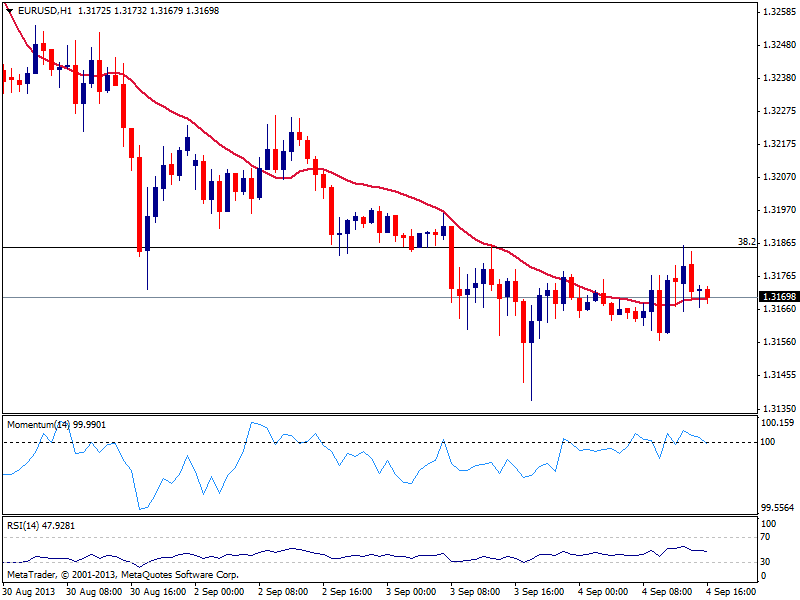

EUR/USD Current price: 1.3169

View Live Chart for the EUR/USD

So you think is worth trading the EUR/USD? Think twice: the world has reduced to a 30 pips range for the past 48 hours, with a short lived spike of 20 pips to the 1.3137 low yesterday in the middle. Market needs a trigger, and won’t find it today, with the ECB on Thursday and US NFP on Friday. Both events may provide some action, with the ECB having the less chances of triggering strong movements in the pair, as there’s little the Central Bank can do at this point. In the meantime, the pair continues trading below 1.3185, 38.2% retracement of its latest bullish run, and with intraday charts presenting a neutral stance. The 1.3100 level stands as the 50% retracement of the same rally, and stops below it will likely continue building over the next 24 hours, with 1.3250 as last probable, but not likely, bullish target for today.

Support levels: 1.3140 1.3100 1.3060

Resistance levels: 1.3180 1.3210 1.3250

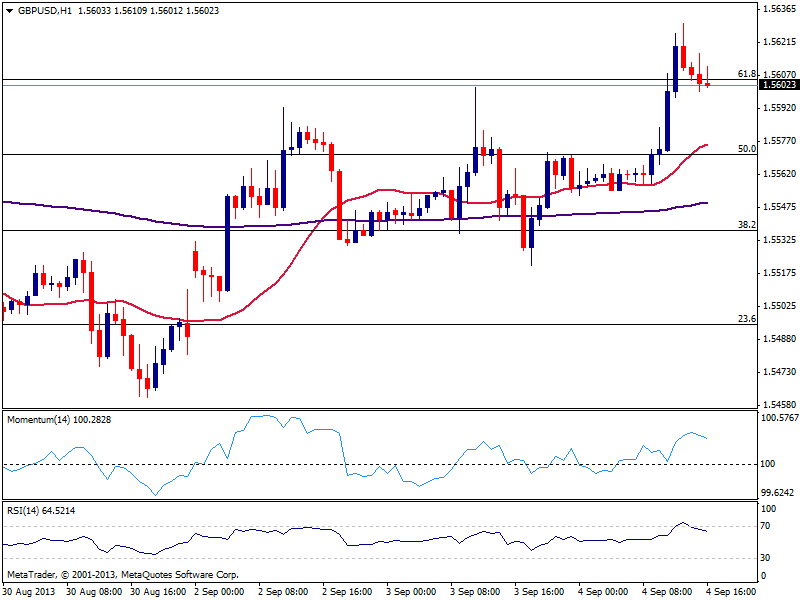

GBP/USD Current price: 1.5608

View Live Chart for the GBP/USD

The GBP/USD maintains the bullish tone based on stronger UK data, breaking above the 61.8% retracement of its latest daily fall at 1.5605. Struggling around the level, the hourly chart shows indicators turning lower, correcting overbought readings in the short term. The 4 hours chart shows indicators also losing upward potential in positive territory, although far from turning bearish: price needs to accelerate below 1.5900 to lose the upward potential, at least in the short term.

Support levels: 1.5590 1.5550 1.5520

Resistance levels: 1.5630 1.5660 1.5700

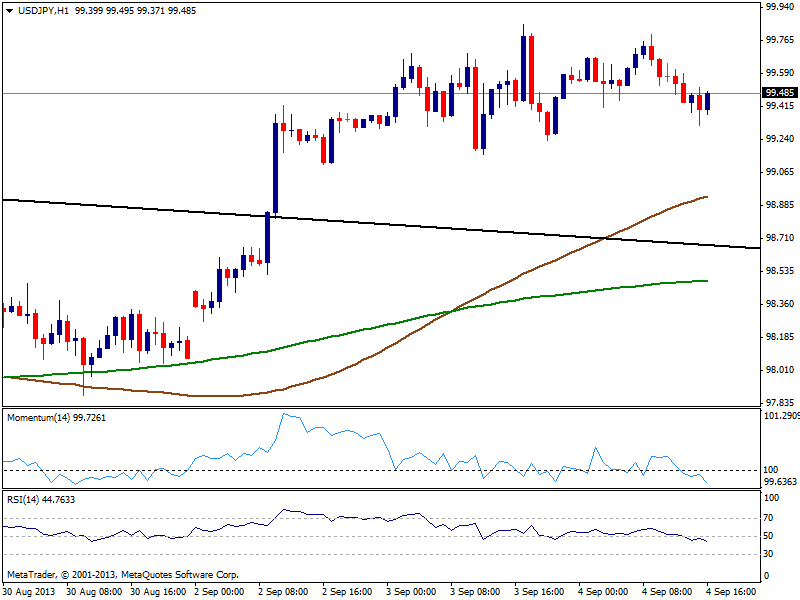

USD/JPY Current price: 99.47

View Live Chart for the USD/JPY

Unchanged since last updates, the pair lost some ground after the release of worse than expected US Trade Balance, with the hourly chart showing an increasing bearish potential, as indicators turn south below their midlines. However, buyers continue to appear on approaches to the 99.20/30 area, and there’s little room for falls beyond it ahead of key data later this week.

Support levels: 99.20 98.90 98.50

Resistance levels: 99.70 100.00 100.30

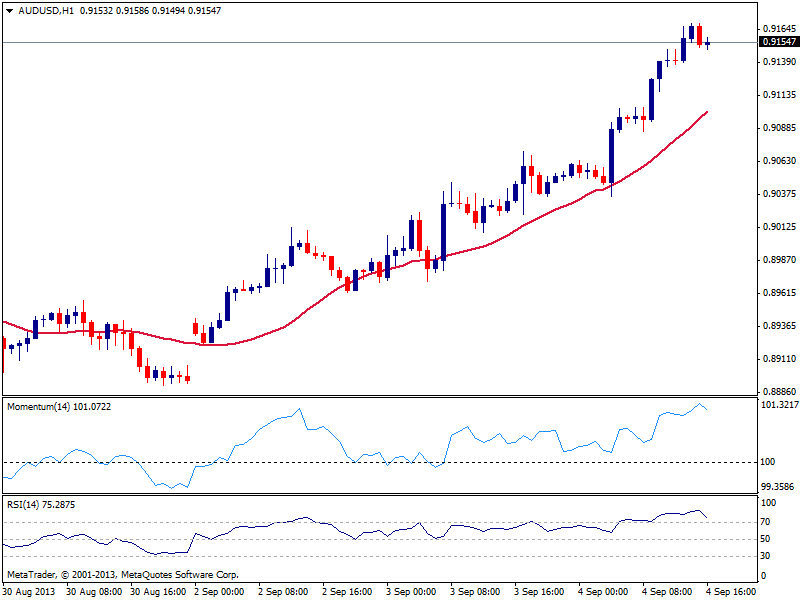

AUD/USD Current price: 0.9154

View Live Chart for the AUD/USD

Commodity currencies outperform this Wednesday, with the AUD/USD surging up to 0.9169 and holding nearby. The hourly chart shows indicators in extreme overbought levels, losing the upward potential yet still not suggesting a downward correction, while the 4 hours chart shows the same picture. As long as above 0.9140, the upside is favored in the short term, with scope to test the 0.9200 level later today.

Support levels: 0.9140 0.9070 0.9025

Resistance levels: 0.9170 0.9200 0.9250

Recommended Content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.