With quite limited volumes across the forex board, investors are placing their hopes, partially, in the ECB monthly economic policy decision, to be unveiled this Thursday. Partially, because there are more Central Banks' decisions coming before the month ends. Both, the FED and the BOJ will have their economic policy meetings, with the first expected to remain on hold, but with increasing chances of a move coming from Japan authorities.

The fact is that besides the usual dovish stance, the European Central Bank is expected to offer little to the market these days. Despite some market talks of a QE extension during the past weeks, Mario Draghi is largely expected to maintain the bond buying program launched in January, unchanged. If something, he will try to down talk the common currency, as the EUR/USD pair has returned to pre-QE levels, and therefore limiting local exports.

Adding to the local situation, Chinese economic slowdown continues worsening, with the latest GDP reading in the country falling down to levels not seen in over six years, whilst oil prices remain subdued. Low inflation is being also blamed on the continued slide in oil prices by almost all central bankers, but sometimes seems more as an excuse than a cause.

With the dollar having lost its shine amid a continued delay from the FED on a rate hike, the unwind of bulls in the American currency is not just a problem for the US. European stocks markets soared when stimulus was announced, as the EUR got cheaper, and exporting become more competitive. But with the year about to end, inflation is actually below zero, and stocks have gave back most of its yearly gains.

Earlier this week, Nowotny, the Austrian National Bank Governor, said that given that inflation is still far from the Central Bank's target, the ECB may need to loosen fiscal policies to boost growth, or use additional tools, fueling speculation the ECB will actually announce some measure in its upcoming meeting. But as said before, no concrete action, beyond more Draghi jawboning, is expected.

Read: What is ECB Quantitative Easing?

If the ECB decides to continue buying €60bn a month, mostly in government bonds, repeating that the program will extend until September 2016, or further if needed, the market will likely be disappointed and sell the common currency.

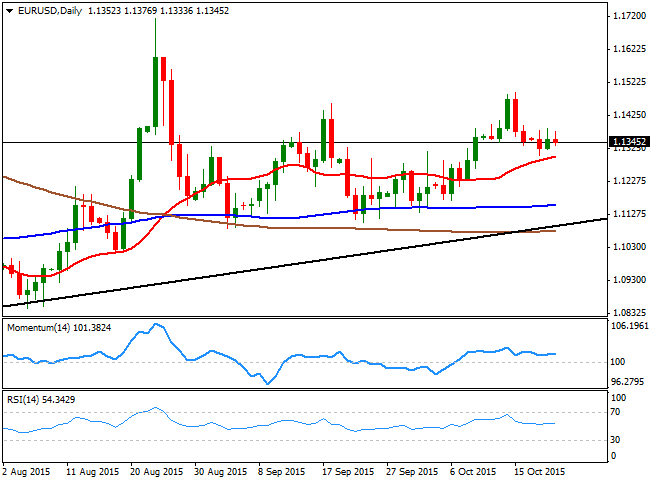

EUR/USD technical view

From a technical point of view, the EUR/USD pair retains a bullish tone in the daily chart, despite the ongoing absence of directional strength as the price has remained firmly above a bullish 20 SMA ever since the month started. There is a daily ascendant trend line coming from April low at 1.0519 which comes these days around 1.1120 a major static support level. Also, strong selling interest has been surging ever since early May on approaches to the 1.1460 region, dismissing the spike up to 1.1713 from late August.

So far this week, the pair has been unable to advance beyond 1.1400, which means that if somehow Draghi gives the EUR a push, the pair needs to break above it test the 1.1460 level, en route towards 1.1500, this Thursday.

The pair is far from the major support mentioned, but if the price breaks below 1.1280, the downside is favored towards the 1.1120/60 region for the upcoming sessions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains need to clear 0.6400

AUD/USD rose for the third day in a row, approaching the key 0.6400 resistance on the back of the acute pullback in the US Dollar amid mounting recession concerns and global trade war fear.

EUR/USD: Powell and the NFP will put the rally to the test

EUR/USD gathered extra steam and advanced to multi-month peaks near 1.1150, although the move fizzled out somewhat as the NA session drew to a close on Thursday.

Gold looks offered near $3,100

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day".

Interoperability protocol hyperlane reveals airdrop details

The team behind interoperability protocol Hyperlane shared their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal provided by the Hyperlane Foundation by April 13, the team shared in a press release with CoinDesk.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.