- Ethereum 2.0 rollout is scheduled for December 1.

- There are several things investors should keep in mind to navigate through the transition period.

The launch of the second version of the Ethereum protocol, also known as Serenity, may become the biggest event of the year for the industry. It will define the future of the second-largest cryptocurrency ecosystem by the market value and the protocol of choice for the overwhelming majority of decentralized applications.

Ethereum 2.0 is meant to become a self-sustaining financial ecosystem with a unique value. The much-awaited upgrade will bring many changes to computer world, making the network more scalable and secure. The blockchain will also switch from Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism and create options for a passive income for ETH holders.

The new version will be launched on December 1, 2020. However, the transition to the new version is a complicated process that is not going to happen overnight. Moreover, there are several essential things to be taken into consideration to navigate through this period successfully.

1. The launch date can be changed

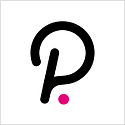

Ethereum 2.0 developers announced that they would start rolling out Beacon Chain, the critical component of the new version of the protocol, on December 1. However, this date is not carved in stone. Actually, it depends on whether the project secures the support of at least 16,384 validators with the total amount of 524 288 ETH staked in the network, over $200 million at the current exchange rate.

These conditions should be met at least one week before December 1; otherwise, the launch of Beacon Chain genesis block will be postponed again.

A dedicated deposit smart contract put in motion on November 4 serves as a bridge between ETH 1.0 and ETH 2.0 as it allows users to send their coins from the current blockchain version to the new one and participate in the staking.

Over 57,000 ETH are already staked, which is about 10% of the required amount.

ETH 2.0 launchpad

2. Two networks will coexist

Ethereum 2.0 will be launched as a separate network that will run in parallel with the first version of the protocol. This means that the life of a regular ETH user won't change overnight. Users will continue interacting with their ETH-based applications and services as usual.

As the migration to the new protocol is too complicated, the developers decided to do it step-by-step to ensure that all services work uninterrupted and the whole ecosystem does not collapse if something goes wrong.

3. 32 ETH will be frozen for an indefinite timeframe

Ethereum 2.0 will allow users to earn passive income at around 7% per annum, which is a very attractive feature and a key difference from the existing framework.

However, to become a validator, the network participant shall transfer at least 32 ETH – about $14,700 at the current exchange rate – to the deposit smart contract. These coins will be effectively locked for an indefinite period, meaning that the user won't be able to get them back until the transition progresses to Phase 2, which is expected to happen in two years at the soonest.

The experts are concerned that this condition may discourage people from joining the network at the early stages because they will have to wave farewell to their money for an extended period. The value of their deposits may decrease over time if the ETH price goes down.

Also, as the total value of ETH locked in the network will grow, the deposits will become less profitable.

4. Scammers are all around

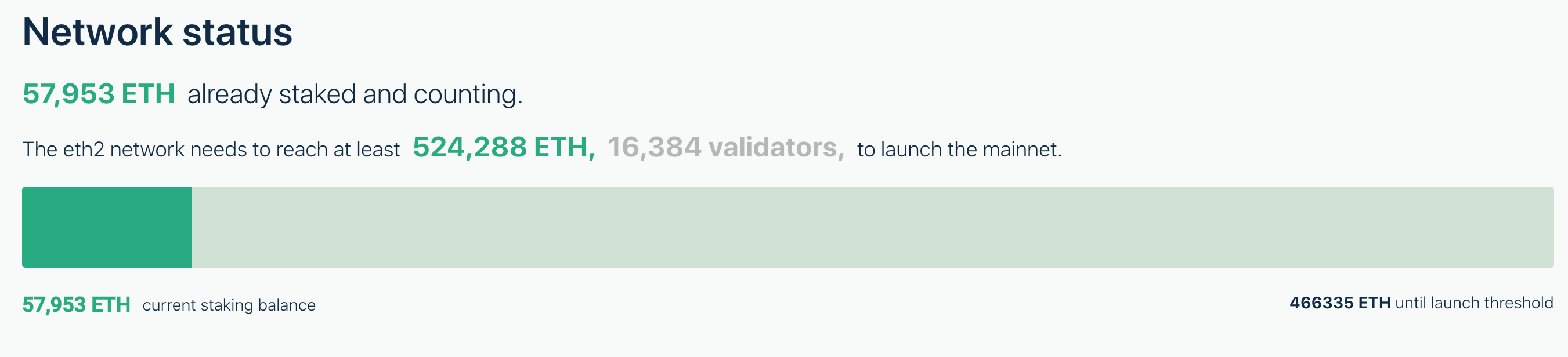

ETH users interested in staking their coins on the deposit smart contract and participating in Phase 0 deployment should be aware of many scammers trying to make people deposit coins via their links, websites or applications.

The whole process is very complicated and investors should do their due diligence before sending their money to a smart contract. The official validator deposit contract address is provided on the Ethereum 2.0 mainnet website. Anyone using a different address is a scammer.

Prysm Eth2 Testnet

According to the information provided on the ETH 2.0 mainnet website, the developers urge ETH holders to use only Eth2 launchpad utility at launchpad.ethereum.org

Do not send funds to any other contract, and do not send ETH directly to the contract. If you want to participate in eth2, use the eth2 launchpad launchpad.ethereum.org. Prysmatic Labs endorses this address as the recommended way to become an eth2 validator.

5. There are multiple clients for ETH 2.0

As Ethereum is a decentralized network, anyone can create their own software to work with ETH 2.0. Currently, four validator clients are listed on the official ETH launchpad website. They are Lighthouse, Nimbys, Prysm and Teku. They all have their advantages and disadvantages and users can pick the one that suits them best.

Basically, the variety of software providers creating apps for ETH 2.0 make the network more user-friendly, inspires healthy competition and ensures that a single developer does not control the whole network.

Key takeaways

The launch of the Beacon Chain is the start of a big journey that will eventually transform the Ethereum protocol to a new, more secure, scalable ecosystem with advanced functionality. The rollout is scheduled for December 1. However, it depends on whether the project secures the required amount of coins and the support of over 16,000 validators.

To become a validator, users should deposit at least 32, which will be frozen on the new protocol that will run in parallel with the old chain. The stakers will be able to get their money back after the migration is completed.

There are currently four officially supported ETH 2.0 validators but independent developers can create their own software to interact with the new chain too. The competition ensures that a single software provider does not monopolize the network.

ETH holders shall do their due diligence and avoid using unverified software or service as they may be scammers.

ETH price implications

At the time of writing, ETH/USD is changing hands at $458. The second-largest coin bottomed at $83 on March 13 and has been gaining ground steadily ever since. If Ethereum 2.0 rollout goes according to the plan, the price may easily reach $800 as there is no resistance between the current price and $800, according to In/Out of the Money Around Price (IOMAP) data.

Ethereum's In/Out of the Money Around Price

The upgrade will improve ETH security and scalability, which will have positive price implications.

The transition to Proof-of-Stake (PoS) will incentivize investors to hold their coins to get staking rewards. This trend will reduce token supply amid the growing demand, leading to the price increase.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Celebrity meme coins controversy continues amid Pump.fun revenue dominance

Pump.fun outperformed the Ethereum blockchain on Tuesday after raking in $1.99 million. Following this achievement, a meme coin based on actress Sydney Sweeney was the subject of controversy after its developers dumped their bags on investors.

PEPE's on-chain metrics indicate potential rally after weeks of silence

PEPE has struggled to see any significant price move after reaching an all-time high in May. Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon. A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

Ethereum has failed to overcome key resistance despite bullish sentiment surrounding ETH ETF

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Crypto community blasts Polkadot following report of treasury spending

Polkadot reports $87 million of treasury spending during H1. Crypto community members expressed harsh feelings toward the DOT team's high spending. DOT is up more than 2% in the past 24 hours but risks correction following the report.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.

Analytics and Charts-637407770634765134.png)