- Ethereum keeps flashing massive bullish signals, attracting investors from Bitcoin.

- Peter Brandt flips bullish on Ethereum, converting up to half of his Bitcoin holdings to Ethereum.

- High transaction fees on the Ethereum protocol suggests that the rally might delay as investors wait for normalization.

Ethereum continues to receive massive attention from both investors and traders. The largest altcoin has managed to sustain price action above $1,000 despite the rejection at the record high of around $1,481. Many analysts believe that Ethereum will shoot up to $3,000 in the near term, as covered in the recent past.

Consequently, Peter Brandt, a prominent investor, believes that “ETH/BTC is the best bet.” He is so bullish on Ether to the extent of converting a substantial portion of his BTC holdings to ETH.

Why is Ethereum attracting investors’ attention?

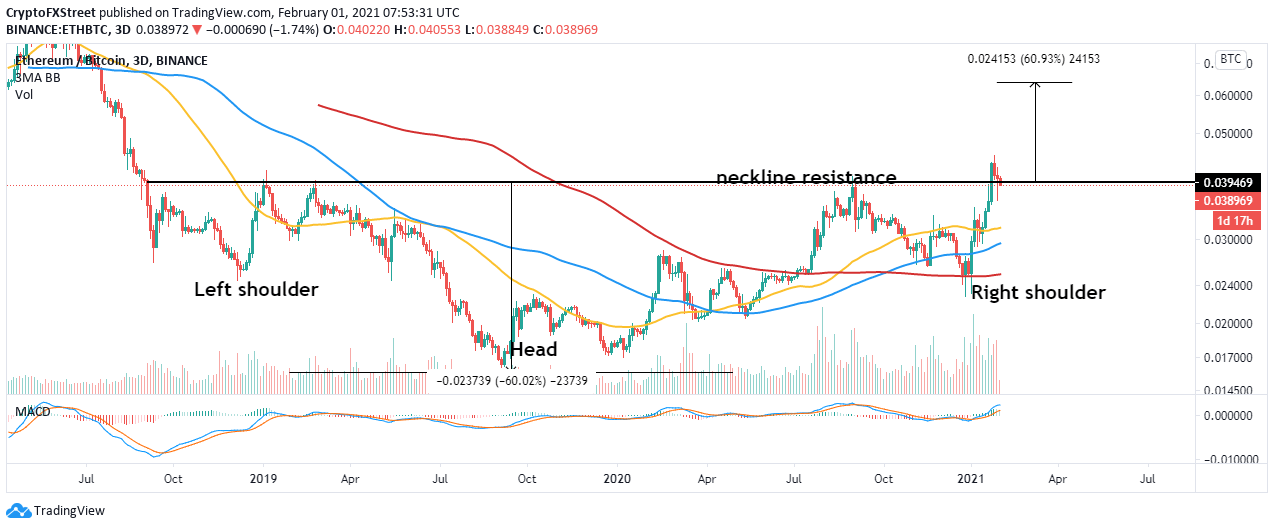

The 3-day ETH/BTC chart brings to light the formation of an inverse head-and-shoulders (H&S) pattern. This pattern is used in technical analysis to predict bullish outlooks once the asset’s price breaks above the neckline’s resistance. Traders incorporate this pattern when entering into a long position. It is essential to watch out for a surge in volume to confirm the sharp breakout.

Based on the H&S pattern, a conservative prediction is a 60% upswing to 0.0367 from the neckline’s resistance. However, the most optimistic breakout target is a 150% spike to 0.099. Realize that the Moving Average Convergence Divergence stresses the bullish outlook following a recent cross of the MACD line (blue) above the signal line.

ETH/USD 3-day chart

Is ETH/BTC the best bet to make? – Peter Brandt thinks so

Peter Brandt is a long-term Bitcoin bull that has recently flipped bullish on Ethereum. Intriguingly, the investor who owns Bitcoin agrees that the largest cryptocurrency “has had one heck of a run.” And he believes that “it has a long way to go.”

However, he has turned his attention to the pioneer smart contract token. He reckons that ETH/BTC is on the verge of a significant move. Brandt is comfortable with converting between a third and a half of all his Bitcoin holdings to Ethereum.

Simultaneously, another analyst, CryptoThies, predicts ETH/BTC possible rally to its all-time high around 0.1. The analysts shared his roadmap prediction of the digital asset pair, suggesting that February will be an exciting month for ETH/BTC.

Potential roadmap for $ETH vs $BTC in 2021. Based on standard crypto seasonality (Oct-June, followed by consolidation June-October). Assumes that #ethereum revisits former ATH vs #BTC at .1, which would be around 30% market dominance pic.twitter.com/gbVnjRNmPK

— CryptoThies ♔ (@KingThies) January 31, 2021

Looking at the other side of the picture

Santiment, one of the leading on-chain analysis platforms, cautions that the rising gas fees on the protocol could impede the rally. Currently, $11.45 (three-week high) is needed to complete a transaction on the Ethereum protocol.

Ethereum average fees/median fees

Usually, high fees lead to a cooling effect as users wait for the fees to return to normal levels. Santiment suggests that a market top is not a guarantee. However, the increase in gas fees demands caution.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[12.35.11,%2001%20Feb,%202021]-637477697747425026.png)