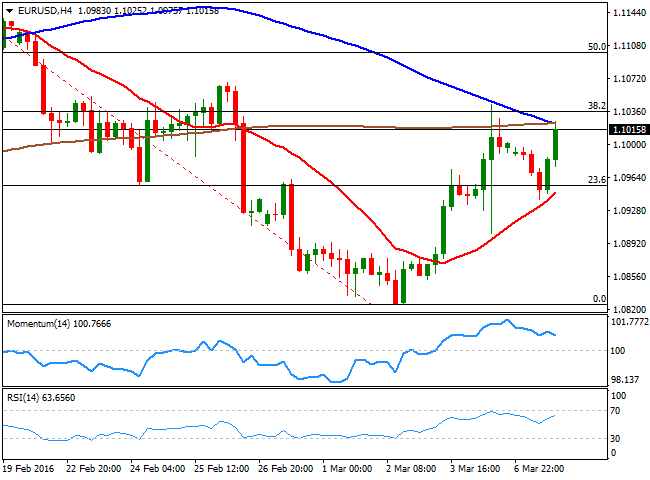

EUR/USD Current Price: 1.1013

View Live Chart for the EUR/USD

The American dollar posted a tepid advance during the first half of the day, but investors decided to re-sell the currency at better levels, sending it into negative territory in the American afternoon all across the board. Soaring oil's prices were behind dollar's weakness, with Brent surpassing $40.00 a barrel and WTI futures flirting with $38.00 a barrel, the highest since January 4th. The common currency found little support in local data, as the EU Sentix confidence index fell to 5.5 against previous 8.0 for March, while German Factory Orders edged 0.1% lower, above the -0.5% expected, but the second monthly decline in-a-row, indicating the economic slowdown is reaching the European largest economy.

Most major currencies rallied past Friday's highs against the greenback, but the EUR/USD pair barely advanced beyond the 1.1000 figure, ahead of the ECB's upcoming economic policy decision next Thursday. The Central Bank is expected to cut the deposit rate further lower into negative territory, although investors are also cautious on the probability of the announcement of additional measures.

The pair fell down to 1.0939 before trimming losses, and the 4 hours chart shows that a bullish 20 SMA provided a strong intraday dynamic support. Nevertheless, the pair remains below it’s the 38.2% retracement of its latest daily slump in the 1.1040 region, also Friday's high and the level to break to confirm further gains. The technical indicators in the mentioned time frame hold in positive territory, but lack clear directional strength, suggesting the pair may continue trading within its recent range during the upcoming sessions.

Support levels: 1.0980 1.0950 1.0920

Resistance levels: 1.1045 1.1080 1.1120

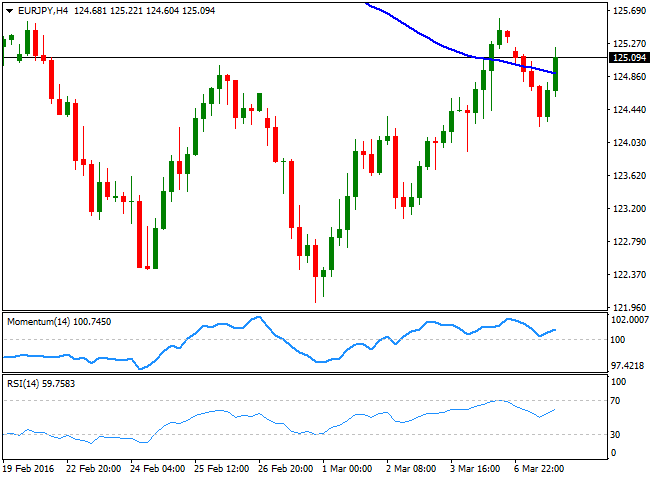

EUR/JPY Current price: 125.08

View Live Chart for the EUR/JPY

The EUR/JPY pair fell down to 124.23 this Monday, with the yen firmer during Asian trading hours amid some comments from BOJ's Governor Kuroda, suggesting the Central Bank will refrain from adding more easing in the forthcoming meetings. The advance, however, was limited by improved market sentiment, and the EUR/JPY changed course on EUR's demand. The short term picture for the pair is mild bullish, as in the 1 hour chart the price has recovered after approaching a bullish 100 SMA, currently at 124.25, whilst the technical indicators advanced beyond their mid-lines, albeit are now turning lower, suggesting limited buying interest around the current level. In the 4 hours chart, the technical bias is bullish, but also limited, as the price struggles to hold above a mild bearish 100 SMA, whilst the technical indicators head north, having bounced from their mid-lines. Friday's high at 125.60 is the immediate resistance level, yet it will take a break beyond 126.00, to offer a more constructive outlook for this week.

Support levels: 124.90 124.40 124.00

Resistance levels: 125.60 126.00 126.55

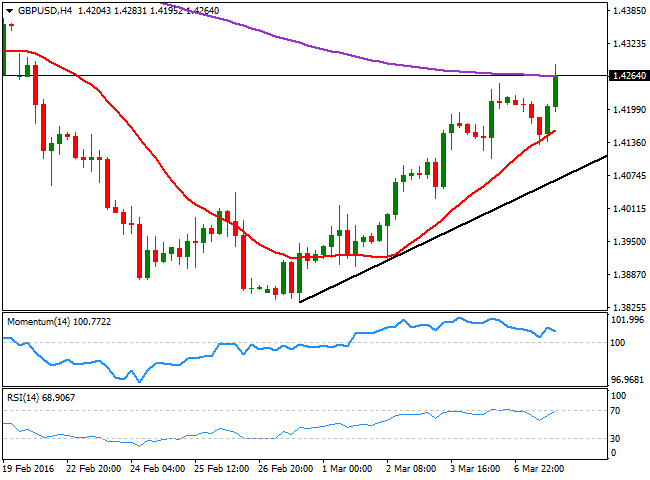

GBP/USD Current price: 1.4263

View Live Chart for the GBP/USD

The British Pound surged to a fresh 2-week high of 1.4283 against the greenback, helped by news that the Bank of England is ready to offer extra liquidity around the time of the Brexit referendum. The Central Bank said it will closely monitor market conditions, and that it will add three extra indexes LTRO's by the ends of June. Adding to dollar's broad weakness, the news brought some relief to those expecting a plummeting Pound, should the kingdom leave the EU. Anyway, and from a technical point of view, the pair advanced for sixth day in-a-row, with a daily close above 1.4250 suggesting an interim bottom has taken place. The price is now aiming to fill the weekly opening gap left last February 21st, at 1.4356, the next probable bullish target on a break above 1.4300. The 4 hours chart, shows that the rally stalled around its 200 EMA, but an early slide met buying interest around a bullish 20 SMA, currently around 1.4160. In the same chart, the RSI indicator heads north around 69, also supporting the ongoing bullish bias, although the Momentum indicator has lack its previous bullish slope, and turned slightly lower within bullish territory, suggesting some consolidation before next leg north.

Support levels: 1.4260 1.4215 1.4160

Resistance levels: 1.4290 1.4330 1.4360

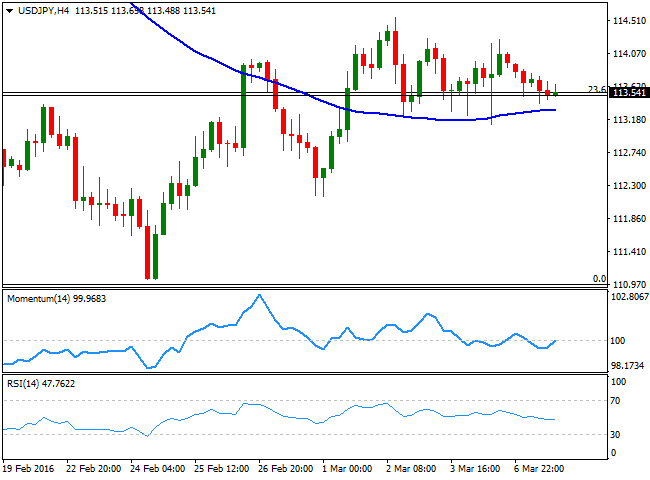

USD/JPY Current price: 113.54

View Live Chart for the USD/JPY

The USD/JPY pair trades lifeless around the 113.50 region, the 23.6% retracement of the latest daily slump between 121.68 and 110.97, but with the bears still on the drivers' seat. Early Monday, BOJ's Governor Kuroda said that the Central Bank will asset the effects of negative interest rates, suggesting no additional measures are currently planned, whilst maintaining his optimistic outlook for the country's economic outlook. The news helped the Yen rallying during Asian trading hours, but there was no follow through after Wall Street's opening, amid surging stocks and commodity. The short term outlook keeps favoring the downside, as the price in the 1 hour chart is currently developing below its 100 SMA, whilst the technical indicators in the same time frame have been unable to advance beyond their mid-lines, and are currently resuming their declines. In the 4 hours chart, the pair presents a neutral stance, with the price a handful of pips above a horizontal 100 SMA, and the Momentum indicator hovering around its 100 level. The RSI indicator however, keeps heading south around 46, supporting additional declines on a slide below the 113.10 level, the immediate support.

Support levels: 113.10 112.70 112.35

Resistance levels: 113.80 114.25 114.60

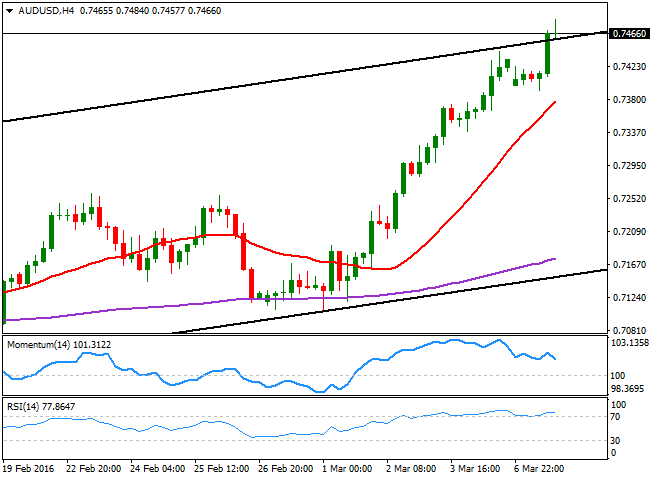

AUD/USD Current price: 0.7465

View Live Chart for the AUD/USD

The Australian dollar retains its latest strength, having advanced against the greenback to a fresh year high of 0.7483, boosted by sharp commodities' gains. Oil was not alone in its advance this Monday, as iron ore prices rose 18.6%, its biggest ever one-day increase. Australia is the world's second largest producer of iron ore, and the Aussie usually gets benefited by soaring mining resources. But it's also well known that the largest consumer is China, and this last, will announce its trading figures for February during the upcoming Asian session, which means that if the outcome is negative, the AUD may give back its gains. In the meantime, the pair has broken above its daily ascendant channel, indicating an increasing upward momentum that should keep the pair running beyond the 0.7500 region. Short term, the 1 hour chart shows that the technical indicators are giving signs of exhaustion in overbought territory, but that the price is well above a bullish 20 SMA. In the 4 hours chart, the 20 SMA has advanced up to the 0.7380 region, maintaining a strong bullish slope, whilst the RSI indicator consolidates around 78 and the Momentum indicator continues to draw a bearish divergence, heading south within bullish territory, yet to be confirmed.

Support levels: 0.7445 0.7410 0.7380

Resistance levels: 0.7490 0.7530 0.7585

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains offered around 1.1380

The EUR/USD maintains its bearish tone on Tuesday, presently lingering around the 1.1380 zone amid the persistent buying pressure on the US Dollar. The improved sentiment in the Greenback comes amid rising US yields and mixed US data results from JOLTs and US Factory Orders.

GBP/USD treads water in the low-1.3500s

GBP/USD stays in the offered position on Tuesday and trades in the low-1.3500s, constantly following the strong rise in the Greenback. In the meanwhile, Cable's price movement is in line with Bailey's cautious tone and the mixed data from the US docket.

Gold bounces off lows, retargets $3,350 and above

Gold is falling from its multi-week high of over $3,400 achieved on Monday. It is currently losing further momentum and flirting with the $3,350 region per troy ounce on the back of a strong Greenback, higher yields and mixed US data.

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

AUD/USD drifts lower amid cautious RBA, global trade uncertainty

AUD/USD retreats to 0.6460 as Aussie loses ground after Monday’s rally. RBA minutes reveal that the board debated a 50 bps interest rate cut but opted for a 25 bps cut to preserve predictability. Focus shifts to US JOLTS Job Openings due later in the day, Wednesday’s Australian GDP and Friday’s NFP for fresh cues.