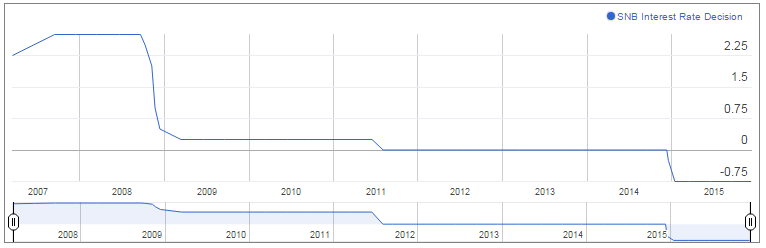

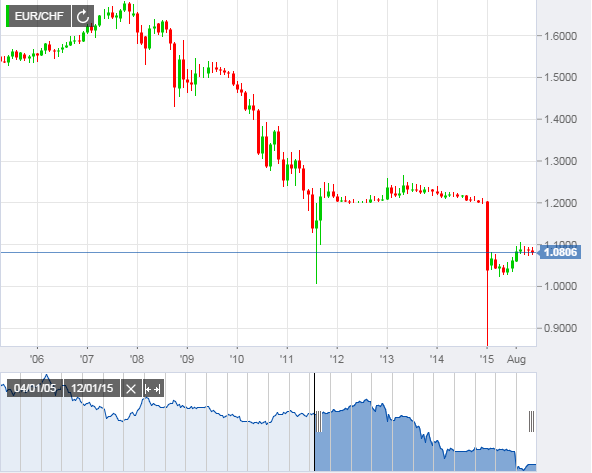

The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are required to ease pressure on the franc, SNB noted. The SNB can be expected to remain active in the foreign exchange market in order to influence the exchange rate situation whenever deemed necessary.

The Swiss National Bank (SNB) at its December 10th meeting decided to maintain its expansionary monetary policy. The target range for the three-month Libor was left unchanged at between –1.25% and –0.25%, and the interest rate on sight deposits with the SNB was also kept unchanged at –0.75%.

Swiss economic policies need to keep euro area tensions in mind

Switzerland is surrounded by euro countries and thus it pays for the SNB to follow the ECB’s policies closely. SNB has previously taken cue from the ECB to determine its own policies. Hence when the ECB disappointed the markets with a smaller than expected stimulus package, it was largely expected that the SNB would also not move. SNB proved the markets rights by holding rates steady. The scenario can be expected to remain largely unaltered in the coming months.

Analysts at ING rightly observed that in the immediate future, in an event of an extension of the current ECB monetary policy downward, pressure will be exerted on the CHF-EUR interest spreads. This will result in climbing tensions on the Swiss franc. Also, economic turmoil in the euro zone could result in sharp fall in the value of euro. This will in turn raise demand for safe heaven purchases leading to the appreciation of the Swiss currency. The SNB then will have to intervene and control the currency by slashing rates again.

ECB chief Mario Draghi post the December 10th meeting assured markets that the central bank will intensify the use of easing tools to bring inflation closer to target. The ECB has said that it can and will ease further to stabilize prices in the bloc. This implies that the downward pressure on rates in the euro zone will continue for a long time now. The markets can thus expect SNB interest rates to normalize only in 2017.

Inflation to overcome 1 per cent threshold only in 2018

Switzerland, like many other major economies has been suffering the brunt of poor inflation. Inflation mostly suffered a setback after the price floor between the Euro and the Franc was removed. The SVME PMI has also contracted, currently standing at 49.7, down from 50.7; while retail sales too are an issue at -0.8% y/y. Currently, inflation stands at -1.4 per cent.

SNB’s inflation outlook improved in the short-run due to the positive exchange rates effects. For 2016 inflation is expected to rise slightly to minus 0.5 per cent, unchanged from the previous forecast. The 2017 inflation forecast has however been revised slightly downwards from 0.4 per cent to 0.3 per cent. The SNB expects inflation to overcome the 1.0% threshold in mid-2018.

GDP growth will strengthen gradually as global outlook improves

GDP data released earlier this month showed growth stagnated in the third quarter (quarter on quarter), falling below 0.2 per cent market expectation. The central bank estimates real growth to be under 1 per cent in 2015. Growth is estimated to increase 1.5 per cent in 2016. The steading of global economy can be expected to increase foreign demand for Swiss goods and services. Domestic demand will also witness an improvement. The SNB said it will regularly monitor the mortgage and real estate markets and assess the need for an adjustment of the countercyclical capital buffer from time to time.Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.