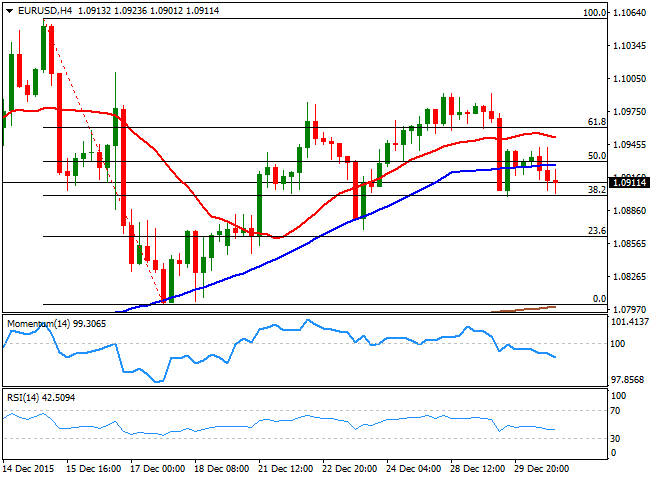

EUR/USD Current price: 1.0911

View Live Chart for the EUR/USD

The American dollar ended mostly higher in the last full trading day of this 2015, as many markets will be closed this Thursday, while others, like the US, will have an early close ahead of the New Year holiday on Friday. At the end of a tumultuous year, the greenback stands victorious across the board, as the US Central Bank was the first to shift its economic policy towards tightening, in world were easing is still a possibility. It's true, the dollar has been unable to advance after the announcement of the first rate hike this December, yet is also certain that market players have been pricing it in, at least since last April.

The EUR/USD pair stands around the 1.0900 figure, 12 cents below the year opening, and it has been unable to establish a clear directional strength ever since bottoming at 1.0461 and bouncing in correction mode. Anyway, there are little reasons for the EUR to strengthen in the term, but at this point, the downside is still seen limited. Shorter term, Tuesday saw the release of US pending home sales that showed an unexpected decline, down for the third time in four months in November, as the index decreased 0.9% to 106.9 from an upwardly revised 107.9 in October.

Technically, the 4 hours chart shows that the price has remained below a now bearish 20 SMA, while the technical indicators head lower below their mid-lines, in line with additional declines. Nevertheless, short term buying interest has appeared around the 1.0900 figure, the 38.2% retracement of the latest daily decline. Some additional declines below the 1.0880/1.09000 figure is required to talk about a possible bearish move during the following sessions, and once the market returns to normal.

Support levels: 1.0890 1.0840 1.0800

Resistance levels: 1.0930 1.0960 1.1000

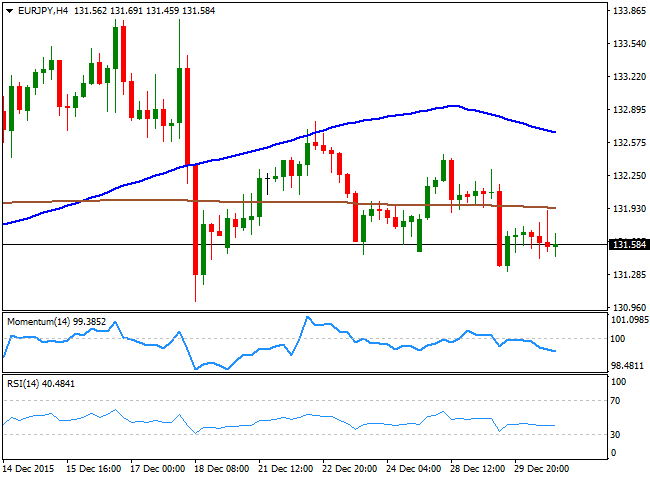

EUR/JPY Current price: 131.58

View Live Chart for the EUR/JPY

The EUR/JPY pair trades pretty much unchanged from its daily opening, maintaining the generally negative tone and meeting selling interest on approaches to the 132.00 level. The technical picture is bearish, as in the daily chart, the pair has remained confined within the lower half of Tuesday's range, and the technical indicators continue headings south within bearish territory, while the 100 DMA continues heading south above the current level. Shorter, term and in the 4 hours chart the technical picture is also bearish, as the price is developing below its 100 and 200 SMAs, and the technical indicators head lower below their mid-lines.

Support levels: 131.30 130.90 130.50

Resistance levels: 131.85 132.20 132.60

GBP/USD Current price: 1.4825

View Live Chart for the GBP/USD

The GBP/USD pair started the day with a positive tone, advancing towards the 1.4850 region, where selling interest has capped short term rallies. The British Pound has entered a selling spiral during these last few months, as slowing growth in the kingdom has reduced chances of a rate hike during the first half of 2016, as initially speculated. Furthermore, the Pound has been suffering lately due to a potential referendum on Britain's future within the EU, to be held as soon as next June. As for this Wednesday, the UK house prices rose by 0.8% in December, according to the Nationwide index, with the annual pace of house price growth up to 4.5%. The GBP/USD pair continues trading near the base of the bearish channel that leads the way since mid September and the 4 hours technical readings favor further declines, as the price is well below a bearish 20 SMA while the technical indicators hover near oversold territory, showing no directional strength amid the ongoing lack of volume.

Support levels: 1.4785 1.4740 1.4700

Resistance levels: 1.4850 1.4890 1.4920

USD/JPY Current price: 120.60

View Live Chart for the USD/JPY

The USD/JPY pair traded within a 30 pips range for a third day in-a-row, ending the day with some gains as the dollar advanced in thin markets. The pair has been lifeless ever since the winter holiday season began, and will likely remain so until the release of US December employment data early January. The longer term stance is still bearish, as in the daily chart the technical indicators hold within negative territory, while the 100 SMA caps the upside around 121.10. Shorter term, and according to the 4 hours chart, the pair can advance some, given that the technical indicators aim higher above their mid-lines, yet gains are seen limited by a strongly bearish 100 SMA heading south around 121.45. Nevertheless, the pair will likely require a strong catalyst to break above this last, and be able, then, to establish a more constructive upward scenario.

Support levels: 120.35 120.00 119.60

Resistance levels: 120.70 121.10 121.45

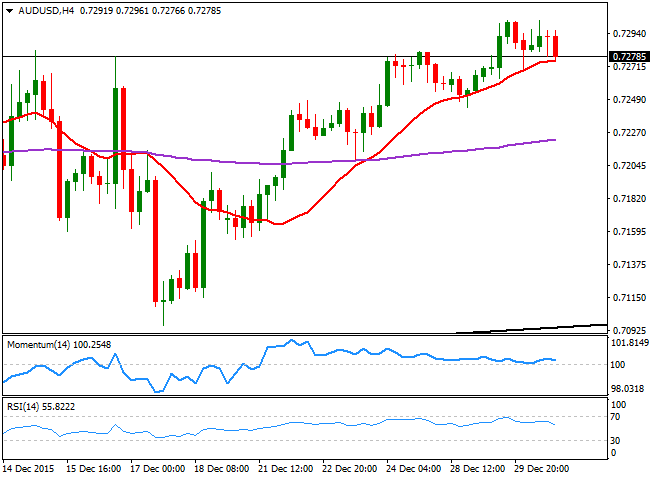

AUD/USD Current price: 0.7278

View Live Chart for the AUD/USD

The Aussie edged lower against its American rival, weighed by a decline in commodities, and as gold break lower, hitting a fresh 2-week low. The AUD/USD pair remained confined to a tight range above the 0.7240 level, overall positive. With limited action expected during the upcoming Asian session, the 4 hours chart for the pair shows that the price is now standing above a horizontal 20 SMA, while the technical indicators have turned slightly lower above their mid-lines. The chart also shows that the price has failed to advance beyond 0.7300 on several attempts during the last two days, although the level to watch is 0.7330, as it will be only above this last that the pair will be gaining some further upward potential for the following sessions.

Support levels: 0.7280 0.7240 0.7200

Resistance levels: 0.7330 0.7365 0.7400

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

NZD/USD turns positive above 0.5700 after RBNZ Orr's presser

NZD/USD returns to the green above 0.5700 early Wednesday. The RBNZ's expected 50 bps interest rate cut to 3.75% in February and signals on future rate cuts weighed on the Kiwi before the pair rebounded on Governor Orr's press conference.

AUD/USD keeps range near 0.6350, Fed Minutes eyed

AUD/USD trades in a range around mid-0.6300s early Wednesday. The cautious market mood, the RBNZ dovish rate cut and Trump's tariff threat-led US Dollar upside remain a drag on the Aussie. Focus shifts to the Fed Minutes amid trade war fears.

Gold price remains close to record high near $2,940 amid trade tensions

Gold price treads water near $2,940 in the Asian session on Wednesday, remaining near the record high as worries that Trump's reciprocal tariffs could trigger a global trade war continue to act as a tailwind for the safe-haven bullion. Fed Minutes is next on tap.

Bitcoin stretches losses as CME premiums dip, Strategy aims to purchase $2 billion worth of BTC

Bitcoin continued its downward trend on Tuesday as K33 Research's weekly report indicated growing declines in BTC CME premium and yields. Meanwhile, Strategy announced plans to issue $2 billion worth of senior convertible notes.

Rates down under

Today all Australian eyes were on the Reserve Bank of Australia, and rates were cut as expected. RBA Michele Bullock said higher interest rates had been working as expected, slowing economic activity and curbing inflation, but warned that Tuesday’s first rate cut since 2020 was not the start of a series of reductions.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.