_20151027141420.jpg)

Of course, at the beginning of the year, FED's head, Janet Yellen, warned that they could rise rates in any meeting, including those with no press conference scheduled. But the October meeting will hardly be the case, as they had their chance last month, and passed. The best the market can anticipate these days, is a December lift off.

Watch: Fed Interest Rate Decision Live Coverage with Valeria Bednarik, Mauricio Carrillo and Dale Pinkert

Additionally, no significant changes in the FOMC statement are expected, besides that maybe the FED will acknowledge the latest soft employment figures, but remaining confident on the sector's growth. Chinese slowdown, and weaker oil prices, will likely have their chapters too, as usual.

Anyway, with the market focused on December, a no-change in the previous wording will likely be seen as dollar positive, as hopes for a rate move before the year-end will remain high. On contrary, a downward surprise with renewed concerns over the dollar's strength, or references to poor economic developments, will result in investors running to price in a delay for next 2016, and therefore sent the USD lower across the board. Also, investors may be looking at the post-meeting commentaries from some of the FOMC officials, for some clues on whether they will actually rise rates.

Market's reactions are expected to be limited, except of course, in the case of a surprise rate hike. That would be a market shocker that can send the greenback running hundred of pips across the board. But as said before, there are the fewest probabilities ever, of such happening tomorrow.

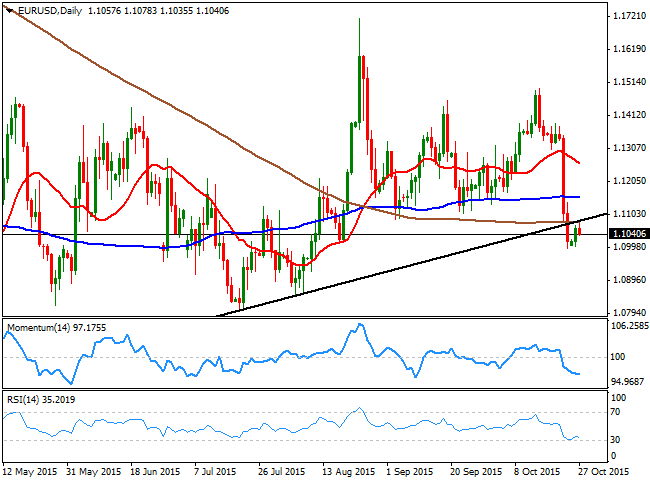

EUR/USD technical outlook

As long as a rate hike remains on the cards, EUR/USD gains will be limited, as Draghi has clearly warned the markets that it will act in December if needed, pretty much saying that if the FED does not raise rates, he will extend facilities in Europe to keep the EUR lower. The pair has been holding above the 1.1000 figure ever since the week started, but the daily chart shows that the bearish tone prevails, given that the pair is unable to recover above the long term ascendant trend line broken last week, and even completed a pullback to it this Tuesday before turning back south. Additionally, the pair is trading back below its 100 and 200 SMAs, while the technical indicators seem ready to resume their declines well into negative territory. The RSI particularly, has corrected its oversold conditions and heads back south around 34, all of which supports additional declines. The main supports below 1.1000 come at 1.0960 and 1.0920, while below this last, the base of these last months' range at 1.0840 is next. The pair needs to recover above 1.1120 to see some upward constructive tone, with 1.1160 and 1.1200 as the next levels to watch post FED.

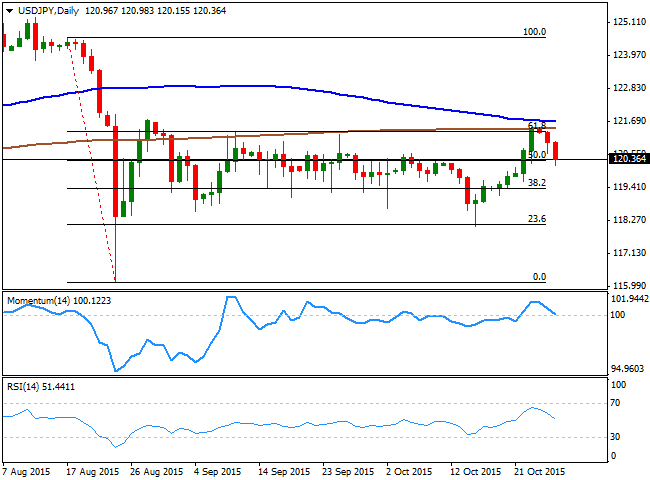

USD/JPY technical outlook

The USD/JPY is back to its comfort zone around 120.35, the level that has acted like a magnet for the past two months. The BOJ will have its monthly economic policy meeting after the FED, early Friday, and speculation has mounted over the possibility of an extension of the ongoing stimulus in Japan, the main reason behind the latest recovery in the pair. It could be that with a on-hold FED, with no change in the wording, the pair will trade around the current level until the Bank of Japan meeting. Anyway, and ahead of the FED, a dovish US Central Bank may send the pair down to 119.30, a strong Fibonacci support, while further declines below this last can see the price extending down to 118.55. To the upside, 120.70 is the immediate resistance, followed by the 121.45 level, the 200 DMA and the level sellers have defended ever since late August.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains need to clear 0.6400

AUD/USD rose for the third day in a row, approaching the key 0.6400 resistance on the back of the acute pullback in the US Dollar amid mounting recession concerns and global trade war fear.

EUR/USD: Powell and the NFP will put the rally to the test

EUR/USD gathered extra steam and advanced to multi-month peaks near 1.1150, although the move fizzled out somewhat as the NA session drew to a close on Thursday.

Gold looks offered near $3,100

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day".

Interoperability protocol hyperlane reveals airdrop details

The team behind interoperability protocol Hyperlane shared their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal provided by the Hyperlane Foundation by April 13, the team shared in a press release with CoinDesk.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.