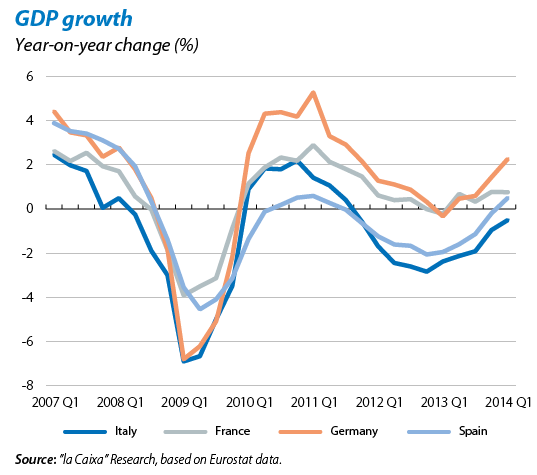

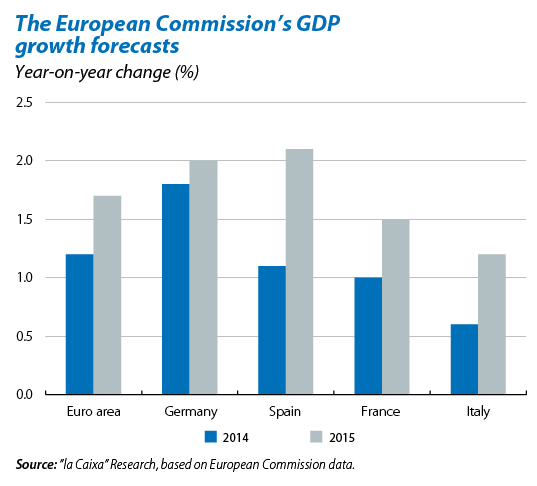

Gaps widen between the euro area's main economies. GDP for the euro area grew in 2014 Q1 by 0.2% quarter-on-quarter although there are notable differences between countries. Germany's surprising GDP growth particularly stood out, 0.8% up on the previous quarter, as well as Spain, which grew by 0.4%, showing certain solidity in its economic recovery. At the other end of the scale are France and Italy, which once again posted worse figures than expected, with zero growth for the French and continued contraction for the Italians (–0.1% quarter-on-quarter). These results fuel doubts as to the growth capacity of these two countries in the medium term and scepticism regarding the structural reforms implemented and those still pending in order to revive growth in their respective economies. This trend has also been noted by the European Commission (EC) in its spring report and clearly different growth rates between the countries of the euro area can be detected in its forecasts for 2014 and 2015. With a view to 2014, Spain will grow at a similar rate to France but ahead of Italy, while Spain is already expected to grow more than these two economies in 2015, at a level close to that of Germany.

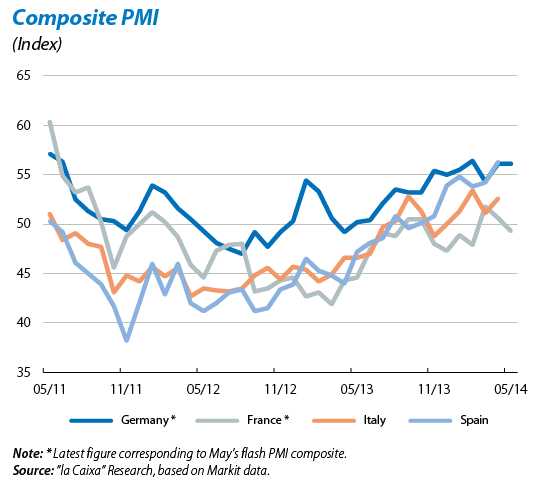

Business and confidence indicators for Q2 also point to a recovery with significant differences between countries. The composite PMI remained above 50 points both in Germany and Spain, around 56 points, specifically. Italy is lagging behind somewhat with 52.6 points. In France, however, the PMI was once again below the threshold of 50 points, the figure as from which negative growth is usually recorded. The economic sentiment index produced by the EC provides a very similar scenario with notable advances for the euro area as a whole and Spain and Germany in particular, while in France this index falls for the fourth consecutive month. If these differences between the two main economies of the region continue or even widen, it could lead to tensions in the coming quarters for key aspects of EU economic policy.

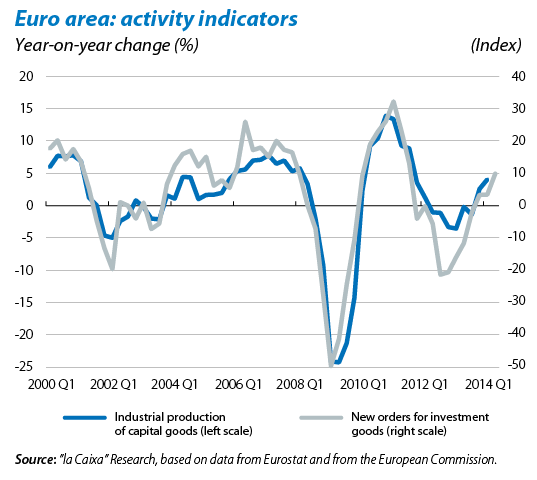

Investment is a key factor in the recovery. In the euro area as a whole, investment has spent the last three quarters posting positive quarter-on-quarter growth figures although it actually started to pick up in 2013 Q4 with a rise of 1.0%. Several leading indicators such as the industrial production of investment goods and new orders for these goods suggest that this upward trend held steady in 2014 Q1 and will continue to gain ground in the short and medium term. The EC expects notable improvement for the whole year and for 2015, of 2.3% and 4.2% year-on-year, respectively. The improved confidence of different agents, less uncertainty regarding the sovereign debt crisis and gradual normalisation of credit conditions are the main factors supporting the EC's predictions, although it also acknowledges that numerous risk factors still remain.

The improvement in household consumption is increasingly convincing. Like investment, household consumption started to record positive growth in 2013 Q2. However, unlike investment, this recovery in consumption was very modest until 2013 Q4 (latest figure available), with its growth rate barely reaching 0.1% quarter-on-quarter on average. Nevertheless, the latest leading indicators point to a possible acceleration in this rate. One clear example are retail sales which posted 1.3% growth year-on-year in March, thereby consolidating a clearly upward trend. On the whole, domestic demand therefore seems to be building up steam and the euro area's sources of growth are rebalancing after a recovery that had been overly dependent on the foreign sector.

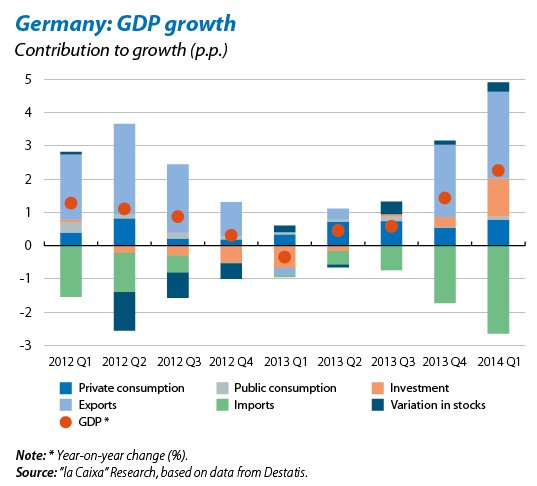

The German economy continues to lead Europe's economic recovery. The aforementioned situation for the euro area as a whole, namely growth in domestic demand in general and investment in particular, are particularly notable in the German economy, which has provided its detailed GDP figures for 2014 Q1. The rate of growth in GDP reached 2.3% year-on-year and investment and household consumption grew by 6.6% and 1.4%, respectively. More dynamic domestic demand led to an upswing in imports, to the extent that the foreign sector's contribution to growth was zero. This is particularly relevant in the case of the German economy as, to date, the foreign sector had been the driving force behind its GDP growth. The latest high frequency indicators, which have been very positive in general, together with the good growth figures for 2014 Q1, are likely to result in the growth forecast for the German economy being revised upwards in 2014, which the consensus of analysts has currently placed at 1.9%.

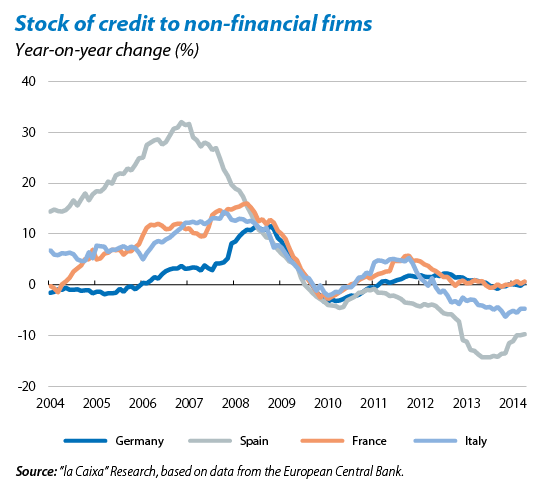

The euro area still needs to reactivate credit. The state of sovereign and corporate debt has notably improved over the last few months but bank credit has hardly progressed and there is still a great deal of fragmentation between the core and periphery countries. To a greater or lesser degree depending on the country, both supply and demand factors can be seen to be hindering the flow of credit. In spite of the incipient economic recovery, demand's credit capacity is still affected by the delicate situation many firms and households find themselves in. Although the outlook has improved considerably, the deleveraging that many of these must carry out means that the recovery in demand's credit capacity is particularly slow. The conditions for credit supply are hardly optimal either. The uncertainty surrounding the launch of the Single Supervisory Mechanism and especially details regarding the stress tests and AQR that European banks must pass mean that they are still extremely cautious in granting loans.

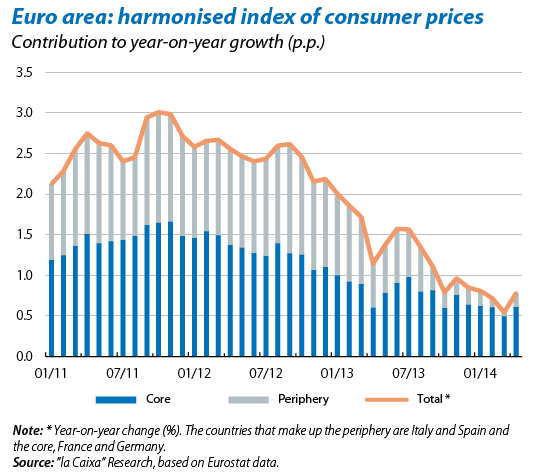

Low inflation continues to pressurise the ECB. Far from embarking on an upward trend, the risk that inflation will remain at its current level or fall even further has increased. In April the year-on-year rate of change for the harmonised CPI stood at 0.7%, 0.2 percentage points above March's figure. However, this is likely to fall again in May as the figures for Spain and Italy, which have already been announced, have unexpectedly fallen. These low inflation rates have been occurring since the end of 2013 and are due both to domestic factors such as a large amount of surplus production capacity and wage adjustments in many periphery countries, as well as external factors such as relatively stable oil prices and the appreciation of the euro which is also pushing down inflation (see the Focus «The effects of the euro's appreciation» in this Monthly Report). Consequently, for months now all eyes have been on the ECB.

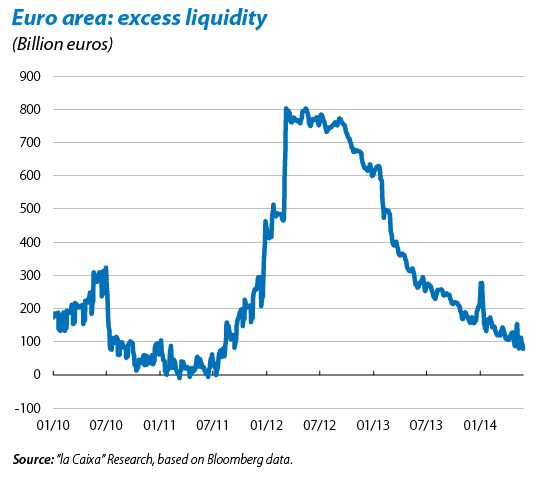

The ECB, moving towards another round of monetary stimuli. The euro area's leading monetary institution is still concerned about inflation remaining abnormally low and points to the slowness in the recovery of credit as one of the main reasons for this situation. That is why, for the last few months, Mario Draghi has been modifying the tone of his statements in his public appearances, increasingly stressing the different tools available to the ECB and, especially, his willingness to deploy them. Having reached this point, the great challenge now facing the ECB is to carefully handle the expectations, created by itself, that are keeping yields on public and corporate debt at extremely low levels. As the ECB noted in its last Financial Stability Review, these levels are extremely fragile and could suddenly rise if there are any changes in the global risk appetite or if the expectations created are disappointed. A delicate balance that the ECB must pay a lot of attention to over the coming months.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.