AUD/USD Analysis: Bulls remain at the mercy of USD price dynamics, FOMC decision in focus

- AUD/USD catches fresh bids and recovers a part of the RBA minutes-inspired losses on Tuesday.

- Bets for a less hawkish Fed, a positive risk tone undermines the USD and lends support to the pair.

- Traders keenly await the outcome of the highly-anticipated FOMC meeting later this Wednesday.

The AUD/USD pair attracts fresh buying during the Asian session on Wednesday and reverses a part of the overnight losses led by the Reserve Bank of Australia's (RBA) hint of a rate pause. In fact, the minutes of the RBA meeting held on March 7 revealed a step down in hawkishness as policymakers only considered a 25 bps hike and agreed to revisit the case for a pause at the April meeting amid the uncertain economic outlook. Apart from this, a strong follow-through rally in the US Treasury bond yields was seen as another factor driving flows away from the lower-yielding Australian Dollar. That said, the prevalent selling bias around the US Dollar (USD) assists the pair to regain some positive traction.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, languishes near its lowest level since February 14 amid expectations for a less aggressive policy tightening by the Federal Reserve (Fed). In fact, the markets seem convinced that the US central bank will soften its hawkish stance and have been pricing in a smaller 25 bps lift-off in March. Moreover, the recent collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - fueled speculations that the Fed might even start cutting interest rates during the second half of the year. Hence, the focus remains on the outcome of the highly-anticipated two-day FOMC meeting, scheduled to be announced later this Wednesday.

Apart from this, investors will closely scrutinize the accompanying monetary policy statement, the updated economic projections and Fed Chair Jerome Powell's comments at the post-meeting press conference for clues about the future rate-hike path. This, in turn, will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the AUD/USD pair. In the meantime, a generally positive risk tone, bolstered by easing fears of a full-blown global banking crisis, might continue to act as a headwind for the safe-haven buck and lend support to the risk-sensitive Aussie, warranting caution for bearish traders and before positioning for any meaningful slide.

Technical Outlook

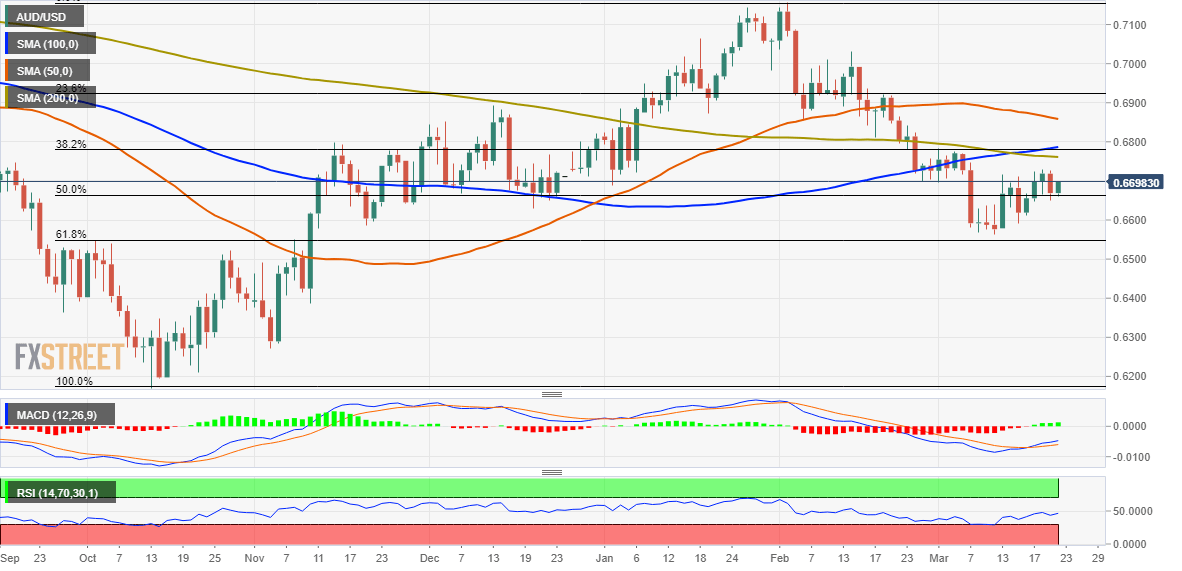

From a technical perspective, any subsequent move up beyond the 0.6700 mark is more likely to confront resistance near the 0.6730 region, or the weekly high touched on Monday. This is followed by the very important 200-day Simple Moving Average (SMA), near the 0.6760 area, and the 100-day SMA, near the 0.6780 zone. A convincing break through the said barriers might prompt a short-covering rally and lift the AUD/USD pair beyond the 0.6800 mark, towards testing the 50-day SMA, currently pegged around the 0.6850-0.6855 region. Some follow-through buying will negate any near-term negative bias and set the stage for an extension of the recent recovery move from a four-month low set on March 10.

On the flip side, the 0.6655-06650 zone now seems to protect the immediate downside ahead of the 0.6615 region. The next relevant support is pegged near the 0.6590-0.6585 region and the YTD low, around the 0.6565 level, which coincides with the 61.8% Fibonacci retracement level of the rally from the October 2022 low. A convincing break below the latter will be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to accelerate the fall towards testing the 0.6500 psychological mark. Spot prices could eventually drop to the next relevant support near the 0.6410-0.6400 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.