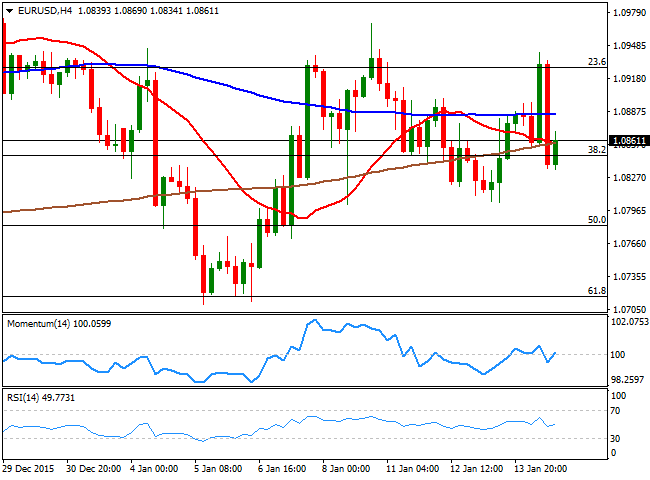

EUR/USD Current Price: 1.0860

View Live Chart for the EUR/USD

It was another dull day across the forex board, as majors lacked directional conviction, despite there were plenty of action among equities and commodities, and the release of several macroeconomic figures. Germany released its wholesale price index, down by 1.0% in December 2015 compared to a year before, whilst monthly basis declined by 0.8%. Also, the ECB released the Minutes of its latest meeting, showing that some members of the government council were looking for a bigger cut in the key interest rate up to 20 basis point. The news were generally EUR negative, but the currency moved in respect of stocks and nothing else. The calendar will be a bit more interesting in the US this Friday, with the release of Retail sales figures for December, and the latest PPI readings, alongside with Michigan consumer's sentiment and some industrial data, which may set the tone for the upcoming week.

Trading in the red, the EUR&USD pair hovers around the 1.0845 region, the 38.2% retracement of the December rally, and the 4 hours chart shows that the moving averages are now directionless and within a tight range, while the technical indicators move back and forth around their mid-lines, reflecting the ongoing range and giving no clues on what's next for the pair. Selling interest has been containing rallies around 1.0925, ever since the year started, and represents the 23.6% retracement of the same advance, while buyers have appeared on approaches to 1.0800. Unless some extension beyond those limits, the pair will maintain a neutral stance and playing the range seems to be the way to deal with it.

Support levels: 1.0800 1.0750 1.0710

Resistance levels: 1.0880 1.0925 1.0950

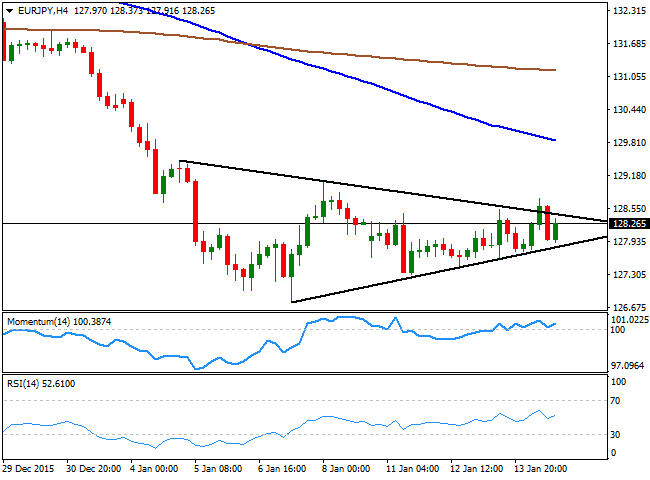

EUR/JPY Current price: 128.24

View Live Chart for the EUR/JPY

The EUR/JPY pair rallied to a fresh weekly high of 128.74, but retreated to its early week range, where it stands ahead of the close. The technical picture is neutral, with the price nearing the vortex of the triangle that contained the price ever since the week started, diminishing the validity of the figure from now on. In the 1 hour chart, the price is a handful of pips above its 100 and 200 SMAs, both with clear bearish slopes, while the technical indicators are flat above their mid-lines. In the 4 hours chart, a mild positive tone comes from the technical indicators that head higher in neutral territory as the price presents higher lows daily basis, although the pair remains well below its moving averages, which reflect bears maintain the lead.

Support levels: 128.00 127.50 127.15

Resistance levels: 128.55 129.05 129.50

GBP/USD Current price: 1.4412

View Live Chart for the GBP/USD

The GBP/USD pair is closing the day pretty much flat above the 1.4400 level, with the British Pound favored by a less dovish-than-expected, Bank of England as the Central Bank left its economic policy unchanged, with only one policy member, Ian McCafferty, voting for a rate hike, as he did for the past few months. The daily chart for the pair is a doji, reflecting investor's uncertainty at current levels, particularly after the pair declined steadily for the past weeks. Technically, the 1 hour chart shows that the price is above a horizontal 20 SMA, while the technical indicators lack upward strength, barely holding above their mid-lines. In the 4 hours chart, the price is still developing below a clearly bearish 20 SMA, now the immediate resistance around 1.4450, while the RSI indicator is aiming slightly higher from the near oversold readings, while the Momentum indicator aims higher, but still below the 100 level, all of which maintains the upside limited.

Support levels: 1.4350 1.4310 1.4260

Resistance levels: 1.4450 1.4490 1.4530

USD/JPY Current price: 118.16

View Live Chart for the USD/JPY

The USD/JPY pair advanced in the American afternoon, following a strong recovery in Wall Street, with the pair above the 118.00 figure by the end of the day, after trading as low as 117.28 earlier in the day. The pair continues trading on sentiment, with easing risk aversion doing little in weakening the Japanese currency. The short term technical picture is showing that, in the 1 hour chart, the price remains below its 200 SMA whilst the technical indicators are turning south from near overbought territory, supporting a downward corrective movement for the upcoming hours, although that will depend on Asian stocks' behavior. In the 4 hours chart, the price is far below its moving averages, while the Momentum indicator turned south above the 100 level, and the RSI indicator holds flat around 52, indicating a limited upward potential. The pair needs at least to recover above the 119.35 level to begin looking constructive, something unlikely for this Friday.

Support levels: 117.70 117.30 116.90

Resistance levels: 118.05 118.40 118.95

AUD/USD Current price: 0.6982

View Live Chart for the AUD/USD

The Australian dollar failed to rally at the beginning of the day following a nice local job report, but finally advanced against the greenback as risk sentiment improved. Earlier in the day, the Australian economy announced that it lost 1K jobs position during December, while the unemployment rate remained steady at 5.8%, against markets' expectations of an advance to 5.9%, yet the AUD/USD pair plummeted to 0.6909, as poor market's sentiment maintained the currency under pressure. Anyway, and despite the positive close, the pair remains below the 0.7000 level, which limits chances of a stronger recovery. Short term, the 1 hour chart shows that the technical indicators are turning south from near overbought territory, while the 20 SMA heads higher below the current level, suggesting a limited bearish corrective movement ahead. In the 4 hours chart, the price stalled around a horizontal 20 SMA, while the technical indicators have lost their upward strength after reaching their mid-lines, in line with the dominant bearish trend.

Support levels: 0.6960 0.6905 0.6870

Resistance levels: 0.7000 0.7040 0.7075

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.