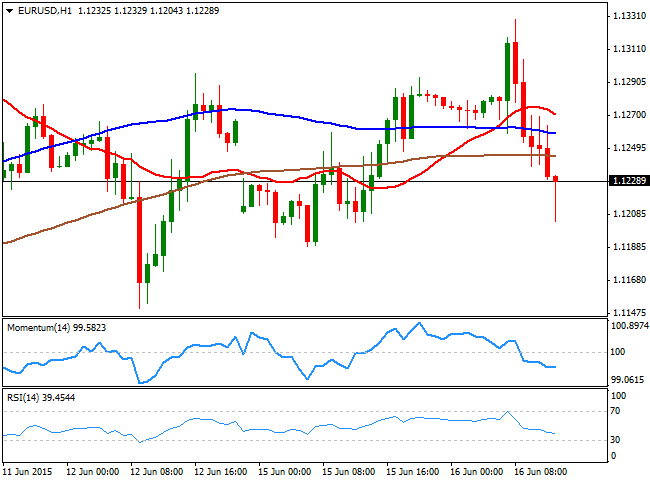

EUR/USD Current price: 1.1223

View Live Chart for the EUR/USD

The EUR/USD pair has accelerated its decline ahead of the US opening bell, after having been as high s 1.1329 early in the European opening. In the data front, German inflation meet expectations in May, matching April readings, although the ZEW sentiment survey came much worse than expected, as uncertainty over Greece future within the EU weighed on the outlook of the local economic situation. The pair accelerated its decline as Greek PM Tsipras addressed to the Parliament, saying that creditor's proposals will lead to a deeper recession. The down beating tone of his speech, is adding to a press conference being given by German Chancellor Angela Merkel, saying that there are no chances of a deal coming before Thursday.

The EUR/USD pair flirted with the 1.1200 level, before the release of US housing data. Building Permits rose to its highest since 2007, albeit housing starts fell 11.1% in May vs. est. -4%. The dollar came under some limited pressure after the release, with the pair bouncing its low but maintaining a bearish tone in the short term, as the 1 hour chart shows that the price remains below its moving averages, whilst the technical indicators head south in negative territory. In the 4 hours chart, the price is now below a mild bearish 20 SMA, whilst the Momentum indicator remains flat around the 100 level, and the RSI indicator anticipates additional declines, heading lower around 45.

Support levels: 1.1200 1.1160 1.1120

Resistance levels: 1.1245 1.1290 1.1330

GBP/USD Current price: 1.5618

View Live Chart for the GBP/USD

The bullish tone of the British Pound is quite undeniable this Tuesday, as the GBP/USD quickly recovered from a daily low set at 1.5541 after the release of tepid UK inflation figures. Yearly basis, May CPI surged as expected 0.1% against previous -0.1%, but the rest of the readings alongside with the PPI figures, resulted quite disappointing. Nevertheless, the GBP/USD pair shrugged off the data, and regained the 1.5600 level, having so far advanced up to 1.5640, and with the 1 hour chart showing that the price holds above a bullish 20 SMA, albeit the technical indicators turned lower after crossing their mid-lines to the upside. In the 4 hours chart, the technical picture is more constructive, with the pair bouncing sharply earlier in the day from a strongly bullish 20 SMA, whilst the technical indicators head north in positive territory, supporting additional advances on a break above1.5640 the immediate intraday resistance.

Support levels: 1.5590 1.5440 1.5490

Resistance levels: 1.5640 1.5675 1.5710

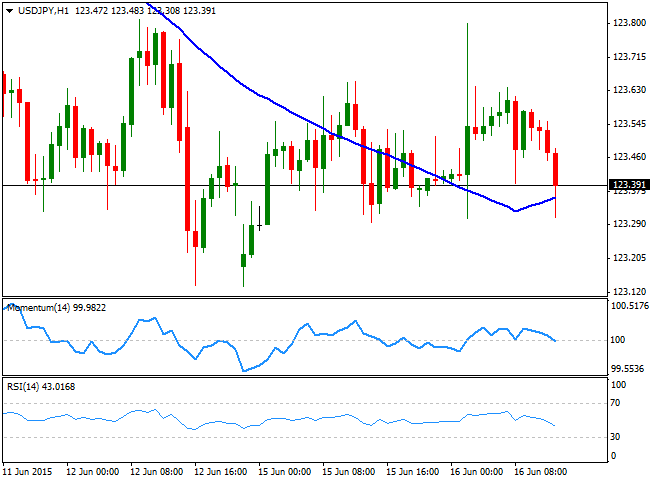

USD/JPY Current price: 123.39

View Live Chart for the USD/JPY

The USD/JPY pair trades uneventfully in quite a limited range, still holding a few pips above the 123.30 support area. The short term picture is neutral-to-bearish, with the price pressuring its 100 SMA and the technical indicators turning south in neutral territory. In the 4 hours chart, the price remained capped by its 100 SMA, whilst the technical indicators also turned lower around their mid-lines, supporting a downward continuation particularly on a downward acceleration below the mentioned 123.30 level.

Support levels: 123.30 122.80 122.45

Resistance levels: 123.80 124.10 124.45

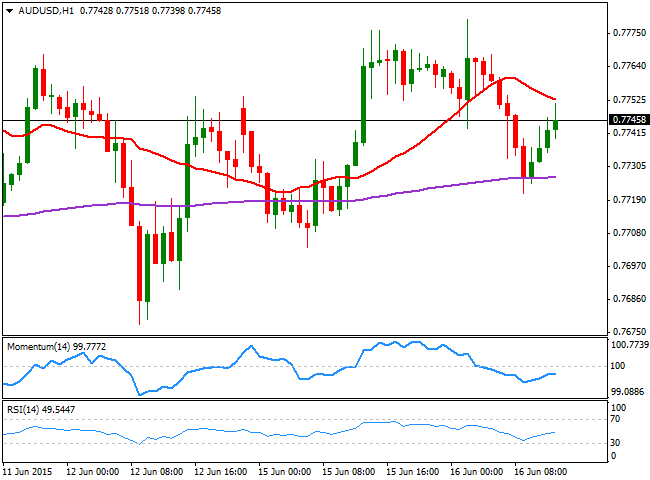

AUD/USD Current price: 0.7747

View Live Chart for the AUD/USD

The AUD/USD pair trades within a familiar range this Tuesday, finding buyers on deeps towards the 0.7700 region, but contained blow 0.7780 a strong resistance level. The 1 hour chart shows that the price is advancing towards a bearish 20 SMA, whilst the technical indicators head higher below their mid-lines, suggesting there's not enough upward momentum to confirm additional advances. In the 4 hours chart, the price is trading between horizontal moving averages, whilst the technical indicators are bouncing from their mid-lines, helping at least, to keep the downside limited.

Support levels: 0.7740 0.7700 0.7660

Resistance levels: 0.7780 0.7830 0.7880

Recommended Content

Editors’ Picks

EUR/USD remains near 1.0400 post-US PCE

The US Dollar’s inconclusive price action allows some recovery in EUR/USD, keeping the pair around the 1.0400 region following the release of PCE inflation data for the month of January.

Gold slumps to fresh multi-week lows below $2,840

Gold stays under bearish pressure and trades at its lowest level in three weeks below $2,840. The uncertainty surrounding the Trump administration's trade policy and month-end flows seem to be weighing on XAU/USD, which remains on track to snap an eight-week winning streak.

GBP/USD clings to gains just above 1.2600 after PCE data

GBP/USD remains positively oriented in the 1.2600 neighbourhood as the Greenback is navigating a vacillating range following the PCE inflation release.

The week ahead – US Payrolls, ECB rate meeting, ITV results – W/c 3rd March

Having seen the Federal Reserve keep rates on hold last month the US labour market continues to show remarkable resilience, despite seeing a slowdown in hiring in January, after a blow out December number.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.