The volatility in the financial markets, decline in commodity prices and weakness in parts of the U.S. economy is beginning to shake the Fed's confidence. U.S. policymakers are growing worried and are starting to prepare the market for the chance of no rate hike in March. While his comments diverge with the more relaxed attitude of FOMC voter George who said earlier this week that the recent market volatility is not "necessarily worrisome" or Vice Chair Fischer who sounded more noncommittal. He said the Fed doesn't know what the impact of volatility is on the U.S. economy at this point because while inflation will likely remain low for somewhat longer, similar volatility in the past left little imprint. The bottom line is that everyone is somewhat worried and are watching the financial markets closely. So at this stage the bar has increased for non-farm payrolls and the March FOMC meeting.

After today's moves the near term outlook for the dollar isn't bright. The employment component of the non-manufacturing ISM index, which is one of our favorite leading indicators for non-farm payrolls dropped to a 1 year low and the last time payrolls dropped this much was in January 2015 and that month non-farm payrolls growth slowed to 201k from 329k. Weaker job growth is certainly expected after last month's strong rise but if softer payrolls is combined with lower wage growth then the dollar is really in trouble. However after such a strong move, a relief rally is not unusual and expected especially ahead of such an important event risk such as non-farm payrolls. USD/JPY completely erased its BoJ gains and now appears poised for a move towards 116.

The decline in the dollar today also drove commodity prices sharply higher. Oil shot up close to 6% despite a massive buildup in oil inventories. According to the Energy Information Administration, crude inventories rose by 7.8 million barrels, significantly more than the market's 4.8 million forecast. Normally this would be very negative for oil prices and the Canadian dollar but because oil is priced in dollars, the commodity and the currency enjoyed strong gains. However once the dust settles, we believe oil traders will wake up to the change in inventories and the prospect of additional Iran output and send oil prices lower. In the meantime, watch how USD/CAD trades around 1.3800, because it is a very important support level for the pair.

The 2% rally in the Euro was nothing more than a function of U.S. dollar weakness because the latest economic reports were right in line with expectations. Today's move has taken EUR/USD above the 200-day SMA and there's no major resistance until 1.12.

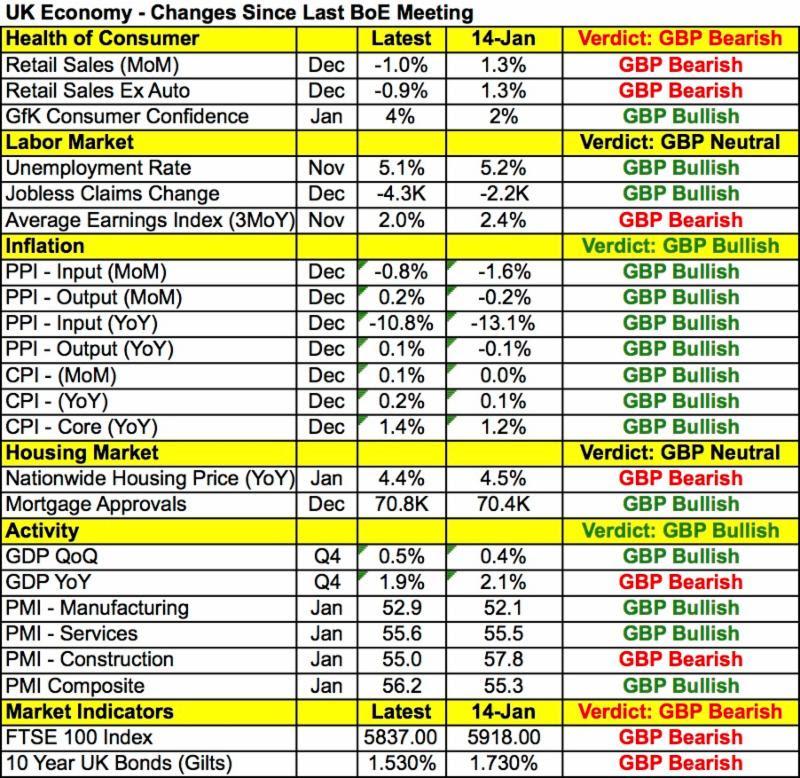

Sterling on the other hand enjoyed strong gains on the back of better than expected economic data. Service sector activity accelerated in the month of January and when combined with the rise in the manufacturing PMI index, lifted the overall composite index higher. This is important going into tomorrow's Bank of England meeting and Quarterly inflation report. Taking a look at the table below, there's actually been a lot more improvement than deterioration in the U.K. economy since the last monetary policy meeting. Aside from the PMIs, inflation also increased, the unemployment rate declined and consumer confidence ticked higher. On the basis of data alone, the BoE has no reasons to grow more dovish but earlier this month Bank of England Governor Carney expressed concerns about inflation and growth and his sentiment could be reflected in the Quarterly Inflation Report. This report also looks back beyond 1 month and if we take a 3 month perspective, conditions have certainly weakened and lower forecasts are necessary. This makes tomorrow's rate decision difficult to forecast and best traded reactively.

Finally the best performing currency today was the New Zealand dollar, which soared close to 3% versus the greenback. Despite the sharp drop in dairy prices, New Zealand's employment report blew out expectations with the jobless rate dropping to 5.3% from 6%. Economists were looking for an increase and the decline caught everyone by surprise. There was underlying weakness with the participation rate falling and wage growth slowing but NZD managed to shrug off the weakness because while RBNZ Governor Wheeler warned that rates could be lowered further he was not as dovish as the market anticipated following recent dairy auctions. The Australian dollar also rose strongly versus the greenback on the back of stronger service sector activity, jump in building approvals and better than expected Chinese data.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.