ECB´s deposit rate cut… and QE extension?

The ECB is about to decide once again about its economic policy, and most analysts agree that Draghi will deliver at least a 10bp deposit rate cut, sending it from the current -0.3% to -0.4%. Initially, the market was hoping for a 15p rate cut, but last Friday, the Government Council anticipated that they did agree on a 10bp rate cut, and nothing more. The news sent the EUR/USD pair above the 1.1000 level, but investors were unable to push it higher, and the pair hovered around the figure ever since, on hold ahead of the release.

The fact is that the market is not sure about what can happen this Thursday, as many speculate that Friday's "leak" was meant to downgrade market expectations ahead of the announcement, to get a more dramatic reaction afterwards. ECB's head, Mario Draghi, is well known for his technique of pulling a rabbit out of the hat during meetings, and rock the financial world. But he also intercalates wait-and-see stances in-between, so uncertainty is quite high at this point.

But in this particular meeting, the ECB is largely expected to act, given the increasing downward risk in inflation. The first reading of the EU inflation for February has suggested a contraction, down to -0.2%, below zero for the first time in four months, supporting another round of policy easing from the ECB. Some believe that the TLTRO could be extended for one year, but little believe that the amount of monthly purchases will be modified.

There's a good chance also that the ECB will revise its inflation forecast towards the downside, currently at 1.0% for this 2016, and at 1.6% for 2017. Growth figures have less chances of suffering a downward revision, given that the latest GDP figures have matched expectations.

Overall, the general feeling across investors is that the ECB may disappoint, but they fear a surprise. A 10bp rate cut is already priced in, so markets' reaction will be linked to Draghi's tone, with the common currency under pressure on a dovish stance, being the most likely scenario.

EUR/USD technical picture

The EUR/USD pair has advanced up to the 1.1070 this week, but this Wednesday, the common currency is among the weakest against the greenback, which trades lower against other major rivals. Poor macroeconomic data in the US has delayed chances of a FED's rate hike, and the market believes it won't act this year, stretching the imbalance with other Central Banks, actually in the easing path.

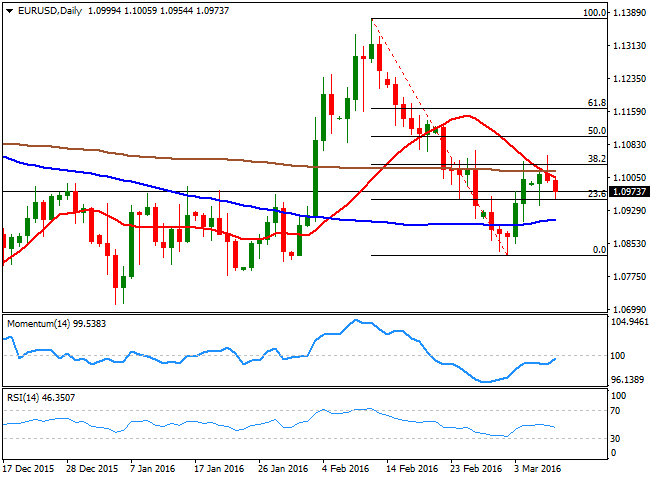

The common currency has been quite immune to additional monetary stimulus' announcements, as the initial sharp reactions are hardly sustainable in time. Technical readings in the daily chart keep favoring the downside, as despite a daily spike, the pair has been unable to recover above a strongly bearish 20 SMA, nor above the 38.2% retracement of the daily slump between 1.1375/1.0842 at 1.1040. Additionally, the RSI indicator in the mentioned time frame has resumed its decline after failing to extend beyond its 50 level, while the Momentum indicator lacks clear directional strength right below its mid-lines.

The weekly low stands at 1.0940, and a break below it could lead to a retest of the base of the range, 100 pips below it. The 1.0800 region has been attracting long term buying interest for over three months now, which means that, in the case of a EUR sell-off, investors will likely take profits out of the table on approaches to the level, which will result in a sharp reversal.

The 1.1040/50 have proved strong many times by the second half of 2015, and with the Fibonacci resistance reinforcing it, it will take a clear acceleration beyond it to confirm additional gains towards the 1.1120/60 region, the next strong long term resistance area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

RBNZ set for another interest rate cut amid trade tariff uncertainty

The Reserve Bank of New Zealand is on track to deliver a 25 basis point cut to the Official Cash Rate, bringing down the key policy rate from 3.75% to 3.50% following its April monetary policy meeting on Wednesday.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.