- The Ethereum London hard fork went live on August 5 and caught investors’ attention.

- ETH price rallied to above $2,800 for the first time since June 7 on bullish sentiment.

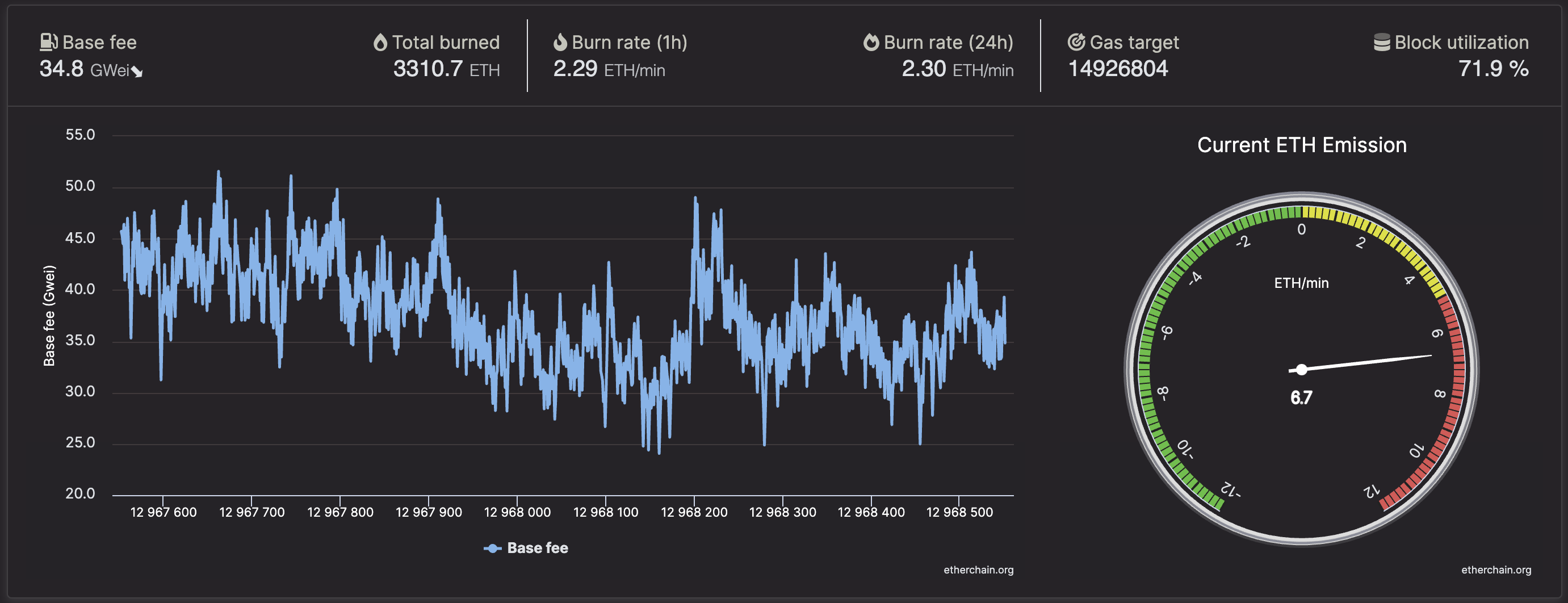

- The Ethereum network has burned over $9 million in Ether so far, with a burn rate of over 2 ETH per minute.

The long-awaited Ethereum London hard fork went live on August 5, which sent ETH price rallying to above $2,800 as one of the new Ethereum Improvement Proposals (EIP) kicked off the burning of Ether at block 12,965,000.

More than 3,000 ETH burned in less than 12 hours

Ethereum price rallied ahead of the London hard fork as investors hope that Ether would become a deflationary asset, and the upgrade would solve the issue of high gas fees.

The latest upgrade to the Ethereum blockchain introduced five new Ethereum Improvement Proposals, including EIP-1559, which aims to improve the network’s user experience and value proposition.

EIP-1559 changed the way transactions are processed on the blockchain and puts forward an algorithm that automatically sets the price of gas.

The upgrade also involves a burning mechanism, which destroys a portion of Ether – that could introduce some deflationary pressure on ETH.

However, only under the condition that the burned fees exceed the issuance of new Ether would only see ETH becoming a deflationary asset. Nic Carter, Castle Island Ventures, added that this would only occur “at times of extreme fee intensity.”

While EIP-1559 comes with benefits, including reduced transaction costs and relieving network congestion, miners were put at a disadvantage with lower mining rewards.

Miners would not be able to receive the same amount of income they made prior to the London hard fork. However, Matt Hougan, the chief investment officer at Bitwise Asset Management, explained that due to the fact that miners are organically linked to the overall value of Ether, they could make up for these losses if Ethereum price rises owing to the protocol changes.

Less than 12 hours following the London upgrade, over 3,000 ETH have been burned, which is worth over $8 million in value. At the time of writing, over 3,310 Ether has been burned, equating to over $9 million in value.

ETH burned

Ethereum co-founder Vitalik Buterin added that the London hard fork makes him “more confident about the merge” to ETH 2.0 that is expected by early 2022.

Ethereum price on track to target $3,000

Ethereum price has rallied following the London hard fork, surging to above $2,800 for the first time since June 7. There seem to be limited obstacles ahead for ETH as it eyes its next target on the upside.

Ethereum price has printed 15 green candles starting on July 21, as investors were enthusiastic ahead of the upgrade. The next bullish target for ETH is at the 50% Fibonacci extension level at $3,058 with minimal hurdles ahead. The bulls must conquer the May 20 high at $2,983 before securing its next aim.

However, investors should also pay attention to the Relative Strength Index (RSI), which suggests that on a technical level, ETH may be slightly overbought.

ETH/USDT daily chart

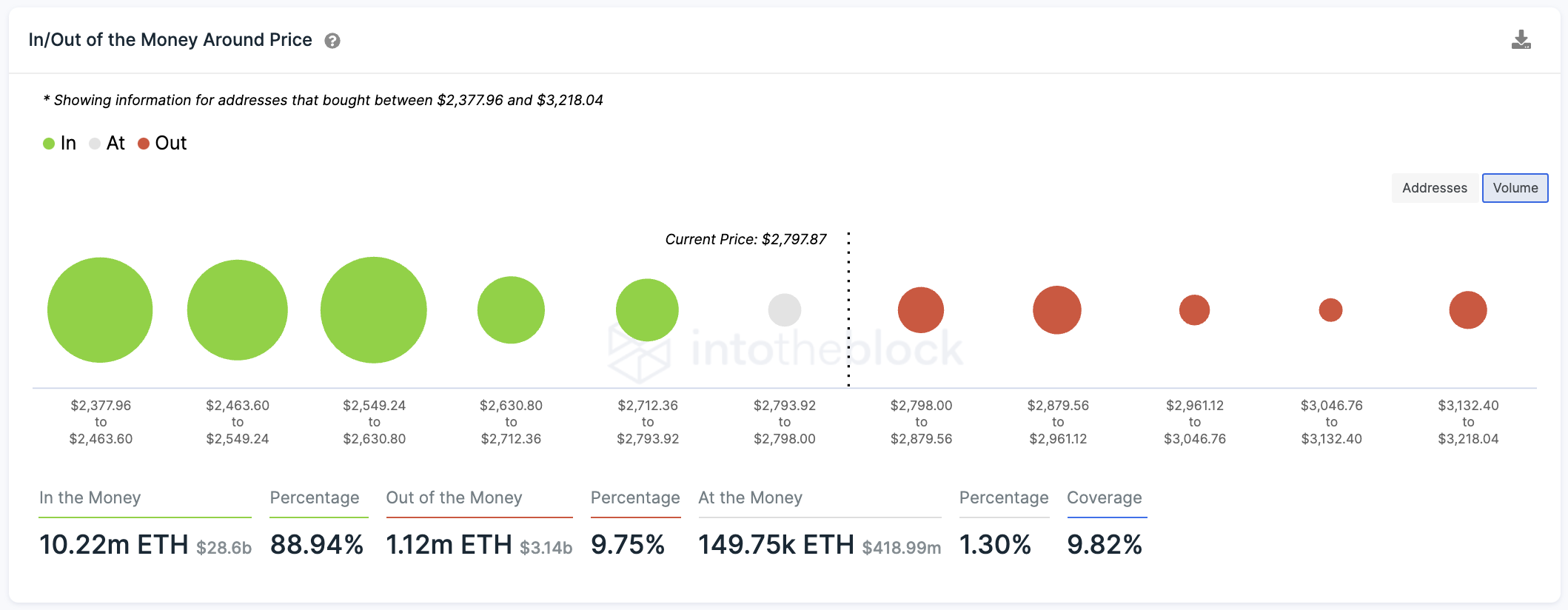

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) also adds credence to the theory that there is little resistance ahead for ETH, as the volume clusters Out of the Money appear to be insignificant, while support appears to be substantial.

Ethereum IOMAP

On the daily chart, the first line of defense will emerge at the 38.2% Fibonacci extension level at $2,737, then the 100-day Simple Moving Average (SMA) at $2,554.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.