The Bank of England is going to have its monetary policy meeting this Thursday, but is largely expected to maintain rates and the APP unchanged this month. Focus will therefore turn towards the quarterly inflation report, and the following Minutes of the meeting.

Inflation remains subdued all across Europe, and the United Kingdom is no exception, as according to the latest readings, prices fell by 0.1% year on year in September, for a second time this year. However, wages posted a solid growth during the third quarter, partially neutralizing the negative mood triggered by falling inflation.

The inflation report is expected to reckon that near-term inflation will remain depressed, but markets still believe the Central Bank is getting ready to raise its rates during the first half of 2016. Also, investors will be watching closely how the MPC votes as so far only one of the nine voting members has pledged for a tighter policy.

Governor Mark Carney has anticipated that he will be giving clear clues on when the Central Bank will decide to change its economic policy before the year end, but being realistic, the BOE will likely refrain from establishing a date, and here is why: low inflation is also being accompanied by a relatively high value of the local currency. Speculative buying, should they pull the trigger, should made its currency even more expensive, which will affect consumption and therefore send inflation even lower.

Pretty much, Carney is expected to do as Draghi from the ECB: let the US Federal Reserve do the dirty work first, triggering a strong dollar rally, and therefore preventing the Pound from appreciating too much when they finally begin tightening their economic policy. And given that the FED has not provided a clear date for a rate hike, despite the hawkish tone from October statement that opened the doors for a move in December, the most likely scenario is a vague wording from the BOE regarding a certain date.

Effects on the GBP/USD

Nevertheless, if officers remain confident on the future, acknowledge the latest strong manufacturing data, and don't express concerns over inflation, the Pound can get a nice intraday boost. Gains however can be limited after the initial spike, as investors will likely enter in wait-and-see mode ahead of the US Nonfarm Payroll report to be released early Friday.

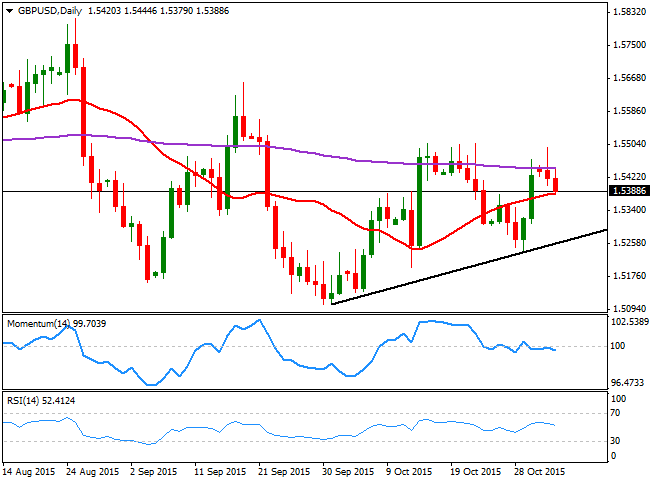

Technically speaking, the GBP/USD pair presents a pretty neutral stance daily basis, given that the pair has been stuck below the 1.5500 level ever since late September, but buying interest increases on dips. In the same chart, the pair presents higher lows in the same period, whilst the price struggles around a bullish 20 SMA ahead of the Super Thursday.

A dovish surprise from the BOE may see the pair declining towards the 1.5250 level, a strong mid-term support, as it will highlight the imbalance between both Central Banks, albeit further declines don't seem likely. Shorter term, the immediate target comes at the 1.5300 level post-release. Yet if the Bank of England comes with a strong hawkish stance, the GBP/USD pair can rally back to 1.5500, although will hardly extend beyond it, at least on Thursday, and ahead of the US employment report.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.