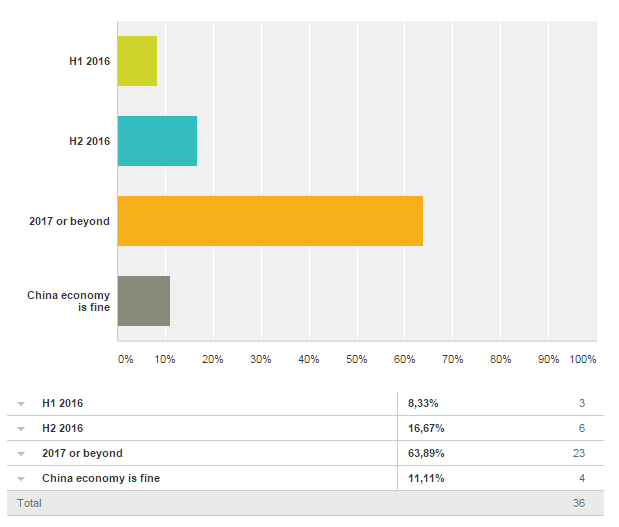

When do you expect China's economy to begin recovering?

After seeing how Chinese markets have started the year, it is no surprising to look at these results. The market doesn't trust China's economy right now and this has huge implications all over the world.

Which emerging market economy is more likely to suffer from a capital outflow in 2016?

Brazil: 11

Turkey: 4

China: 4

Russia: 2

South Africa: 2

Thailand: 1

Ukraine: 1

Nigeria: 1

Saudi Arabia: 1

India: 1

Argentina: 1

Mozambique: 1

This was an open question, but the answers were not that open. Brazil's economy is in trouble, with a recession deepening and the BRL freefalling, and even if facing the Summer Olympics this year, things don't look much better in the near future. It's also noticeable to look at Turkey as another candidacy for a capital outflow this year. Its troubling geopolitical position, along with Erdogan's not very popular government, is not a good combination for another struggling economy.

This survey was conducted between December 16th and 27th of 2015. Answers were submitted in an online form. 48 contributors answered it, including: Marc Nemenoff, Anil Panchal, Larry Arber, Claudiu Cazacu, Scott Barkley, Razvan Mihai, Angelo Airaghi, Haresh Menghani, Eren Sengezer, Abhishek Goenka, Ali Karbalaee, Nikolajs Serikovs, Laith Marmarchi, Omkar Godbole, Yohay Elam, Jesús Fernández, Alfonso Esparza, Ipek Ozkardeskaya, Dan Cook, Ilian Yotov, Matt Weller, Adam Lewandowski, Sebastián Dirazar, Michal Stajniak, Andreas Paciorek, Richard Perry, José Ricaurte Jaén, Georges Batrouni, Christopher Lori, Gonçalo Moreira.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

RBNZ set for another interest rate cut amid trade tariff uncertainty

The Reserve Bank of New Zealand is on track to deliver a 25 basis point cut to the Official Cash Rate, bringing down the key policy rate from 3.75% to 3.50% following its April monetary policy meeting on Wednesday.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.