Bitcoin rose above $40,000 after Jones endorsement

The price of crude oil rose to the highest level since the pandemic started as investors bet that green energy investments will lead to lower oil production. This happened as more oil supermajors are spending billions of dollars to diversify away from oil. Most of them like Shell and BP have created strategies to slash production in the next decade. At the same time, investors believe that oil demand will pick-up as the global economy recovers. In a report published last week, the International Energy Agency (IEA) said that demand will outmuscle supply this year. The West Texas Intermediate (WTI) rose to $71 while Brent rose to $73.

The Australian dollar declined slightly after the latest Reserve Bank of Australia (RBA) minutes. The minutes of the meeting held last week showed that members remained supportive of the ongoing monetary easing. They noted that it would be premature to consider ceasing the bond-buying program. Also, they said that the monetary policy will need to be flexible to reach full employment. On the Aussie, they noted that the currency remained in a narrow range despite increases in most commodity prices. Meanwhile, data from Australia showed that the house price index rose by 5.4% in the first quarter after rising by 3.0% in the previous quarter.

The economic calendar will have some key events today. In Switzerland, the State Secretariat for Economic Affairs (SECO) will publish the closely watched economic forecast data. These numbers will provide more details on how the panel expects the economy to recover. In the UK, the Office of National Statistics (ONS) will publish the latest employment numbers while Germany will release the latest consumer price index (CPI) data. The most important numbers will be the latest US retail sales data that will come during the American session.

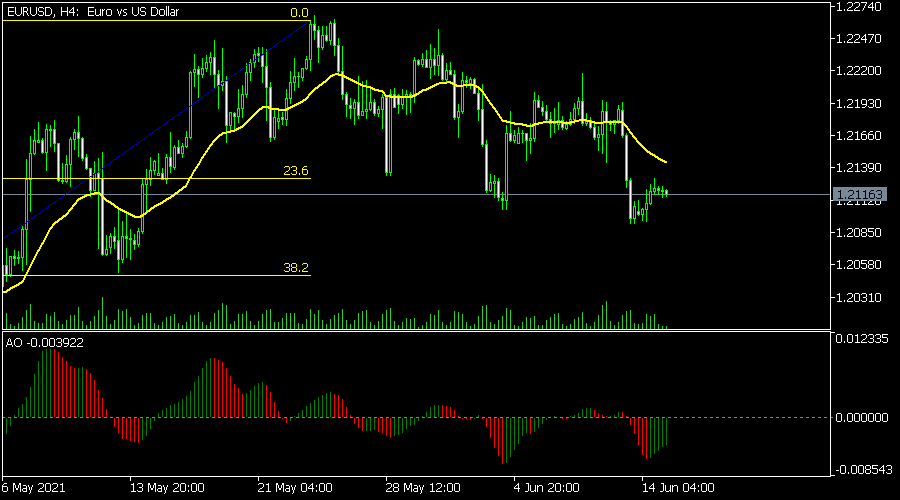

EUR/USD

The EURUSD is in a relatively tight range ahead of the latest German inflation data and US retail sales numbers. It is trading at 1.2115, which was slightly above 1.2095. It is also slightly below the 23.6% Fibonacci retracement level and the 25-day exponential moving averages (EMA) while the Awesome Oscillator is below the neutral level. Therefore, the pair will likely resume the downward trend as bears target the 38.2% retracement level at 1.2050.

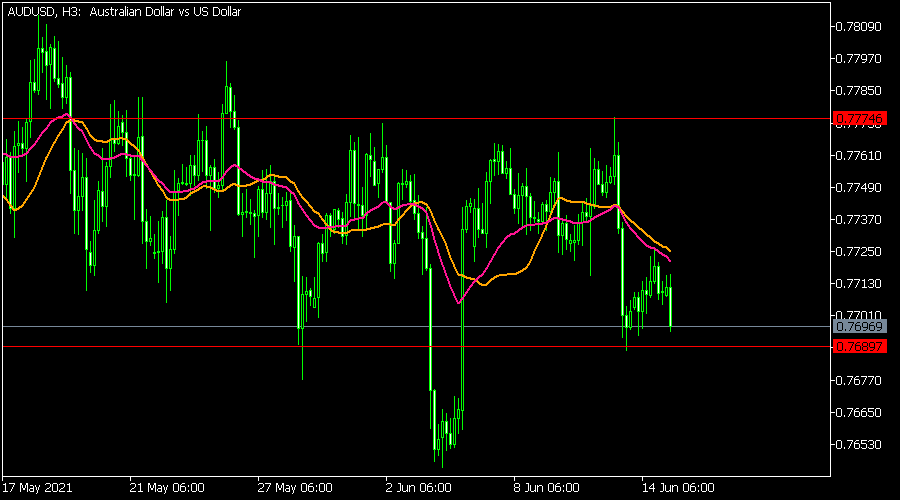

AUD/USD

The AUDUSD pair declined slightly after relatively dovish RBA minutes. It fell to 0.7696, which was substantially lower than Monday’s high of 0.7725. On the four-hour chart, the pair has moved below the 25-day and 15-day moving averages. It is also slightly above the support at 0.7690. The chart also shows that the pair has formed a head and shoulders pattern. As such, it implies that it will soon break out lower.

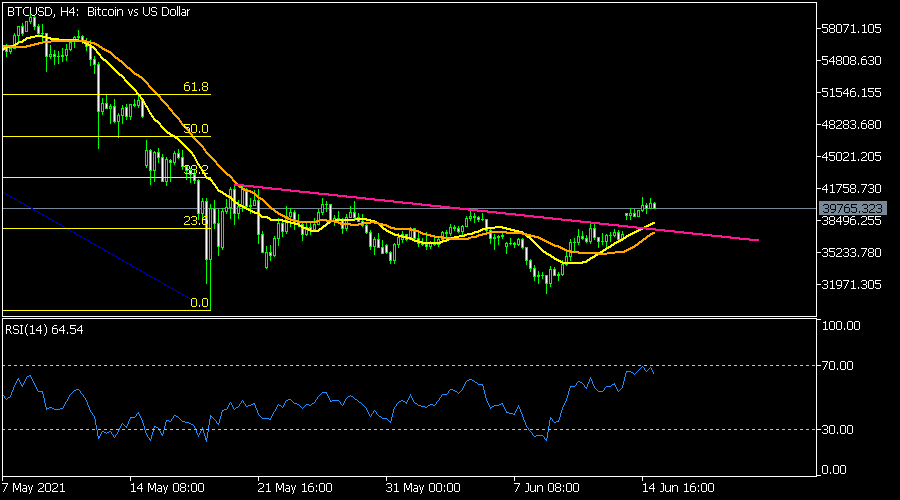

BTC/USD

The BTCUSD pair rose to above 40,000 on Monday after positive statements by Elon Musk and Paul Tudor Jones. It is now trading at 39,888, which is substantially higher than last month’s low of 30,000. The pair has moved slightly above the short-term moving averages. It is also clear that the pair has found some resistance slightly below the 40,000 level. As such, it will need to comfortably clear the 40,000 level for the bullish trend to be confirmed.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.