EUR/USD Current price: 1.1407

View Live Chart for the EUR/USD

The American dollar trades lower against most of its major rivals, exception may by the EUR that fell to a daily low of 1.1424 on speculation the ECB may extend its QE program in its economic policy meeting next week, after ECB's Nowotny said additional measures need to be taken to reach the 2.0% inflation target. The pair bounced some after posting the low, but selling interest capped the upside around 1.1460, with the pair holding near its low ahead of the US batch of data. In the American country, September inflation resulted at -0.2% monthly basis as expected, and remained flat at 0.0% compared to a year before, beating expectations. The annual reading ex food and energy surged to 1.9% from previous 1.8%. Also, weekly unemployment claims fell down to 255K much better than the 270K expected, while the NY Empire manufacturing index posted a sharp drop, down by 11.36 against a decline of 8.00 expected.

The EUR/USD pair accelerated its decline towards 1.1400 after the releases, with the greenback advancing against all of its rivals. Technically, the 1hour chart for the pair shows that the price is well below its 20 SMA but above the 100 SMA around the mentioned low, whilst the technical indicators maintain sharp bearish slopes below their mid-lines. In the 4 hours chart, the price fell briefly below its 20 SMA, whilst the technical indicators continue correcting lower from extreme overbought readings. Nevertheless, buyers are aligned in the 1.1380/1.1400 region, meaning it will take a clear break below this level, to confirm a continued decline for this Thursday.

Support levels: 1.1380 1.1340 1.1310

Resistance levels: 1.1460 1.1500 1.1545

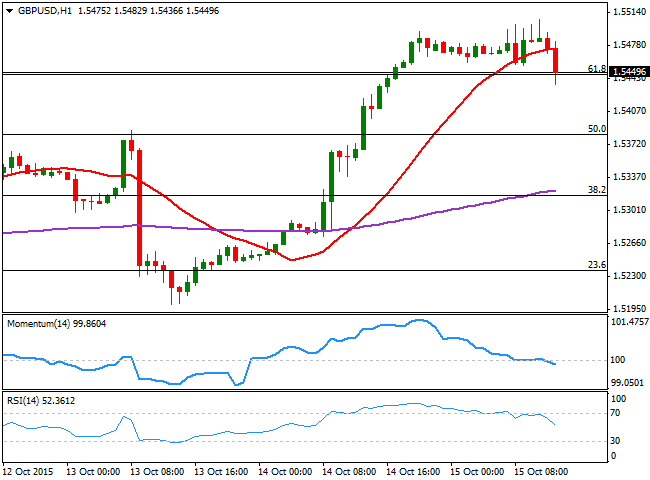

GBP/USD Current price: 1.5444

View Live Chart for the GPB/USD

The Pound spent the first half of the day consolidating its latest gains against the greenback, having extended its rally by a few pips this Thursday, up to 1.5506. With no macroeconomic events in the UK, the pair has been showing little directional strength, until the release of US data, which sent the pair down to 1.5436. Hovering now around the 61.8% retracement of its latest daily decline at 1.5445, the 1 hour chart suggest the pair may decline further, as the price is accelerating below its 20 SMA whilst the technical indicators head lower below their mid-lines. In the 4 hours chart, the technical indicators are retreating from overbought levels, but remain well above their mid-lines, whilst the price is way above its moving averages, limiting the strength on any possible bearish movement.

Support levels: 1.5410 1.5375 1.5330

Resistance levels: 1.5500 1.5560 1.5600

USD/JPY Current price: 118.52

View Live Chart for the USD/JPY

Bouncing from 118.05, upside seen limited. The USD/JPY fell sharply for a second day in a row, after finally breaking its almost 2-month range. The pair traded as low as 118.05 in the European morning, stalling around the 23.6% retracement of its latest decline. The release of US better-than-expected inflation and employment data, helped the pair to bounce up to 118.55, which is the base of the mentioned 2-month range. The 1 hour chart shows that the price is well below its moving averages, but that the technical indicators are bouncing strongly from extreme oversold levels, still well below their mid-lines. In the 4 hours chart, the technical indicators also turned higher, but are still in oversold territory, supporting an upward corrective movement should the price accelerate above the current level. The rally can extend up to 119.35, yet it sellers surged around this last, the risk will turn back lower, with the market then looking for a break of the mentioned daily low.

Support levels: 118.10 117.70 117.20

Resistance levels: 118.60 119.00 119.35

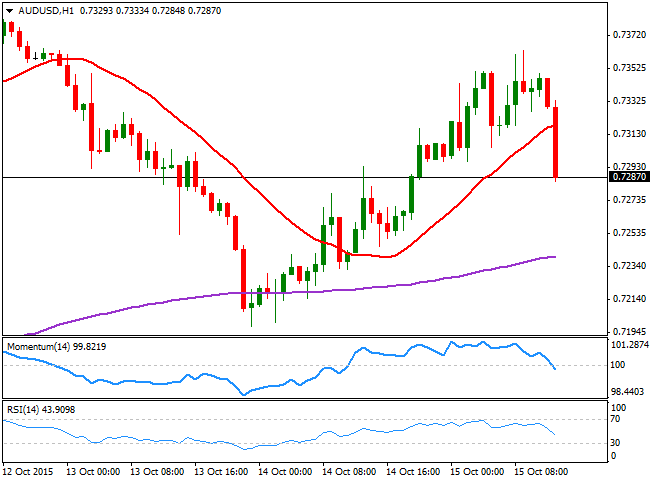

AUD/USD Current price: 0.7284

View Live Chart for the AUD/USD

The Australian dollar continued recovering ground early Thursday, rallying against the greenback up to 0.7363, after mixed employment data. According to the latest release, Australian unemployment rate dropped to 6.2%, as the participation rate decreased to 64.9%. Employment fell 5,100 from August compared with a median forecast of a 9,600 increase. Also, inflation expectations rose in October, to 3.5% from previous 3.2%. Better-than-expected US data however, has sent the pair to a fresh daily low below the 0.7300 level, turning the short term picture strongly bearish, as the price is accelerating below its 20 SMA, whilst the technical indicators are in line with further declines after breaking below their mid-lines. In the 4 hours chart, the technical readings also favor the downside, with further declines seen on a break below 0.7250.

Support levels: 0.7250 0.7220 0.7175

Resistance levels: 0.7300 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.