- Whales are ignoring uncertainties pegged to the Ripple vs. SEC lawsuit outcome.

- Demand for XRP among large-volume holders with 1,000,000 to 10,000,000 coins hits all-time high.

- XRP price hangs above a strong demand area, potentially triggering a rebound.

XRP price is down 12.8% in the past week, trading at $0.3439 at the time of writing. The largest cross-border money remittance token suffered another hit as crypto markets reacted to last week’s United States Federal Reserve decision to hike interest rates by 0.5%.

Nearly all the progress made in November from support at $0.3200 has been erased, a situation that paints a grim picture for the XRP token awaiting a ruling on the lawsuit filed against the issuing company Ripple Labs and its top executives by the US Securities and Exchange Commission (SEC).

Whales rapidly accumulating XRP as price sinks

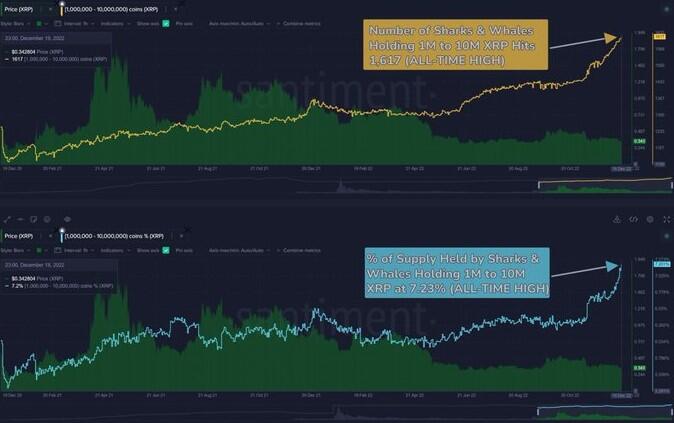

Despite the drop in the price of XRP over the last week, whales have been on a spending spree stacking up XRP tokens. According to insights from Santiment, a leading on-chain analytics platform, whale and shark addresses with 1,000,000 to 10,000,000 XRP have continued to accumulate to the end of 2022.

XRP Supply Distribution

There are 1,617 addresses in that investment tier, holding 7.23% of the network's supply – the highest ever. Investors are likely scooping up XRP tokens with anticipation of a rally turning into the New Year.

Moreover, as demand increases behind the token, XRP price may eventually gain momentum for a significant rebound to $1.0000. Retail investors are on the sidelines amid fears of the downtrend continuing to $0.3000. Possibly, their interest will be renewed by XRP price, making a clear rebound above the falling trend line (dotted) resistance.

XRP/USD daily chart

For XRP to make a sustainable move to $1.000, resistance provided by all the major moving averages must come out of the way. A break and hold beyond the 50-day Exponential Moving Average (EMA) (in red) at $0.3903 would lead to a subsequent uptick above the 100-day EMA (in blue), as provided at $0.4033. Traders will confirm a long-term uptrend when XRP lifts above the 200-day EMA (in red) at $0.4531 and the upper falling trend line (continuous line).

How the SEC lawsuit may impact XRP price

Although XRP price has generally moved alongside the rest of the crypto market in 2022, it has shown tendencies to react positively and negatively to the Ripple vs. SEC case. Many crypto experts and enthusiasts believe that Ripple could topple the regulator to win the case that alleged that it breached the securities law and sold unregistered tokens.

However, the case outcome could go either way now that both parties have made their final submissions. Enthusiasm toward a Ripple victory comes after a series of minor wins by the defendants against the SEC as the case progressed.

However, with the final ruling delayed, XRP price might hang in the balance – possibly eliciting bearing sentiments. A win for Ripple will mean a win for XRP price, which could be why whales are throwing their weight behind the token.

Related news:

Ethereum price prediction is uncertain as censorship declines bolstered by new relayers

Bankrupt crypto lender BlockFi wants customers enabled to withdraw funds

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin reaches new highs near $90,000, on-chain data show chances of pullback

Bitcoin hit a new all-time high of $89,900 on Tuesday before easing to around $86,000, following a 30% surge since November 5. Technical indicators suggest the rally may be overstretched, with a potential corrective pullback ahead.

GIGA investor loses $6M to phishing scam via fake Zoom link

On Monday, a Gigachad (GIGA) investor lost $6.09 million due to a phishing attack involving a fake Zoom link. Crypto investigation firm Scam Sniffer declared the scam that led the victim to a malicious site, compromising their wallet.

Tron, Avalanche and Uniswap: Double-digit gains on the cards, technical indicators show

Tron is breaking above an ascending triangle formation on Tuesday, signaling a potential rally continuation. While AVAX and UNI are retesting their crucial support level — if supported, this suggests an upside move — all three altcoins look poised for double-digit gains as the crypto rally continues.

BNB: Bullish technical pattern validated, eyes all-time high

Binance Coin trades slightly down on Tuesday after breaking above an ascending triangle formation on the weekly chart, following a 12.5% rally last week. The technical outlook suggests a bullish breakout pattern and continuation of the rally, with a target set for a new all-time high of $825.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.