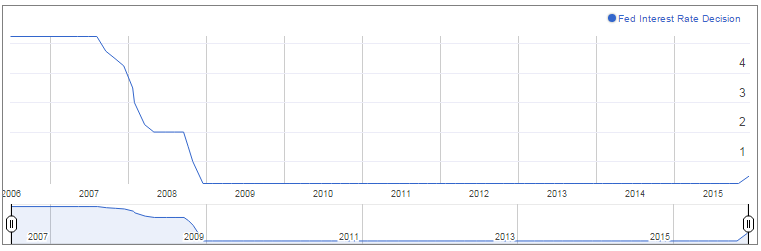

The Fed decided to increase the Fed funds target range by +25bps to 0.25%-0.5%, in line with broad market expectations. The decision was taken considering the notable economic recovery that the US has seen in recent times. Fed Chair Yellen noted "With the economy performing well and expected to continue to do so, the committee judges that a modest increase in the federal funds rate is appropriate."

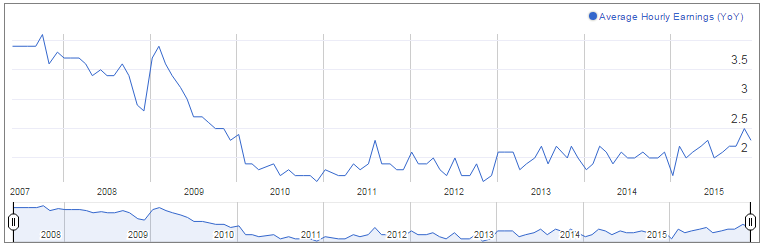

The consumer price index for November showed a rise in inflation to 0.5 per cent from 0.2 per cent recorded earlier. The data highlighted an improvement in the price environment. The unemployment rate has dropped to a seven-year low. It dropped for the second month in a row in November. The unemployment rate currently stands at 5 per cent. The figures signify a robust labor market. The economy is seen gradually progressing towards full employment. Wage growth has been healthy as well. Over the year, average hourly earnings increased by 2.3 per cent.

Outlook for next fiscal year

The Fed expects the recovery at a steady pace in 2016 as well. The median forecasts for growth, employment, and inflation were left largely unchanged at the December 15-16 meeting. Unemployment is anticipated to fall to 4.7 per cent in 2016 while economic growth can be expected to rise 2.4 per cent. The FOMC expects expansion in economic activity at a moderate pace as well as further strengthening of the labor market with gradual adjustments in monetary policy.The way ahead

Now that the first rate hike is behind us, the markets are betting on the number of subsequent rate hikes in 2016. Markets broadly believe there will be 2 hikes in the next year. The Fed has assured the markets that the subsequent rate hikes will be gradual. The decision on future hikes will also be data dependent. This implies that The Fed will monitor inflation figure, which though has increased over time continues to remain way below the 2 per cent inflation target, before raising rates further.

The Fed will however have to ensure that it manages to stay ahead of the curve as the recovery continues. "To keep the economy moving along the growth path it is on ... we would like to avoid a situation where we have left so much (monetary) accommodation in place for so long we have to tighten abruptly.", Fed Chair Yellen noted.

Both unemployment rate and inflation figures are factors on which Fed’s rate decision is largely based. The Fed can be thus expected to decide on the timing as well as the size of future adjustments only after examining both realized and expected economic conditions.

The future rate hike decisions will be governed by the economic outlook formed by economic data. The FOMC expects economic conditions to evolve in a manner that will warrant gradual increases in rate. The Fed stated that it will proceed cautiously if incoming data in the coming months suggest inflation is not growing as expected. However this should not imply that Fed will want to see inflation to hike rates further. A health inflation figure will however help to boost the Fed’s conviction.

How many times will the Fed raise rates next year?

The FOMC said it will raise rates by 25 bps four times in 2016. Another four rate hikes can be expected in 2017. ‘Gradual’, for now thus stands for four rate hikes in 2016 and four in 2017. The question is whether the outlook will be strong enough to justify four hikes in 2016.The set of challenges which may continue to weigh on growth cannot be completely dismissed. A not so impressive global economic outlook is one of the main factors that might plague policy makers in 2016. The slowdown in emerging economies particularly China will continue to interrupt smooth growth process. The strong dollar is hurting US exporters negatively impacting trade. Economists do not see any immediate change in this situation. Also, oil price slump if not reversed will continue to keep prices in check. Core inflation will also suffer in case the dollar is appreciated any further. Wage growth may be hit by discouraged workers and involuntary part-time workers. Poor wage growth will hold back wage pressures, leading to lower inflation.

The poor performance of the manufacturing sector seems to be holding back growth and can be expected to weigh on growth in the immediate future. Manufacturing activity has been hurt by strong dollar, slowing foreign demand and of course the slump in oil prices. The Philadelphia Fed manufacturing index slipped into negative territory in December, falling to -5.9. This is the third negative reading in the past four months. The index for current new orders remained negative and fell to -9.5. Chicago Business Barometer also declined 7.5 Points to 48.7 in November. Sharp dip in new orders that fell to their lowest since March led to this massive decline.

It thus so seems that the downside risks to rate projections are larger as compared to upside risks. The Fed therefore will likely not be able to raise rates four times in 2016. The broad belief in the market is that the Fed will hike rates twice next year.

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

RBNZ set for another interest rate cut amid trade tariff uncertainty

The Reserve Bank of New Zealand is on track to deliver a 25 basis point cut to the Official Cash Rate, bringing down the key policy rate from 3.75% to 3.50% following its April monetary policy meeting on Wednesday.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.