A punch-drunk risk rebound sets in, but for how long? [Video]

![A punch-drunk risk rebound sets in, but for how long? [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/foreign-exchange-market-chart-24348895_XtraLarge.jpg)

Market Overview

Negative sentiment has taken hold of major markets, sweeping through as the fear levels have ramped up over the contagion for global growth from COVID-19. Huge selling pressure through riskier assets have driven bond yields towards record lows and Wall Street to its biggest one-day decline for two years. The key level to watch on the US 10 year yield is 1.32% which is the all-time low from July 2016, a level that if breached would be a massive moment. Traders are factoring in reduced expectations on growth and inflation along with an associated dovish response from major central banks. Volatility levels have spiked higher (VIX at 14 month highs) as a result and markets are flying around. This morning there is a tentative retracement taking hold as punch-drunk markets bounce back from the ropes. However, the question that will be at the forefront of traders’ minds is whether it is just a mild relief rally before the selling pressure resumes. For now, the US 10 year yield is +3 bps off yesterday’s lows and is marginally higher this morning, allowing an equities rebound. Furthermore, gold (the big outperforming asset of recent sessions) is around a percent lower with a degree of profit-taking. For now, this is simply a tentative turnaround from where markets were sitting during yesterday’s session. Much more will be needed to suggest a sustainable recovery is underway.

Wall Street closed with huge losses last night, with the S&P 500 -3.3% at 3226. US futures are rebounding by +0.8% today, but Asian markets were still under pressure, with the Nikkei (playing catch up from a public holiday on Monday) -3.3% and Shanghai Composite -0.6%. In Europe, the bounce back is only mild, with FTSE Futures +0.3% and DAX futures +0.5%. In forex, there is a mixed to marginal risk positive/USD negative move initially, with AUD, CAD and GBP higher. In commodities, gold has pulled back almost -$50 from yesterday’s high and is now over-1% lower on the session. There is also a rebound on oil by c. +0.8%.

There is a US focus to the economic calendar today, with consumer confidence the main event. The S&P/Case-Shiller House Price Index at 1400GMT is expected to have picked up to +2.8% in December (from +2.6% in November). The Conference Board’s Consumer Confidence at 1500GMT is expected to remain strong at 132.0 in February (up from 131.6 in January). Finally we are looking out for the Richmond Fed Composite Index at 1500GMT which is expected to buck the trend (of pick ups in the Philly Fed and New York Fed) by falling back to +10 in February (from +20 in January).

There is also a Fed speaker to look out for with vice-chair Richard Clarida (board member and voter, leans a touch dovish) at 2000GMT. Could he signal a shift in tone on the FOMC?

Chart of the Day – NZD/USD

The Kiwi has come under considerable corrective pressure as traders have moved out of risk, into the safety of the dollar. However there was an interesting move yesterday where USD began to be sold off. This drove an intraday rebound on NZD/USD and opens for a potential near term recovery. Another tick higher from Friday’s low around 0.6300 could be a signal of the market forging some support. Although the bulls could not quite form a bull hammer candlestick, there is a hint of a positive RSI divergence. There would need to be another positive close today, but there is a threat of an improvement on momentum now. The bulls need to breach resistance of overhead supply at $0.6375 to really get going on recovery. There is a seven week downtrend up around $0.6475 now and plenty of room for an unwind from oversold. The hourly chart is showing signs of improvement for the hourly RSI, and above $0.6360 would complete a small +60 pip base pattern. Initial support $0.6325/$0.6330 today.

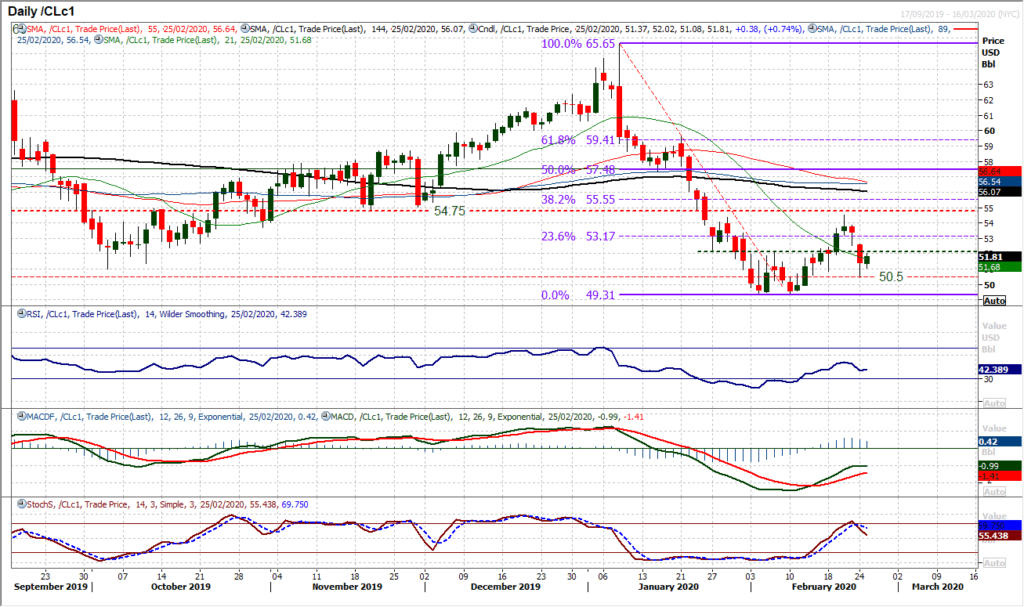

WTI Oil

Oil suffered considerable selling pressure yesterday but the bulls are beginning to put together some kind of fight back now. It should not go unnoticed that during the volatility of yesterday’s selling, WTI rebounded from around the $50.50/$50.60 old support once more. If the bulls can sustain the momentum of the overnight rebound, then the recovery outlook has not been too badly damaged. They will be looking to break back above the resistance around $52.20/$52.50 to regain some momentum. This would see hourly RSI back above 60 and hourly MACD back above neutral. The main caveat, is that this remains a very volatile time in financial markets and traders are nervous. For now this is a very tentative move higher with much resistance to overcome again. A bull failure around the $52.20 resistance would be a concern. Closing back under $50.50 re-opens the key $49.30 lows again.

Dow Jones Industrial Average

Amid broadening fears of the spread of COVID-19, the Dow endured its most significant one day sell-off for two years yesterday. Over -1000 ticks of decline. Leaving an enormous gap open way up at 28,892 the market closed at over two month lows under the key January low at 28,170. Futures are looking for a bounce back today (currently just under +1% higher) so it will be how the bulls react now to this huge snap decline. The old January support is now new resistance at 28,170 and will be the first level to watch. Can the buyers reclaim this level on a closing basis? Beyond that, if the rally can get going it needs to overcome yesterday’s traded high at 28,403 which is the next resistance. The bulls will note that a similar sell-off to this was seen back in September/October, but needs to now find a bull response. The long term uptrend comes in at 27,850 today and if this is broken then there will be growing concerns of an extended decline. Yesterday’s low at 27,912 will be initially supportive today.

Author

Richard Perry

Independent Analyst