Inflation Worries

The consumer price index released on 15th December showed inflation stagnated month on month in November, though the year on year calculation showed a 0.1 per cent rise. Clothing prices weighed on inflation after they fell sharply between October and November. Chris Williamson, chief economist at data firm Markit warned that UK inflation “looks set to remain weaker for longer than forecasters have recently been expectingâ€.

The BoE estimates the headline inflation to stay below 1 per cent in the first quarter of 2016. Domestic cost pressures will have to firm substantially to return inflation to 2% target in around 2 years. BoE Deputy Governor Cunliffe admitted disinflationary pressure lasted longer than was expected. Governor Carney noted price of oil has "fallen markedly again", which he believes has raised the risk of inflation staying subdued. However, oil alone cannot be blamed for dismal prices. The ONS has confirmed that impact of lower energy prices on inflation in November has been less compared to the previous months. Poor wage growth is also a significant factor keeping prices in check.

As the data shows, inflation figures remain much below the central bank’s 2 per cent inflation target. Keeping the poor inflation in mind the BoE Governor Mark Carney said that the bank is committed to meeting the target and will not raise rates, if hiking rates is not the appropriate thing to do. The BoE, he noted aims at increasing the resilience of the banking system in the event of a downturn.

The BoE estimates UK economy is set to grow 2.7 per cent this year, down from a previous estimate of 2.8 per cent. It also slashed 2016 outlook to 2.5 per cent from 2.7 per cent. However, softer spending cuts announced by Chancellor George Osborne in November can be expected to give a boost to growth in 2016.

Wage growth remains a concern

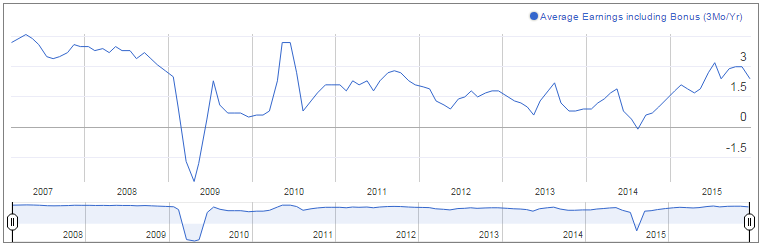

Consumer spending has been the main driver of growth this year. However, this too might no longer be effective in the face of low wage growth. Unemployment has held steady for some time now. The UK labor market data released on 16th December was a mixed bag. The unemployment rate however fell to 5.2 per cent in the three months to October, hitting a seven year low. However, wage growth fell, growing at its slowest in pace since early 2015 in the three months to October. Wage growth slowed to 2.4 per cent from 3 per cent recorded earlier. The latest wage data justifies the central bank’s decision to not rush with rate hike decision. Governor Carney said he would wait for wage growth to rise above 3 per cent before raising interest rates. His sentiment was echoed by BoE Deputy Governor Minouche Shafik who reiterated that the rate cut would happen only when wages rise.

Only higher wages can lift consumer spending and help to stabilize price. BoE Deputy Governor Minouche Shafik thus stressed on the need to raise wages. She said the rate cut would happen only when wages have risen significantly. Senior Economists at Lloyds Bank also feel rate hikes will happen only when wage growth is deemed satisfactory.

Economy marked by absence of balanced recovery

The UK’s deficit on trade in goods and services widened in October and came came in at £4.1 billion, up from the previous widening of £3.1 billion in September. Manufacturing output for October also fell. Manufacturing output fell 0.4 per cent month on month, lower than September’s 0.9 per cent increase. Manufacturers have been particularly hurt by low oil prices. Manufacturing output remains around 6.1 per cent below the level that it had reached when at peak. A survey published on 19th November showed British manufacturers expect their output will fall in the coming three months, the first such decline in three years. UK’s economic growth this year has been so far driven primarily by domestically focused services, hampering the scope for a balanced recovery.BoE ought to keep ‘Brexit’ considerations in mind

Britain's planned referendum on its membership of the European Union is due. Economists hold there exists a lot of uncertainty over the vote's result. On the event of Brexit business sentiment in UK could be badly hurt and this will likely pose serious threat to Britain's economy in 2016. The central bank will thus have to keep the Brexit consideration in mind while deciding on monetary policy stance going forward.When will the BoE raise rates?

The BoE is in no rush to follow the U.S. Fed in raising rates. There is "no mechanical link" between the Bank's thinking and that of other central banks, the minutes of the December meeting highlighted. Cunliffe was unable - to put any timing on when the first upward move in rates was likely. All he could say was the BoE’s next move would be dependent on economic data.The BoE’s earlier short-term inflation forecast prompted investors to push back their expectation of rate hike timing to late 2016/early 2017. BoE Governor Mark Carney had hinted earlier that decision on the probable time when BoE will raise rates will come into "sharper relief" around the turn of 2015. He however has now said that the central bank will move when the time is right. Economists polled by Reuters expect the BoE to begin raising rates in the second quarter of 2016.

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

RBNZ set for another interest rate cut amid trade tariff uncertainty

The Reserve Bank of New Zealand is on track to deliver a 25 basis point cut to the Official Cash Rate, bringing down the key policy rate from 3.75% to 3.50% following its April monetary policy meeting on Wednesday.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.