In a surprise move the BOJ decided to increase purchases of exchange-traded funds (ETFs). The central bank will now purchase ETFs at an annual pace of 300 billion yen ($2.45 billion) and the ETFs will constitute stocks issued by firms which invest in physical and human capital. The new ETF purchase program was introduced in addition to the current ETF purchase program of around 3 trillion yen annually. The BOJ upon realising existent massive purchases have led to a sharp decline in the availability of liquidity in the bond (JGB) market, decided to lengthen the maturity of bonds it purchases.

These measures, the BOJ governor Kuroda said were not additional easing. The shift in policy stance was aimed at supplementing the QQE. The objective is primarily to encourage companies to raise wages and overall investment. The BOJ in its latest policy statement said, "There are many companies that are actively spending on capital expenditure and human resources. We hope such moves broaden further. From this standpoint, the new measures are aimed at supplementing QQE.â€

BOJ confident economic recovery is on track

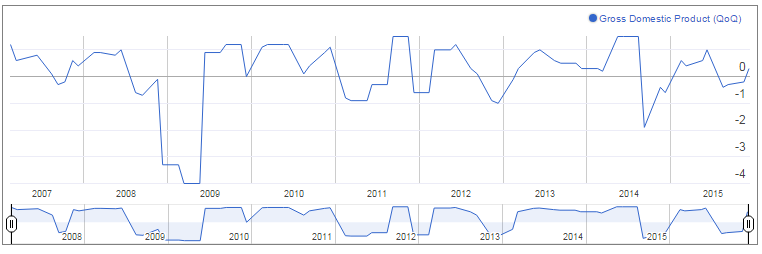

The Japanese economy, the BoJ said, will continue to grow at a moderate pace despite exports and production being hit by the emerging markets’ slowdown. Kuroda talked up the economic recovery at the press conference following the December 18th meeting. The BOJ is upbeat about the recovery process. The central bank’s belief that the economy is showing signs of recovery has been strengthened by the Q3 GDP data, which was revised upward from the initial estimate, then seen contracting 0.8 per cent in the third quarter.The recent rise in machinery orders as well as industrial production figures for October raises hope that recovery is in track in the fourth quarter. Underlying inflation has been holding up. Considering the positives, Kuroda said "…we don't see risks to the economy and prices as heightening or materialising.â€

He believes there is no severe impact of the slowdown in emerging economies on Japan's economy. Nor is the slowdown “threatening achievement of our price target", he said. Also, he does not see any risk of “economic and price conditions undershooting†the bank’s estimates.

Kuroda is of the opinion that QQE has managed to be fruitful. “Companies and households are shifting away from a deflationary mindsetâ€, he noted. He mentioned he is willing to do everything possible to “broaden the positive momentum.â€

The concerns that lurk beneath

The central bank noted these developments but did not forget to reiterate that the QQE will continue till Japan achieved its 2 per cent inflation target. It will also examine both upside and downside risks to economic activity and prices from time to time and make necessary adjustments as and when required.

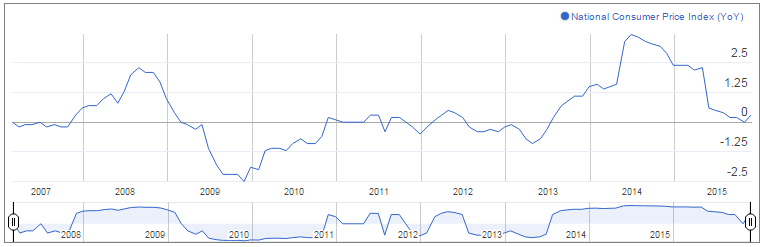

The aggressive easing championed by Abenomics has not yet been able to produce the desired results. The BOJ has been compelled to push back the time by which it expected to achieve its inflation target. The BOJ had in its October meeting pushed its expectation for when inflation will reach its target to the second half of fiscal 2016. The forecast for inflation in the current fiscal year has been slashed to 0.1 per cent and to 1.4 per cent for fiscal 2016. The persistently low inflation will be a constant reminder to the BOJ that will have to initiate additional stimulus measures to move closer to the 2 per cent inflation target as soon as possible.

The forecast for economic growth in the current 2015 fiscal year has been slashed to an average of 1.2 per cent and to 1.4 per cent for fiscal 2016. In 2017 economic growth is expected to further take a beating from a planned increase in sales tax on April 1, 2017. The government might choose to introduce a supplementary budget exceeding 3 trillion yen to boost growth.

Amari feels GDP target for the fiscal is “ambitiousâ€

The revised Q3 GDP shows Japan has managed to avoid technical recession for now. Japan’s initial estimate of a contraction in the July-September quarter was revised to an annualized expansion of 1.0 per cent. The upward revision has been facilitated by capital expenditure which was revised up the 1.3 per cent fall estimated earlier. However, it is not yet time to relax. The economy needs to expand an annualized 3 per cent in each of the remaining quarters to meet the 1.5 per cent growth in the year to March 2016. Economy minister Amari himself feels this GDP target to be "quite ambitious."

Growth will likely be hindered by weak household spending and exports in the current quarter. This weakening will cause the economy to grow only moderately in the October-December quarter.

Japan's core consumer prices fell in October for the third straight month. Household spending slumped as well. Core consumer price index (CPI), which includes oil costs, fell 0.1 per cent in the year to October. Household spending fell 2.4 per cent in October from a year earlier, against a median market forecast for a 0.1 per cent rise, underlining poor wage growth. Japan's jobless rate however fell to 3.1 per cent in October from 3.4 per cent in September. The recently released data raises doubt whether the central bank can achieve its inflation target by early 2017. Analysts polled by Reuters are of the opinion that oil costs may force the central bank to cut its quarterly inflation forecasts yet again in January 2016.

Hidenobu Tokuda, senior economist at Mizuho Research Institute warned that the overall tone of the December Tankan survey indicated companies were taking a cautious stance on the future. Emerging market concerns and disappointing consumer spending could be the reason for such cautious outlook. He also added that companies are planning to raise spending only in the second half of the fiscal year, highlighting companies are delaying investment.

No plans for immediate easing

For now it seems the BOJ will move only if persistent weak overseas demand hurt business confidence and in the process discourage companies from boosting investment and raising wages. Kuroda sees no need to slash rates further into the negative territory. He feels, in Japan the borrowing costs were already very low on account of the central bank's aggressive asset purchases (QQE). Kuroda noted "Our QQE has had an intended impact on the economy and financial markets. Banks have been increasing their loans to the real economy ... Rebalancing has also been taking place".Kuroda also believes that the emerging markets will gradually move out of the slowing phase supported by growth in advanced economies. This in turn will assist Japan attain moderate increase in its trade volume. He also sees certain possibilities of an increase in capital investment “given companies' strong spending plans."

The fact that the BOJ sounded upbeat (as evident from the latest monetary policy statement) and expressed confidence in economic recovery, the possibility of an imminent rate cut in January 2016 can be certainly removed from the cards. No additional stimulus seems to be in the pipeline. Research Analysts at Nomura, expect additional monetary easing by the Bank of Japan only in April 2016. Senior economist at Mizuho Research Institute, Hidenobu Tokuda however feels that the BOJ could ease as early as in January 2016 as “wages are not likely to rise fast enough to satisfy the BOJ's price target."

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.