Renewed Risks for Eurozone's Inflation; Deutsche Bank Announced €6.2B Q3 Loss

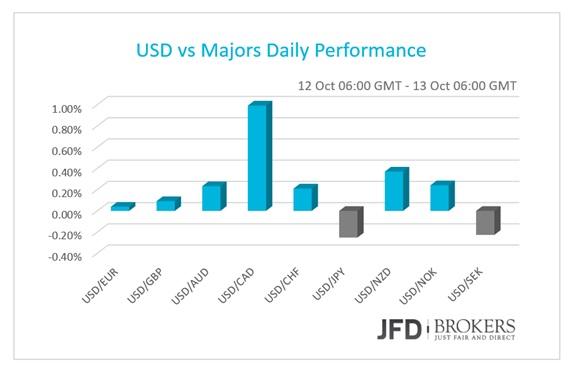

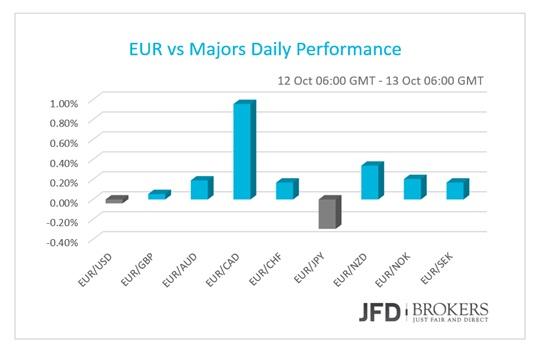

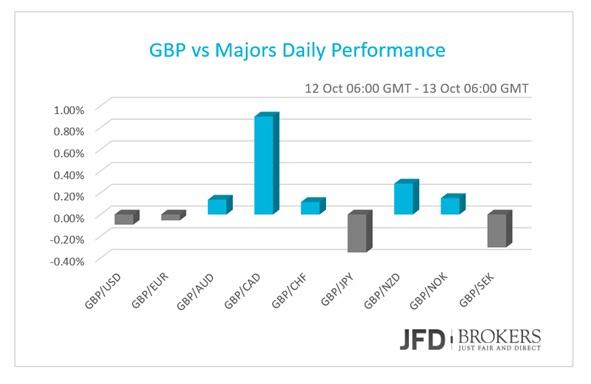

The volatility was thin in the market yesterday, in the absence of market-driving news in the macroeconomic front, however, the most volatile major currency was the Canadian dollar which plunged following the BoC Governor speech. Euro Area face renews deflationary risks according to a CB policymaker while UK's September's final inflation is expected to come out zero.

Euro Area: Inflation and Growth Risks to the downside renewed

The shared currency was traded marginally higher against the other G10 currencies on Monday and early Thursday with significant gains against the Canadian dollar. The only economic indicator released from Eurozone, yesterday was the Spanish inflation rate which came out 0.8% in September, on a monthly basis, well above the deflation figure of August. CB policymaker Yves Mersch said that inflation rate in the Euro Area would take more than initially expected to pick up and reach central bank’s 2% target. The downside risks for inflation and economic growth renewed. The reasons for that are the growth in emerging economies that slows down, the strong euro and the drop in commodity prices. In addition, he said again that ECB is ready to act if needed, a statement the ECB President repeats in his last press conferences.

Monday was a very quiet day in terms of scheduled data releases from the U.S., as well as from Europe. Nothing changed to the EUR/USD pair as it remained trapped in a tight range, roughly around the 1.1350 area. The pair managed to remain above both the 50-SMA and the 200-SMA on the 1-hour and 4-hour charts, while the 50-SMA crossed above the 200-SMA on the 4-hour and daily charts, highlighting the fact that the bias in the short-term has changed to bullish. If last week’s buying pressure continues, I expect the pair to challenge the psychological level of 1.1400. A decisive break above the latter level will then concentrate our focus to the 1.1460 barrier. The MACD oscillator is moving above its trigger and zero lines suggesting that the bears have lost some momentum while the RSI moved above 50 indicating that the trend’s momentum is gaining momentum.

GBP Traders Closely Eye Inflation Rate

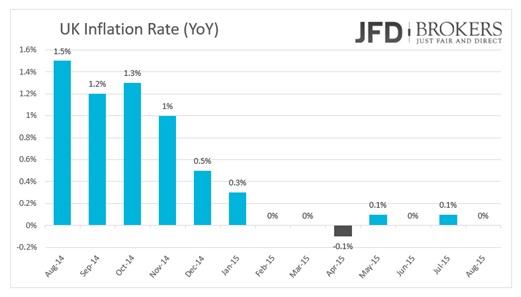

The pound was also traded virtually unchanged versus the G10 currencies in absence of any significant market news. The only update for the UK economy was the Conference Board Leading Economic Index that rose by 0.2% in September, healthier than the previous month deceleration by -0.3%. The GBP traders today, are looking forward to September’s final inflation rate.

GBP/USD moved quietly during yesterday’s session maintaining its gains against the dollar after it rebounded from the 1.5100 level. The pair is trading in a tight range between the 1.5300 and 1.5380 level with the 50-SMA pointing downwards ready to test the 200-SMA on the daily chart. In addition, both of the moving averages are ready to provide a significant resistance to the price action near the 1.5380 level. On the downside, support is possible around the 1.5260, with a close below possibly indicating that the October move higher was just a retracement of the major downtrend.

USD/CAD continues to post gains!

The USD/CAD continues to move higher for the second consecutive day, holding steady at the highest levels in three days. For the time being the pair is finding support at the psychological level of 1.2900, temporary at least. This downward move from 1.3450 to 1.2900 can be translated as a retracement on the daily chart as well as a technical correction of the trend in the medium-term. A breakout above 1.3200 may negate any bullish outlook, and signal the resumption of the overall bullish trend, targeting the latest major swing high at 1.3315. On the other hand, a decisive break below the key support level of 1.2900, could give further strength to the bears and may drive the battle towards the daily 200-SMA, around 1.2750.

USD/JPY – Technical Outlook

The USD/JPY pair is still traded in a perfect triangle pattern that has not been completed by a breakout. For the moment, we expect the prices to be traded in a tight range between the key support level of 118.50 and the 121.75 barrier. Both the MACD and the Momentum lie near their neutral levels confirming the validity of the formation, while the stochastic is moving near the 50 level, reaffirming the disagreement between investors. I would be fairly neutral on any directional move.

Gold – Technical Outlook

The precious metal is continuing to edge higher the last couple of days, however the area around $1,170 is likely to prove problematic, since the daily 200-SMA, as well as the weekly 50-SMA, are providing a significant resistance to the metal. If we see a pullback in the next few hours, the yellow metal should find support around the $1,142, where the 50-SMA will possible provide some support to the bulls. But so long as the gold remains above the aforementioned obstacles and also above the daily 50-SMA then I expect further gains, with the next targeting being the psychological and historical $1,200 level.

UK Brent Crude oil – Technical Outlook

UK Brent Crude oil has sold off heavily, closing the day negative at 6.17%, following the break above the psychological level of $50 during yesterday’s session. The bounce-off the $42.20 area and more recently from the $47.00, was a clear sign that momentum remains with the buyers, at least for the short-term. It is very significant that the commodity remains above $50.00, for the time. A move back below $47.00 is needed to invalidate the bullish outlook while a break above $54.20 will confirm the bull’s dominance.

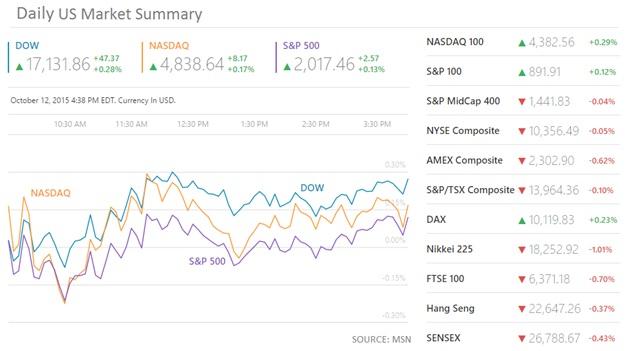

U.S. Indices marginally higher ahead of major earnings reports

The three most popular U.S. indices closed Monday’s trading session slightly higher ahead of major earnings reports like Intel Corp (NASDAQ : INTC, 32.21), JPMorgan Chase & Co. (NYSE: JPM, 61.71) and Johnson & Johnson (NYSE: JNJ, 96.01).

During the day, the indices plunged into negative territory and rose back several times. The Dow Jones posted +0.28% gains, the seventh winning daily session in a row with UnitedHealth Group Inc. (NYSE: UNH) the top winner stock with more than 2.7% gains added at its value. Nasdaq Composite index rose by +0.17% while the S&P500 picked up just by +0.13%.

The S&P500 had another choppy session pretty much confined to the recent range and there is no change in view. The index has been firmly capped below 4500 since August, having made several failed attempts at breaching that critical level. On the daily chart, the 200-SMA is continuing to provide resistance to the index below the key resistance level of 4500. On the weekly chart, the index has made 2 consecutive winning weeks following the strong rebound from the 3900 and 4060 areas. On the same timeframe, both the MACD and the RSI, even though in negative territory, are both ready to step in the bullish area. If that occur in the next couple of days then I would expect the index to regain the critical level of 4500.

Deutsche Bank posted record losses of €6.0bn for Q3

Deutsche Bank has posted a record quarterly pre-tax net loss around €6.0bn for Q3. The Co-Chief executive of the bank announced a clean-up plan with sharp decrease in the employees, decrease in the dividend payments and also cuts on staff bonuses.

Shares in Deutsche Bank AG (ETR: DBK) the German giant bank, fell to 25.75 during yesterday’s session, retracing some of its gains made on Friday’s trading session. The DBK’s shares suffered a sell-off in August and September, as it plunged more than 17% and 8%, respectively. In the first 2 weeks of October the company’s shares regained some ground as it has been traded 6.95% so far.

The bulls found a strong support near the psychological level of 23.00 and more recently at the 24.57, where they manage to lift the price above the key level of 25.00.

As it stands, the share price is currently struggling to break above some significant resistance levels, including the psychological level of 27.00, as well as the 50-SMA on the daily chart. Slightly above the 28.00 area, also the 200-SMA is ready to provide a significant resistance to the price action.

Bearing the above in mind, if we see a close above the aforementioned obstacles then we could see a bigger retracement, prompting a more aggressive move towards the 29.45 – 29.80. On the other hand, the stock will only continue to be bearish, in such an oversold environment, when we should see a break below the 24.57, as well as a fail attempt above the 26.65 – 27.00. Furthermore, the higher time-frames indicate there is a possibility that this could occur.

Economic Indicators

In the morning, Germany’s and Sweden’s final Inflation rate for September will be printed. Later in the morning, British inflation rate is expected to show that consuming prices remained unchanged in September, which means zero inflation rate. Alongside, other indicators like retail price index, producer price index and BoE credit conditions survey will be out.

A while later, the ZEW Survey will inform us for October’s Economic Sentiment and Current Situation in Germany as well as Economic Sentiment in Eurozone. All of the three numbers from ZEW are forecasted that will be dropped, indicating a less optimistic outlook. Going to U.S., the monthly budget statement for September will be eyed. It is anticipated to have grown to $95.0B from $-64.4B before. Later in the afternoon, attention will turn to New Zealand, where the RBNZ Governor Wheeler will give a speech. In Australia, the Westpac consumer confidence for October will be out.

Overnight, Japan will release its inflation rate for domestic corporate goods followed from China’s final inflation rated for September.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.