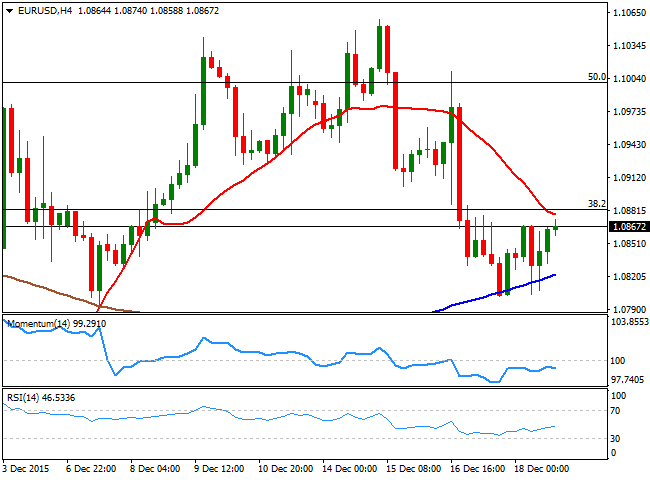

EUR/USD Current price: 1.0867

View Live Chart for the EUR/USD

The EUR/USD pair ended the week lower, although it managed to bounce on Friday from a low set at 1.0804, as stocks in Europe and America extended their Thursday's declines. Market's direction was set by the US Central Bank decision of finally raising its interest rates by 25bp and continued weakness in oil prices, helping the dollar higher into the year-end. During the upcoming days, the US will release the final revision of its Q3 GDP and Durable Goods Orders, probably the only macro events that could trigger some action, as winter holidays kick-in.

Technically speaking, the EUR/USD pair has lost the bullish potential triggered by the ECB earlier this month, as it broke below 1.0880, right after FED's announcement, and held below it for the second half of the week. The level represents the 38.2% retracement of the October/December decline, and as long as below it, gains should remain limited. The 4 hours chart shows that the 20 SMA heads lower and converges with the mentioned Fibonacci resistance, while the technical indicators are turning south below their mid-lines, following a corrective movement from oversold readings, supporting further declines. Nevertheless, it would take a break through 1.0790 to confirm some steadier downward momentum during the upcoming days.

Support levels: 1.0840 1.0790 1.0750

Resistance levels: 1.0880 1.0915 1.0950

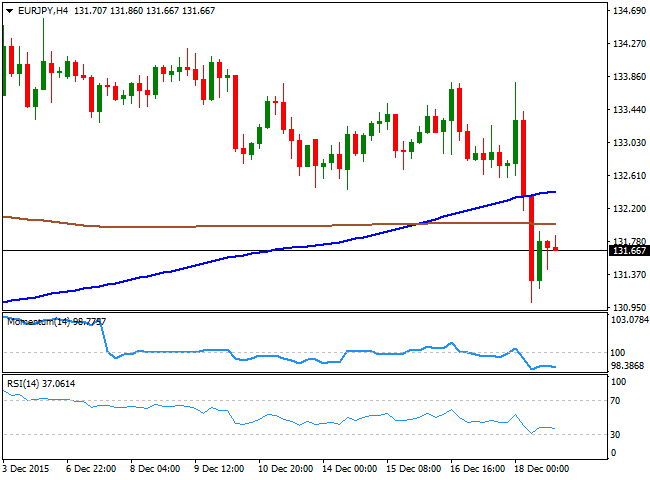

EUR/JPY Current price: 132.65

View Live Chart for the EUR/JPY

The Japanese yen recovered most of the ground lost with the FED, after the Bank of Japan decided to apply some changes to their stimulus plans, in its Friday's economic policy meeting. The Central Bank adopted new measures, including expanding the eligible collateral for Bank credit, in a desperate move to boost local inflation, still far below the 2.0% target. The EUR/JPY pair fell down to 131.01 on Friday before bouncing up to 133.66 where it closed, down for a second week in-a-row. From a technical point of view, the pair is gaining bearish potential as in the daily chart the pair retreated sharply after testing a bearish 100 DMA while the technical indicators turned sharply lower, although are still above their mid-lines. in the 4 hours chart, the technical indicators have barely bounced from oversold readings before resuming their declines, whilst the price is back below its 100 and 200 SMAs, maintaining the risk towards the downside.

Support levels: 131.00 130.60 130.20

Resistance levels: 131.95 132.40 132.80

GBP/USD Current price: 1.4912

View Live Chart for the GPB/USD

The Pound suffered the most last week, falling against the greenback down to 1.4863, the lowest in eight months, before closing a few pips above the level, at 1.4889. The British currency suffered from soft local data, pretty much doing the past two months, but was also affected by weakening oil prices, as the commodity sunk to fresh 7-year low last week. The GBP/USD pair daily chart shows that the price has extended far below a bearish 20 SMA, while the Momentum indicator heads higher below its 100 level, following a positive opening last Friday that anyway did not last. In the same chart however, the RSI indicator maintains its bearish slope nearing oversold levels, keeping the pair exposed to additional declines. Shorter term, and in the 4 hours chart, the technical outlook is also bearish as the price held below a strongly bearish 20 SMA, while the technical indicators have turned lower below their mid-lines. Selling interest has been strong on approaches to the 1.4950 figure, the level to break to see an upward corrective movement that can extend up to 1.5050.

Support levels: 1.4860 1.4815 1.4770

Resistance levels: 1.4900 1.4950 1.4995

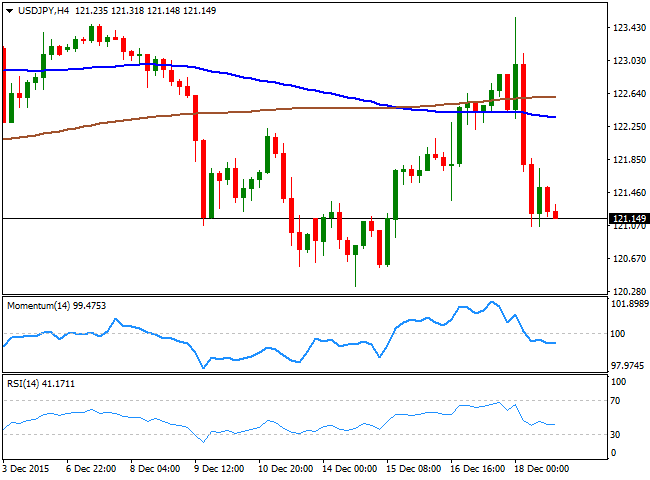

USD/JPY Current price: 121.46

View Live Chart for the USD/JPY

The USD/JPY pair plunged to 121.05 after the Bank of Japan decided to modify its economic policy, buy announcing a new 300B yen program for purchases of ETF's, while also extending the duration of JGBP purchases to 12 from 10 years, and expanding the eligible collateral for Bank credit, including foreign currency denominated loans and housing loan portfolios. The pair erased most of its weekly gains and closed at 121.14, after meeting some buying interest around the 121.00 figure on Friday. The technical picture is now bearish, as in the daily chart, the pair is now below its 200 DMA, after a brief advance beyond it, while currently hovering around the 100 DMA. In the same chart, the technical indicators have turned sharply lower below their mid-lines, reflecting the ongoing bearish momentum. Shorter term, the 4 hour chart presents a clear bearish tone, as the price has fallen far below its 20 SMA, while the technical indicators head south within negative territory. Renewed selling interest below 121.05 should lead to a stepper decline this Monday, down to the 120.00/30.

Support levels: 121.05 120.60 120.30

Resistance levels: 121.70 122.20 122.66

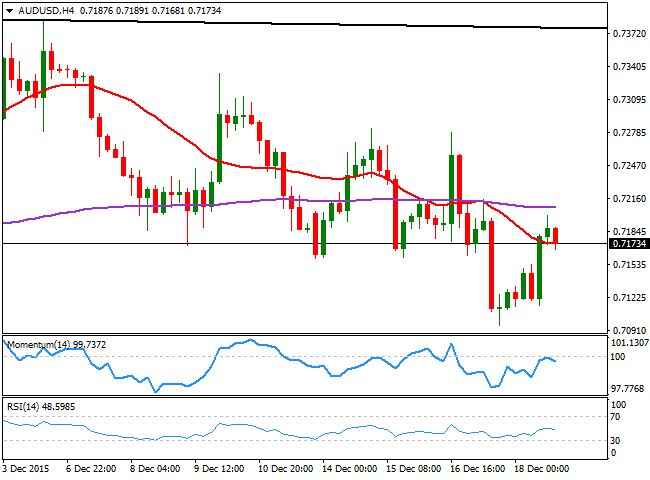

AUD/USD Current price: 0.7173

View Live Chart for the AUD/USD

The AUD/USD pair closed the week unchanged around 0.7170, weighed by continued weakness in the prices of metals. Iron and gold prices plunged with the dollar advancing post-FED, and the Aussie followed, although the decline in the currency has been limited, which suggests some further declines, particularly if the dollar maintains its strength, are likely. Technically, the daily chart shows that the pair has been consolidating within a large triangle ever since late August, and it has approached to the base of the figure last week, but bounced. In the same chart the 20 SMA caps the upside around 0.7240, also a strong static resistance, while the technical indicators aim higher, but in negative territory, limiting the downside as long as the price remains above the daily ascendant trend line, which stands around 0.7070 for this Monday.

Support levels: 0.7160 0.7120 0.7070

Resistance levels: 0.7200 0.7240 0.7280

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.