The US Federal Reserve, however, left the easing path long ago and took the opposite direction, rising rates for the first time in over a decade last December, and pledged to a steady continuation of the tightening path during this 2016, suggesting 3 to 4 rate hikes for this 2016. Hopes of such moves diminished with every release of poor macroeconomic figures showing that between December and February the economic recovery somehow stalled.

Watch: Trade Federal Reserve interest rate decision with FXStreet

And the FED meets again. The US Central Bank will release the updated projections of its funds target rate, alongside with the latest decision, and overall, the market is expecting them to signal 2 to 3 hikes this year, down from previous 4. The FOMC will also offer its latest economic projections, but this last data won't be relevant, given that policy makers have overestimated the economic developments in the country and the market knows it. Rates are expected to remain unchanged between 0.25%-0.50%.

The big question now is whether they will leave doors open for a June rate hike, or if they will keep them closed until September. The first scenario can see the dollar surging against its weaker rivals such as the EUR and the GBP, but it will be hardly enough to affect the JPY or the AUD. The second big question will be if forthcoming data can support further tightening.

Investors will also pay attention to Yellen's statement, and trade accordingly. The FOMC is largely expected to reiterate that upcoming decisions will remain data-dependent, while assessing the effects over the local economy of the ongoing global slowdown. But for the majority of analysts, a hawkish stance is expected, given that inflation seems to be finally picking up as the core PCE price index rose from 1.4% to 1.7% on an annual basis.

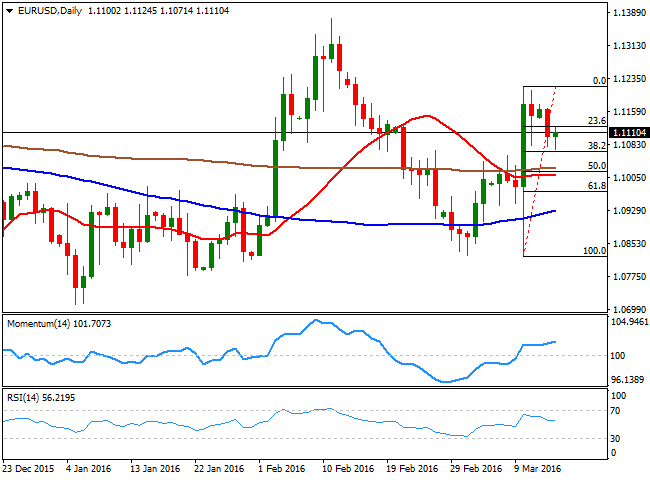

EUR/USD technical outlook

The EUR/USD pair holds to most of its post-ECB gains, consolidating around the 1.1100 level ever since the dust settled, with little directional strength in the bigger picture, and despite ongoing dollar's weakness and the failed attempts of weakening the EUR from Mario Draghi.

Nevertheless, the technical picture favors the upside, as the pair is back trading above its 100 and 200 DMAs, with the longest now around the 1.1000 figure, adding its strength to the psychological support. But it's also notable that the moving averages have been pretty much horizontal for almost two months, in line with the ongoing uncertainty surrounding the pair.

In the same chart, the technical indicators have recovered bullish territory, but lack enough strength to confirm a stronger rally. Should the FED disappoint, the pair can return to last week highs above 1.1200, and beyond, towards the 1.1240/50 region, a strong static resistance level. Gains beyond this last are unlikely for this Wednesday, but some follow through beyond it could signal a steady advance during the forthcoming sessions towards the 1.1460 region. The immediate support comes at 1.1065, the 38.2% retracement of the latest bullish run, but it will take a downward acceleration below the mentioned 1.1000 figure to see the pair getting back to its latest range of 1.0800/1.1000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.