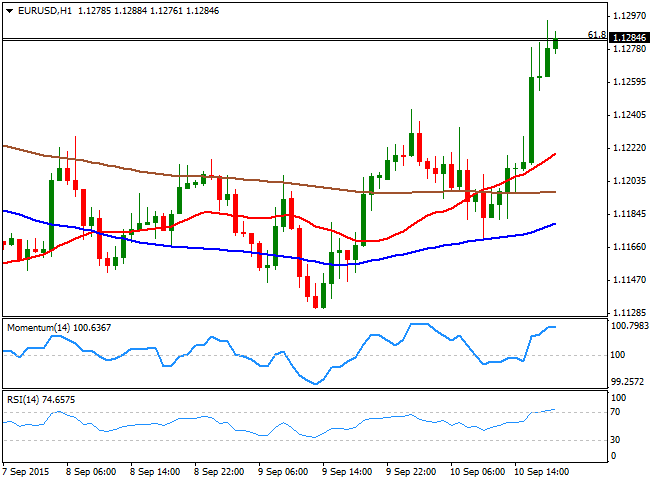

EUR/USD Current price: 1.1284

View Live Chart for the EUR/USD

Dollar bulls finally gave up on the American session, after worse-than-expected US data affected investors' sentiment towards a rate hike in the country next week. The EUR/USD pair flirted with the 1.1300 level, as in the US, wholesale inventories decreased by 0.1%, while wholesale sales dropped 0.3% in July. Also, import prices declined 1.8% in August following a 0.9% drop the previous month, mostly due to lower fuel prices. Prices exports also fell in by 1.4% a 0.4% decline in the previous month. Weekly unemployment claims edged at 275K, as expected. The market seems to have overreacted to this minor reports, but is because the uncertainty over what the FED will do next week, which is driven the market. US stocks surged, despite most European and Asian indexes closed in the red, also weighing on the USD.

The EUR/USD pair ends the day around the 1.1280 level, the 61.8% retracement of the latest bullish run up to 1.1713, and the 1 hour chart shows that the technical indicators are giving signs of exhaustion in overbought territory, whilst the price has managed to advance well above its moving averages. In the 4 hours chart, the technical indicators have bounced from their mid-lines and maintain their bullish slopes, whilst the 20 SMA heads slightly higher around the 1.1190 level. September high at 1.1331 is now the immediate resistance, followed by the 50% retracement of the same rally at 1.1365.

Support levels: 1.1240 1.1200 1.1160

Resistance levels: 1.1330 1.1365 1.1410

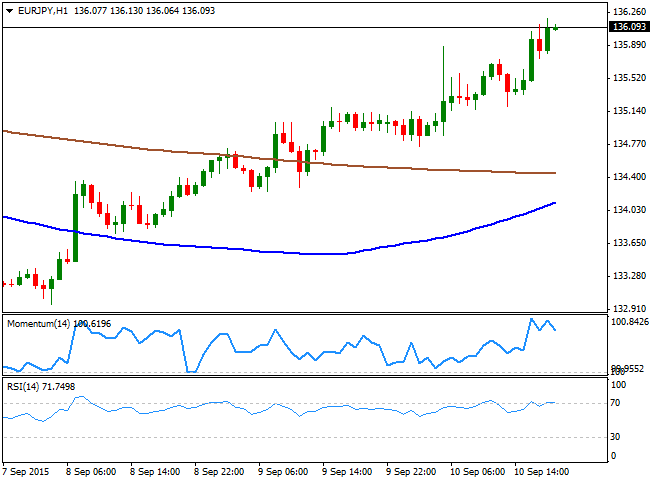

EUR/JPY Current price: 136.08

View Live Chart for the EUR/JPY

The EUR/JPY advanced another 100 pips this Thursday, extending its weekly rally up to 136.19, holding nearby by Wall Street's close. The Japanese yen has been in selling mode ever since the day started, on speculation that the BOJ will extend its facilities to achieve the 2.0% inflation target before the end of the fiscal year, something that at this point, looks quite unlikely. As for the EUR/JPY technical picture, the 1 hour chart shows that the price extended further above its 100 and 200 SMAs, with the shortest gaining upward momentum, but still below the largest. In the same chart, the technical indicators have lost their bullish strength in overbought levels, suggesting some consolidation ahead before a new run higher. In the 4 hours chart, however, the technical indicators have recovered their upward strength after a tepid downward correction, pointing to a continued advance for this Friday.

Support levels: 135.80 135.35 13490

Resistance levels: 136.30 136.70 137.20

GBP/USD Current price: 1.5468

View Live Chart for the GPB/USD

The British Pound surged to a fresh 2-week high against the greenback of 1.5475, helped by broad dollar weakness. Earlier in the day, the Bank of England released its latest economic policy decision, where the Central Bank decided to maintain unchanged its main benchmark and the APP. Minutes of the meeting showed that only 1 of the 9 MPC members dissented by voting for a rate hike, as in the previous meeting. The GBP/USD reacted positively to the BOE, jumping to the 1.5450, although it immediately retraced back below the 1.5400 level, finding buying interest in the 1.5380 price zone. The bullish momentum is losing steam in the short term, as the 1 hour chart shows that the price is well above its 20 SMA, while the technical indicators have turned flat in extreme overbought levels. In the 4 hours chart, the 20 SMA heads sharply higher well below the current level, whilst the RSI indicator heads higher around 73 and the Momentum indicator is turning slightly higher above the 100 level, all of which supports further gains, with the immediate resistance at 1.5490, the 50% retracement of the latest bearish run.

Support levels: 1.5450 1.5410 1.5365

Resistance levels: 1.5490 1.5525 1.5550

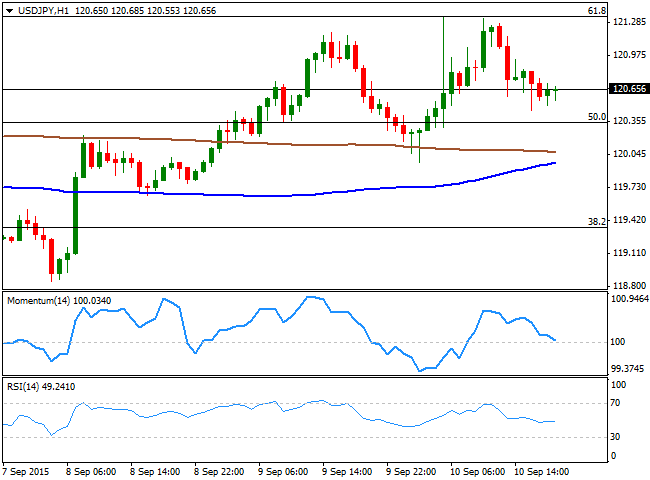

USD/JPY Current price: 120.65

View Live Chart for the USD/JPY

The USD/JPY pair surged to 121.33 during the past Asian session, boosted by comments made by Bank of Japan Governor Haruhiko Kuroda, who remarked that whilst the economic recovery has been irregular, conditions are given to reach the 2% inflation target, spurring speculation the Central Bank is ready to embark on another round of financial stimulus. The pair retested the highs with the European opening, but failure around a key Fibonacci resistance alongside with tepid US data, sent it south during the American afternoon. The pair however, remains in the green daily basis, and the 1 hour chart shows that the price remains well above a strong Fibonacci support and the 100 and 200 SMAs, although the Momentum indicator heads lower and approaches the 100 level, whilst the RSI indicator stands flat around its mid-line. In the 4 hours chart, the technical indicators continue to head lower from overbought levels, but remain above their mid-lines, whilst the price hovers around a bearish 100 SMA. The pair will likely accelerate its decline on a break below 120.35, the 50% retracement of the latest bearish run.

Support levels: 120.35 120.00 119.60

Resistance levels: 120.95 121.35 121.80

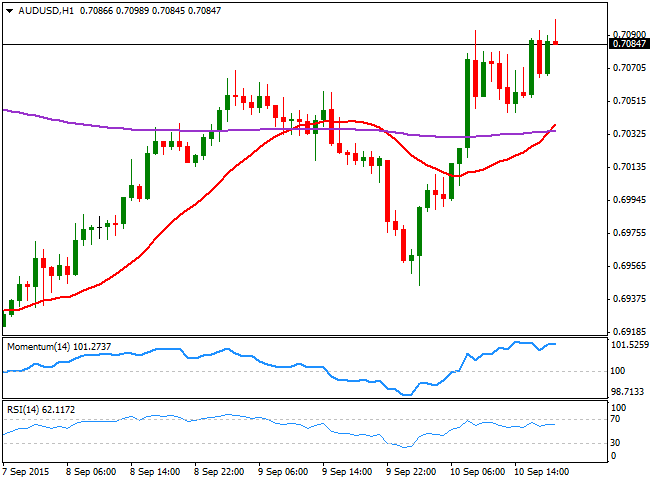

AUD/USD Current price: 0.7084

View Live Chart for the AUD/USD

The Australian dollar regained the upside against its American rival this Thursday, with the pair flirting with the 0.7100 level by the end of the day, trading at levels not seen since September 1st. The Aussie was supported by better-than-expected Chinese inflation figures and an upward surprise in Australian employment data, as the country managed to create 17,400 new jobs, against expectations of 5,000, whilst the unemployment rate fell as expected to 6.2%. The 1 hour chart shows that the 20 SMA is crossing above the 200 EMA below the current level, whilst the technical indicators have turned flat near overbought levels, as the pair has spent the last few hours in consolidative mode. In the 4 hours chart, however, the technical outlook is bullish, as the 20 SMA heads sharply higher below the current level, whilst the technical indicators have regained their upward strength after a brief downward correction.

Support levels: 0.7040 0.7000 0.6965

Resistance levels: 0.7095 0.7135 0.7170

Recommended Content

Editors’ Picks

AUD/USD holds lower ground below 0.6350 after dismal Australian data

AUD/USD keeps its offered tone intact below 0.6350 in Wednesday's Asian trading, undermined by below forecasts Australian Constuction Output and monthly CPI data. The data fan more RBA rate cut expectations. Risk-off flows and renewed US Dollar demand also add to the weight on the Aussie.

USD/JPY: Rebound gathers steam to near 149.50

USD/JPY is extending the rebound to near 149.50 in Asian trading on Wednesday. The pair tracks the upswing in the US Dollar and the US Treasury bond yields, fuelled by the US House passage of the Republican Budget plan, advancing Trump's tax plans.

Gold buyers jump back amid tariff uncertainty

Gold price struggles to build on Tuesday’s rebound in the Asian session on Wednesday. Gold buyers try their luck as safe-haven flows return on US President Donald Trump’s tariff uncertainty and weak US economic prospects.

Strategy stock dips as Bitcoin price crashes below $90K, sparking concerns of forced liquidation

Strategy witnessed an 11% stock decline on Tuesday, stirred by Bitcoin's market's plunge below $90,000 and fueling speculations of a forced liquidation for the company.

Five fundamentals for the week: Fallout from German vote, Fed's favorite figure stand out Premium

Statements, not facts, are set to dominate the last week of February. Further fallout from Germany's elections and new comments from Trump on trade may overshadow most figures –but not the Fed's favorite inflation figure.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.