- A report by Kraken exchange says that September has historically been the worst-performing month for BTC.

- DBS Bank’s Taimur Baig noted that the pandemic had increased cryptocurrency adoption.

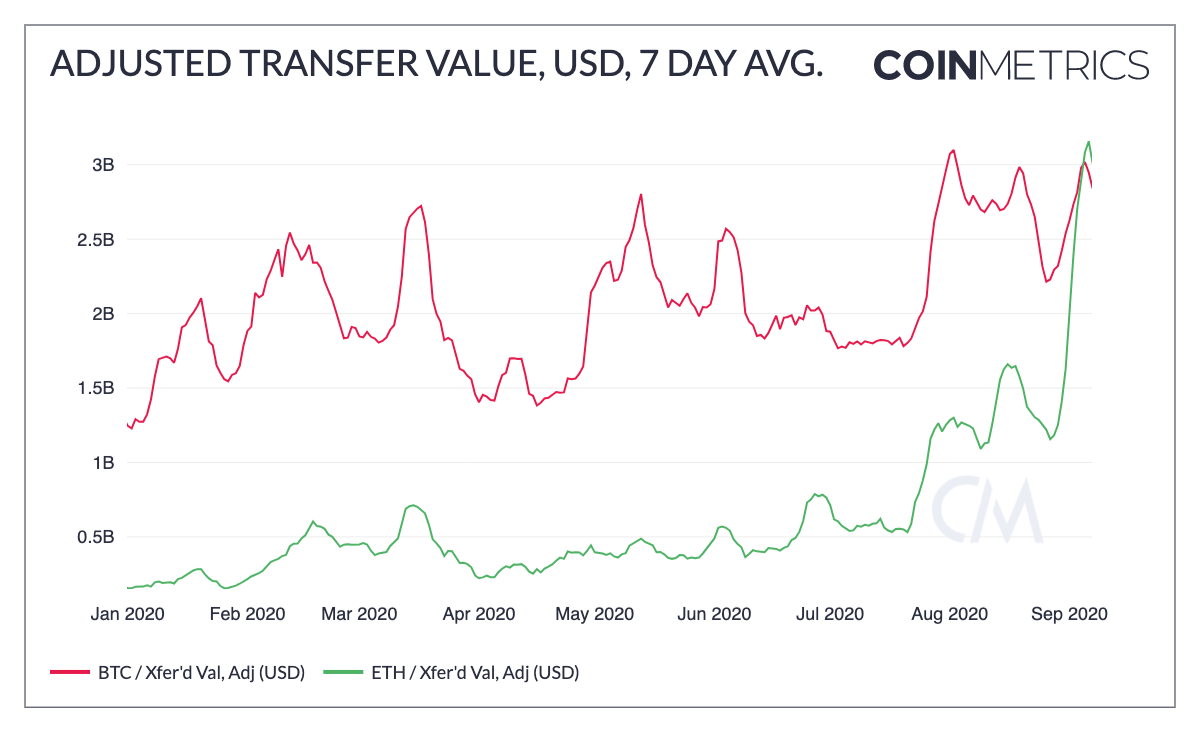

- Ethereum’s weekly e-commerce output has recently surpassed Bitcoin’s after nearly two years.

Bitcoin

Bitcoin will see a renewed surge in volatility soon – Kraken

Kraken cryptocurrency exchange recently released its August 2020 Bitcoin volatility report. As per the report, the recent decline in BTC’s price is not to be worried about as historically, September has been the worst-performing month for the flagship coin.

Did you know?

— Kraken Exchange (@krakenfx) September 8, 2020

September is #Bitcoin's worst performing month, with an average return of -7%.https://t.co/fAaXgFL2V7 pic.twitter.com/oLp6MXBKTE

The report also mentioned that BTC’s “annualized volatility” dropped to as low as 15% in July. Whenever this has happened in the past, the coin has always bounced back stronger, as per Kraken. On average, Bitcoin’s volatility surge was marked by a peak at 140%, during which investors generated 196% returns in 94 days.

What is a 'suppressed pocket' and why is it good for #Bitcoin?

— Kraken Exchange (@krakenfx) September 8, 2020

After falling into one, #BTC has historically averaged volatility of 140% and gains of +196%. https://t.co/fAaXgFL2V7 pic.twitter.com/1WJidPSgx7

In the report, Kraken also pointed out the loss of Bitcoin’s market dominance to altcoins due to the rise in the DeFi craze.

Since the start of 2020, altcoins have been stealing market share from bitcoin. Following the emergence of DeFi in 2Q, bitcoin’s dominance has fallen further.

According to Kraken, BTC could continue to lose market share to rising altcoins. But when traders are done extracting profits, selloffs will lead to capital entering the Bitcoin market, resulting in the stretch of BTC's dominance.

Pandemic has accelerated digital asset adoption – DBS Bank exec

In its quarterly report on cryptocurrencies, the Singapore-based DBS Bank said that there had been an acceleration of digital asset adoption led by the pandemic. Taimur Baig, the bank’s chief economist, identified two distinct demand phases - pre-pandemic and post-pandemic.

Pre-pandemic demand was largely speculative. People saw bitcoin had a spectacular run and wanted to be part of that game, so what’s wrong with putting in 1% of assets under management [into BTC]. But I think post-pandemic is beyond speculative. It’s more about, “This thing has fixed circulation, it will not be debased.” People are worried about dollar outflow and wondering if they should hold crypto in addition to gold as a safe-haven currency.

DBS isn’t the only bank to observe this trend. Singapore-based digital asset bank Sygnum also echoed this view. Martin Burgherr, co-head of clients at Sygnum Bank, noted that since the outbreak of the COVID-19 pandemic, there had been increased interest in digital assets from businesses and individuals. They view digital assets as an alternative and a way to protect against growing inflation risk, as per Burgherr.

Baig added that pegging to the USD for countries suffering a currency crisis or hyperinflation may bring short-term credibility. However, this doesn’t work out well for a lot of currencies, he added.

If you look at Venezuela or even Lebanon, which is in the middle of a massive financial crisis, could you, at some point going forward, conceive that instead of linking your currency to the U.S. dollar, you link it to a cryptocurrency?

Discussing China’s CBDC efforts, Baig said that there are two dimensions to consider. Firstly, a digital renminbi (e-RMB) is how China’s central bank, the People’s Bank of China (PBoC), can dominate its sprawling fintech ecosystem noted. The second dimension is about the potential for an e-RMB to become a way for individual nations to bypass the USD settlement mechanism, which makes them “somehow answerable to the Southern District [Court] in New York or the Securities and Exchange Commission,” said Baig.

Role of cryptocurrencies in money-laundering is minuscule compared to cash – Report

According to a new report by British defense and aerospace company BAE Systems, most criminals involved in money laundering activities prefer cash over cryptocurrencies. The report further noted that money laundering is one of the gravest global threats to the economy.

The activities of all cyber-criminals, whether working individually, as part of a small gang, as organized crime groups or even for a nation-state, have resulted in annual total cyber-crime revenue estimated at USD 1.5 trillion.

On behalf of the global financial messaging services provider SWIFT, BAE Systems noted that the role of cryptocurrencies in money laundering is minuscule compared to cash. This is contrary to a common fear that digital assets are an easier way for criminals to move and liquidate stolen funds. The report stated that the number of identified laundering cases through virtual assets is “relatively small” compared to the volumes of cash laundered using traditional methods.

Nevertheless, concerns regarding the privacy-centric features of some cryptocurrencies continue to prevail in the community.

The raft of alternative cryptocurrencies that offer greater anonymity, as well as services like mixers and tumblers that help obscure the source of funds by blending potentially identifiable cryptocurrency funds with large amounts of other funds, could boost the appeal of cryptocurrency for nefarious purposes.

SWIFT pointed out to the North Korean cybercrime group, the Lazarus Group, in the report. In 2018, the group organized a massive cyberattack and stole $30 million worth of digital assets.

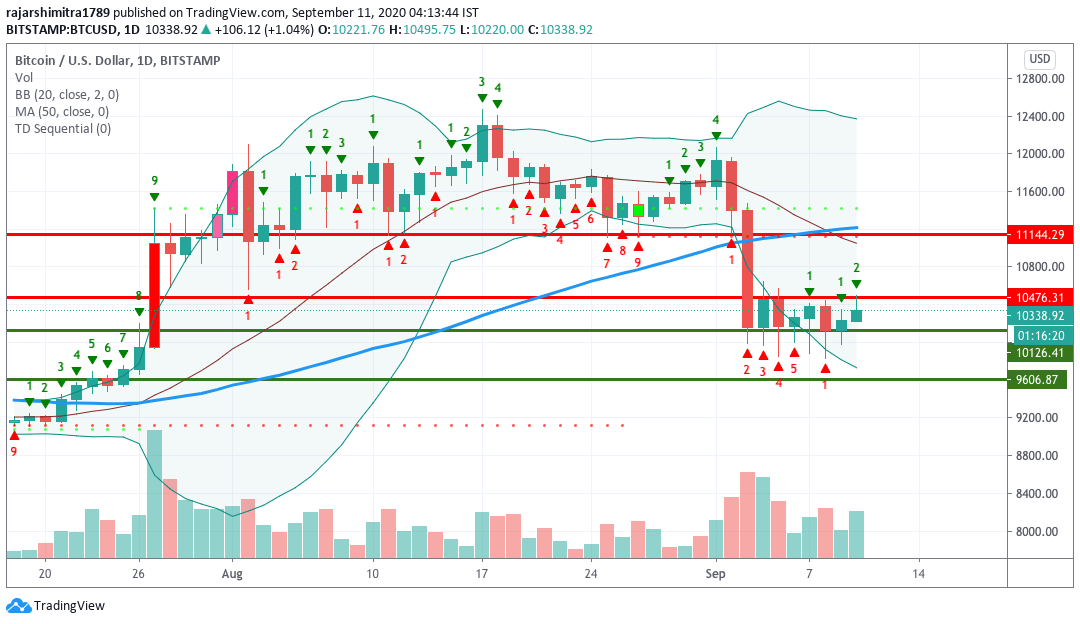

BTC/USD daily chart

BTC/USD bulls have stayed in control for the second straight day as the price went up from $10,216.60 to $10,350.39. It has charted two green candles in the TD sequential indicator as buyers aim for the $10,476.30 resistance line. If they overcome that line, the currently bullish TD sequence sees the price reach up to $11,148.75 before it experiences a reversal.

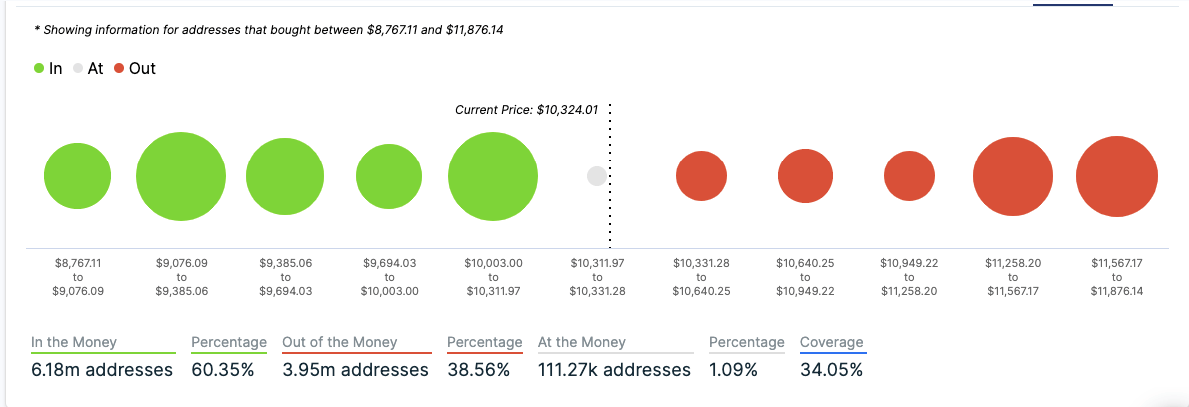

BTC IOMAP

BTC is sitting right on top of healthy support levels. On the upside, the price can go up to $11,258.20 before it meets strong resistance. As such, we can conclude that Bitcoin currently has sufficient upside potential.

Ethereum

Ethereum's weekly economic output surpasses that of Bitcoin

The adjusted weekly value of Ethereum trades has recently surpassed Bitcoin for the first time since 2018, as per analytics firm Coin Metrics. A few days back, the “7-day average adjusted transfer value” reached $3.08 billion for Ethereum. On the other hand, Bitcoin hit $3.01 billion. Coin Metrics uses the metric mentioned above to capture the real economic output of the Ethereum market. The analytics firm attributes the surge to the rise of decentralized finance (DeFi).

DeFi Pulse data shows that the total value locked (TVL) in DeFi protocols is around $7.6 billion. Coin Metrics pointed to the introduction of yearn.finance’s yETH vault as one of the recent DeFi developments that’s responsible for the economic output spike. There is $78.6 million worth of ETH locked in the yETH vault and $1.12 billion locked up in yearn.finance overall. Plus, all the drama surrounding SushiSwap also majorly contributed to this monetary flow.

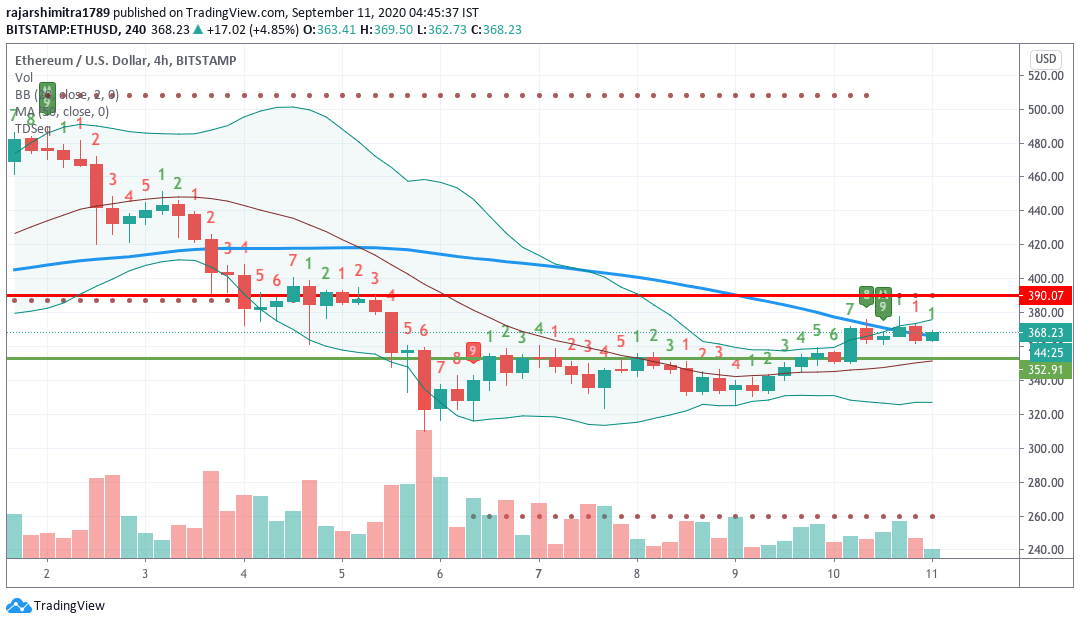

ETH/USD daily chart

ETH/USD bulls have bounced up from the $335.80 support level and taken the price to $367.88. Ethereum managed an intraday high of $377.80 before it retreated away. However, the bulls will want to regain momentum and aim for the $377.60 resistance level (SMA 50) once again. The MACD shows decreasing bearish momentum following the recent price action.

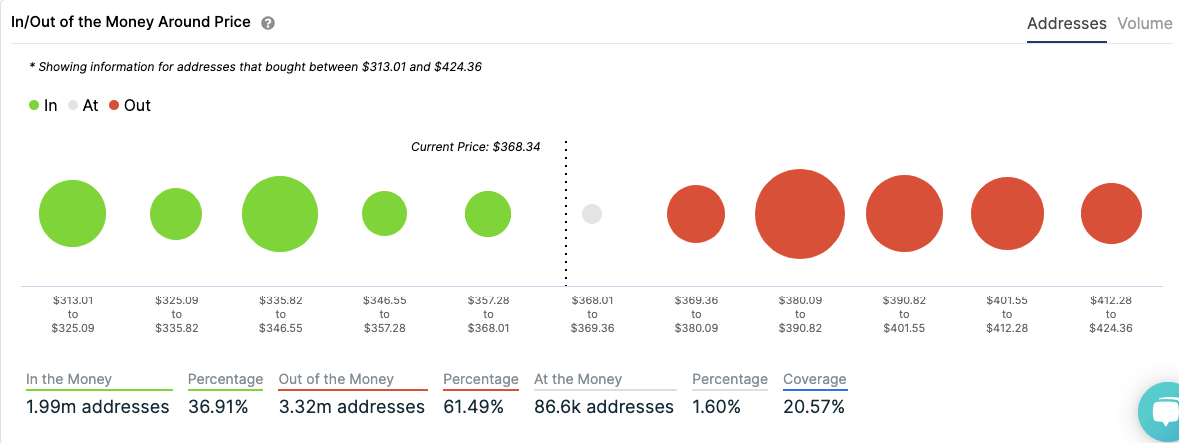

ETH IOMAP

ETH is not sitting above healthy support levels. As can be seen in the IOMAP, the price can potentially go down to $355.82 before it hits notable support. On the upside, the price can go up to $380 before it encounters strong resistance.

ETH/USD 4-hour chart

The ETH/USD 4-hour chart shows that the buyers and sellers are currently trying to regain control around the SMA 50 curve. The TD sequential keeps changing between the green one candlestick and the red one candlestick. If the bulls somehow manage to retain control, they should be able to take the price up to the $390 resistance line before it experiences a reversal.

Ripple

XRP/USD daily chart

-637353788378809514.png)

XRP/USD has gone up from $0.2382 to $0.2427 since this Wednesday. The William’s% R is still hovering inside the oversold territory, so further positive action is expected. Having said that, it’s difficult to see how the bulls can challenge the $0.2547 resistance level any time soon.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637353787311993482.png)