Economic indicators prove China is gradually adopting consumer-led growth model

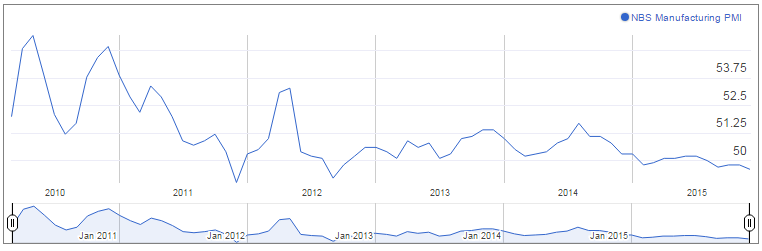

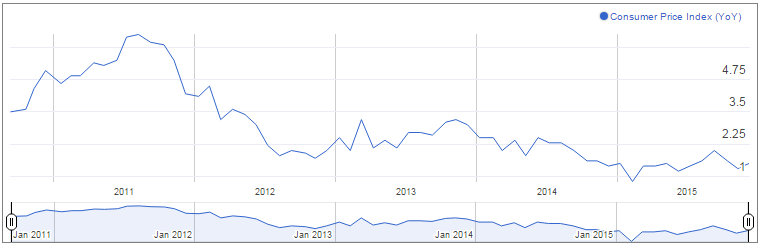

The recent economic data released underline China’s motto to move towards a consumer driven economy. Official data released recently showed China's Consumer Price Index (CPI) increased 1.5 per cent year on year in November helped by substantial rise in the cost of food. On the other hand China’s record-breaking online shopping festival known as Singles' Day helped retail sales to grow 11.2 per cent in November, more than 11.1 per cent estimated by economists. Consumption accounted for 60 per cent of the country’s GDP in the first half of 2015, up 5.7 per cent from the first six months of 2014.The National Bureau of Statistics reported Chinese official non-manufacturing PMI increased to 53.6 in November from 53.1. China’s official PMI on the other hand fell to 49.6 in November, the lowest since August 2012. China's manufacturing activity contracted for the ninth straight month in November, as per the final Caixin/Markit China Manufacturing Purchasing Managers Index. Weak foreign demand continues to weigh on China’s manufacturing sector.

China has wanted for some time now to reduce the economy’s dependence on manufacturing and infrastructure and the economy definitely looks to be moving in the desired direction.

Sectors which might continue to worry policy makers

It is true that the year-over-year growth rate of industrial production (IP) has shown significant improvement. IP rose from 5.6 per cent in October to 6.2 per cent in November. However, it must be noted that the three-month moving average remains below 6 per cent. Also, the producer price index in November dipped 0.5 per cent month on month. The PPI has remained unchanged from last three months’ rate, marking the 45th month of decline. The poor performance of the manufacturing sector which continued to stagnate hurt the PPI.The prices of value-added international were seen falling in November. This fall in tradeable goods prices might increase pressure on the government to devalue the yuan further. It will support export for one. Also, as Bill Adams, senior international economist at PNC Financial Services noted “a weaker yuan will put upward pressure on yuan-denominated prices of commodities that can be traded as well as manufactured products and ease deflationary risks."

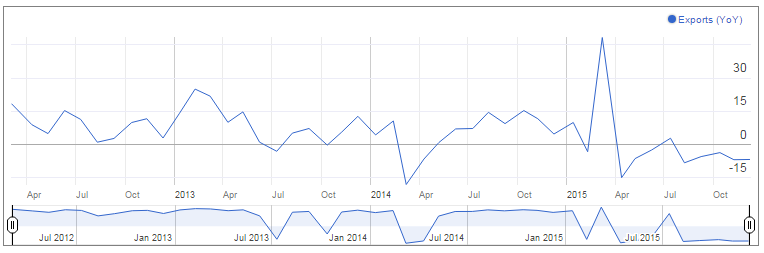

China's trade performance in November remained sluggish. Exports declined worse-than-expected 6.8 per cent on year on year comparison, marking fifth straight month of decline. Imports on the other hand declined 8.7 per cent. Imports fell for the 13th month in a row. The dismal export import figures have once again raised doubts that the Chinese economy will be able to recover even in the last quarter.

China to speed up supply-side reform in 2016

China's annual Central Economic Work Conference on 21st December stressed on the need for China's prudent monetary policy to be more flexible and forceful. The need to raise the country's fiscal deficit ratio gradually has been recognised. China will to push forward "supply-side reform" in 2016. China needs to develop new growth engines and at the same time combat factory overcapacity as well as property inventories. To support a slowing economy China will also likely expand its budget deficit in 2016.Projections

People's Bank of China (PBoC) economists slashed their 2015 growth forecast to 6.9 per cent from a 7 per cent projection in June. Growth had slipped below the 7 per cent mark in the third quarter for the first time since the global financial crisis. The economists however expect economic growth to come in at 6.8 per cent in 2016 on improved consumer inflation and rebound in real estate sales. According to the forecast released by the government-backed research institute, growth will slow to between 6.6 per cent and 6.8 per cent next year. Consumer prices, they opined will rise 1.7 per cent next year as against 1.5 per cent forecast earlier. Exports can be expected to increase 3.1 per cent next year, reversing the decline in 2015.

Central bank researchers are optimistic that "the number of positive factors will gradually increase in 2016.†The factors which will support growth in 2016 include recovery of real estate sales, the positive impact of macro and structural policies, as well as some modest improvement in external demand.

Fixed-asset investment growth will likely increase 10.8 per cent next year from the 10.3 per cent increase they estimate for this year. Property investment will likely stabilize in 2016 helped by rebounding land and home sales; while infrastructure investment growth will grow steadily because the government plans to speed up approvals for water, rail and affordable home projects.

More easing likely in 2016

Global growth has suffered several setbacks this year on account of the slowing emerging economies, particularly China. The slowdown in China has hurt international trade causing trade balance to suffer in many developed countries. Kevin Lai, chief economist Asia Ex-Japan at Daiwa Capital Markets in Hong Kong correctly points out "The U.S. is doing okay, but the problems with emerging markets are really quite big."The PBoC had in the past one year slashed rates six times and cut the RRR to combat deflationary pressure which was weighing on growth. The measures have supported industrial sector as credit to troubled firms increased. Such supportive measures together with property market upturn will likely help to further boost domestic demand in 2016. The overall fiscal policy can be expected to remain expansionary in 2016.

The government eased restrictions on home buying to boost the property market. Policies favouring foreign trade and exporters were also announced to boost trade. Yuan was made to weaken to near four-month lows against the dollar to support export. However, given the current scenario only a drastic devaluation can help exporters.

The PBoC also decided to cut the overnight SLF lending rate to 2.75% and the seven-day rate to 3.25% as. The objective is to inject cash into the banking system to support the slowing economy. With this step the central banks plans to lower borrowing costs for businesses.

The government may introduce more stimulus in 2016 to achieve Chinese President Xi Jinping’s goal for GDP expansion of at least 6.5 per cent over the next five years. "In the next five years, China's development should not just be focused on growth pace, but also growth volume, and, more importantly, growth quality," Xi said. Echoing market sentiments, Yang Zhao, Chief China Economist at Nomura expect “may be four RRR cuts and two more benchmark rate cuts in 2016â€.

UBS Group economists have expressed some hope adding that stronger policy support and quicker project implementation “could help offset partly the downward pressureâ€.

Qu Hongbin, chief China economist and co-head of Asian economic research at HSBC Holdings Plc in Hong Kong feels it is high time for China “to act in a more decisive and co-ordinated manner to lift confidence and end deflationâ€. He feels if the deflationary pressures are not crushed right away will “exacerbate the debt problem and risk a downward spiral". The current situation calls for more supportive policy measures. The central bank can be expected to further slash rates in 2016 and the government can be expected to step up fiscal spending.

Also, now that the yuan has been accepted in the IMF’s SDR basket, it remains to be seen if the central bank will intervene to control its value. Will the yuan undergo more devaluation is the most dominant question in the forex market now.

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.