The results of the early parliamentary elections in Greece

Who will carry out the Greek reforms which the government of former Prime Minister Alexis Tsipras, who resigned after part of his party stood against the austerity measures, committed to in exchange for provision of a third rescue package? Greeks made the decision in early parliamentary elections, which were held on 20 September.

Pre-election forecasts gave similar chances to the leftist Syriza and the center-right New Democracy parties. It was therefore clear that ultimately the most important thing wouldn’t be who won the election formally, but who could put together a viable coalition capable of implementing the necessary reforms.

Third place was attributed in advance to the neo-Nazi Golden Dawn party. Other parties expected to gain seats in the Parliament were the socialist Pasok party, the centrist party Potami, and also the extreme left-wing Popular Unity party, which split off from Syriza, and the Independent Greeks, who were part of the coalition in Tsipras‘ government.

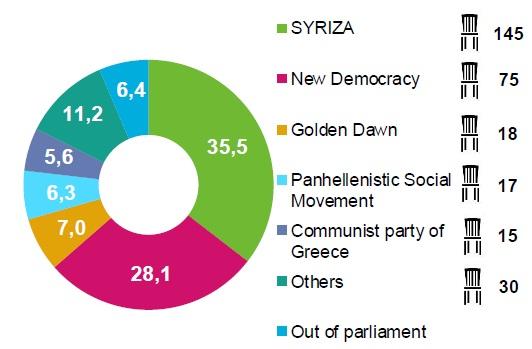

And the results? The following morning confirmed the victory of Syriza. Alexis Tsipras won with a fairly large margin of almost seven per cent - the count showed that he won 35.46% of votes, while the conservative New Democracy party only obtained 28.10%.

Parliamentary elections in Greece (v %)

The neo-Nazi party Golden Dawn finished in third place winning 6.99% of the votes cast. The socialist party Pasok received 6.28% and the Greek Communist Party got 5.55%.

The right-wing party Independent Greeks, with which Syriza is likely to again form a coalition, received 3.69% of the votes for Parliament. Together they will have a majority of three hundred parliamentary seats (145 + 75).

The centrist party Potami also advanced and the centrist union, Popular Unity, which split off from Syriza before the elections, remained below the three percent threshold to enter parliament. There was not much interest in the election itself. Only 56.57% of eligible voters participated in it, which is less than in January, when voter turnout reached 63.6%.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains need to clear 0.6400

AUD/USD rose for the third day in a row, approaching the key 0.6400 resistance on the back of the acute pullback in the US Dollar amid mounting recession concerns and global trade war fear.

EUR/USD: Powell and the NFP will put the rally to the test

EUR/USD gathered extra steam and advanced to multi-month peaks near 1.1150, although the move fizzled out somewhat as the NA session drew to a close on Thursday.

Gold looks offered near $3,100

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day".

Interoperability protocol hyperlane reveals airdrop details

The team behind interoperability protocol Hyperlane shared their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal provided by the Hyperlane Foundation by April 13, the team shared in a press release with CoinDesk.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.